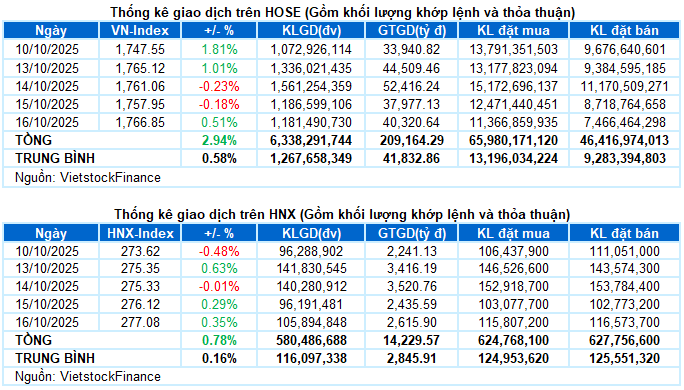

I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON OCTOBER 16, 2025

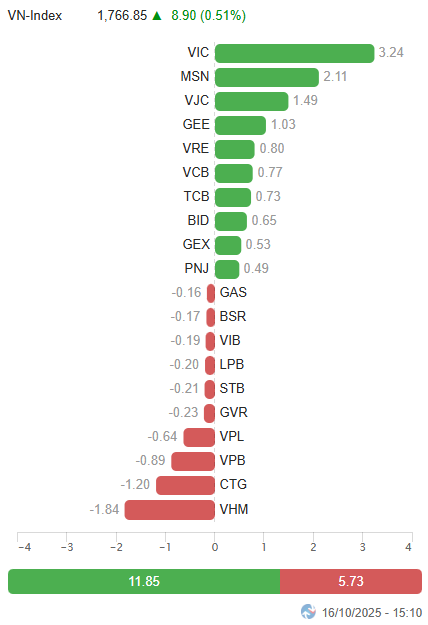

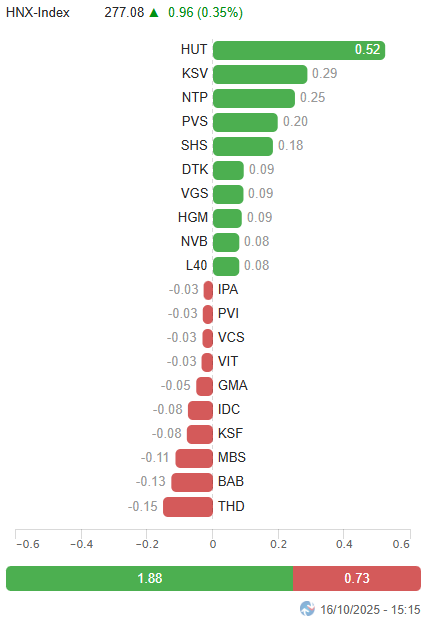

– Major indices maintained their upward trend during the October 16 trading session. Specifically, the VN-Index gained 8.9 points (+0.51%), closing at 1,766.85 points. The HNX-Index also rose by nearly 1 point (+0.35%), reaching 277.08 points.

– Trading volume on the HOSE slightly decreased by 1.8%, totaling nearly 1.1 billion units. Meanwhile, the HNX recorded over 100 million matched units, a 12.4% increase from the previous session’s low.

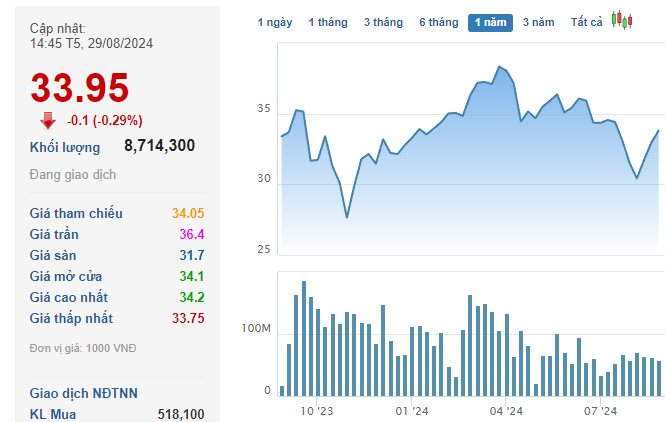

– Foreign investors returned to net buying on the HOSE with 540 billion VND but remained net sellers on the HNX with 132 billion VND.

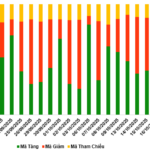

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

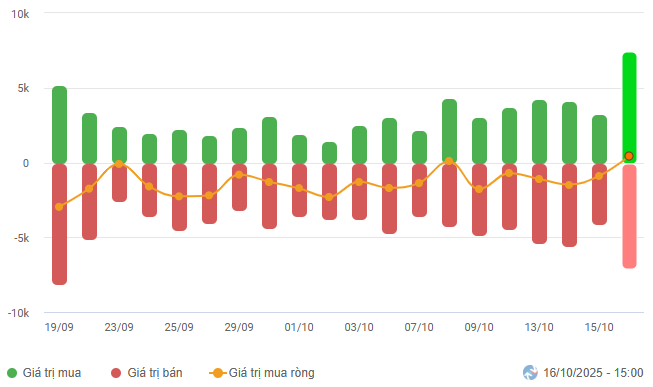

Net Trading Value by Stock Code. Unit: Billion VND

– The market traded in a tug-of-war state during the October 16 derivatives expiration date. The VN-Index experienced alternating increases and decreases around the 1,760-point mark throughout the morning session with low liquidity. Market breadth remained balanced, reflecting a clear divergence among sectors and investors’ cautious sentiment. The afternoon session saw little change, except for the familiar strong fluctuations in benchmark stocks during the derivatives expiration date, widening the index’s range toward the end of the session. The VN-Index closed at 1,766.85 points, up 0.51% from the previous session.

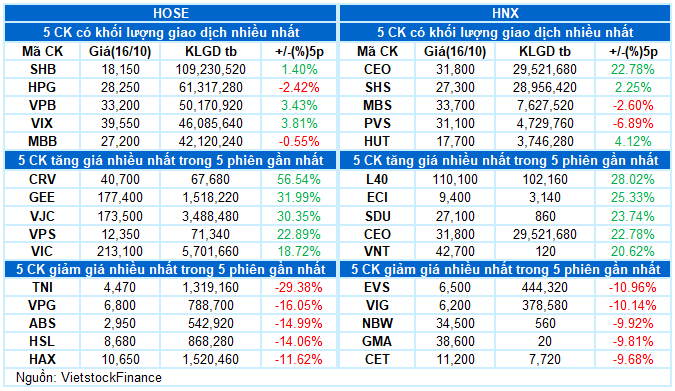

– In terms of impact, VIC, MSN, VJC, and GEE were the most positive contributors, adding a combined total of nearly 8 points to the VN-Index. Conversely, VHM and CTG exerted significant pressure, subtracting 1.8 and 1.2 points from the index, respectively.

Top Stocks Influencing the Index. Unit: Points

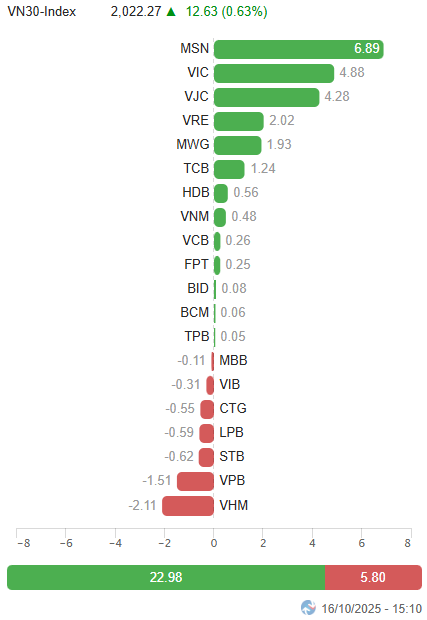

– The VN30-Index surged toward the end of the session, closing with a 12.63-point gain at 2,022.27 points. Market breadth showed a clear divergence with 13 gainers, 12 losers, and 5 unchanged stocks. On the positive side, MSN stood out by hitting its ceiling price from the opening bell, while VJC maintained its momentum with a 6.4% increase after three consecutive ceiling sessions. In contrast, CTG, VHM, VPB, and VIB traded less favorably with adjustments exceeding 1%.

By sector, real estate was today’s focal point with impressive demand across multiple stocks. These included DXG, DIG, NLG, DXS, and SJS, all hitting their ceiling prices, along with PDR, VRE, TCH, KBC, QCG, NHA, LDG, NTL, and others surging over 3%.

The industrial sector also recorded a 1% increase, but the sector’s landscape was more polarized. The upward trend was led by GEE hitting its ceiling, GEX (+3.97%), VJC (+6.38%), HVN (+1.42%), HHV (+3.26%), DPG (+1.86%), BMP (+6.44%), while GMD, MVN, VSC, HAH, PHP, SCS, PC1, CII, and others remained in the red.

Most other sectors exhibited similar patterns, fluctuating within narrow ranges with interspersed greens and reds.

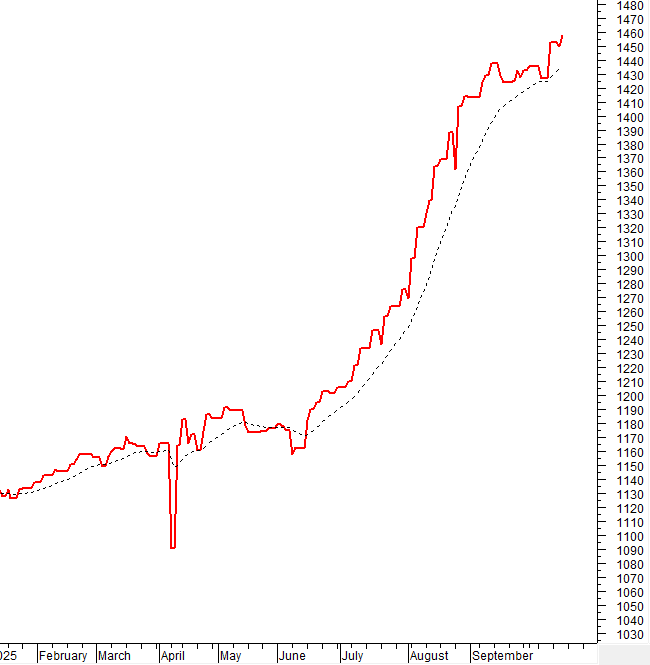

The VN-Index gained points after a strong tug-of-war session and is currently in a short-term accumulation phase following its surge to new highs. The Stochastic Oscillator continues to weaken after giving a sell signal in the overbought zone, indicating that volatility is likely to persist in upcoming sessions.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – Volatility Likely to Continue

The VN-Index gained points after a strong tug-of-war session and is currently in a short-term accumulation phase following its surge to new highs.

The Stochastic Oscillator continues to weaken after giving a sell signal in the overbought zone, indicating that volatility is likely to persist in upcoming sessions.

HNX-Index – Crossed Above the 50-Day SMA

The HNX-Index slightly increased and crossed above the 50-day SMA. The continuous appearance of small-bodied candles with long wicks recently indicates a prevailing tug-of-war state.

However, the MACD indicator continues to rise after giving a buy signal and has crossed above the zero threshold, improving the short-term outlook.

Capital Flow Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this state continues in the next session, the risk of a sudden downturn (thrust down) will be limited.

Foreign Capital Flow: Foreign investors returned to net buying in the October 16, 2025 trading session. If foreign investors maintain this action in upcoming sessions, the situation will become more positive.

III. MARKET STATISTICS ON OCTOBER 16, 2025

Economic & Market Strategy Analysis Department, Vietstock Consulting Division

– 17:43 October 16, 2025

Technical Analysis Afternoon Session 17/10: Bearish Engulfing Line Emerges

The VN-Index experienced a notable correction, accompanied by the emergence of a Bearish Engulfing Line candlestick pattern, signaling heightened short-term risk. Conversely, the HNX-Index formed its third consecutive bullish candlestick, indicating a contrasting trend.

Vietstock Daily 16/10/2025: Clear Market Polarization?

The VN-Index remains volatile, with declining liquidity reflecting investors’ cautious sentiment. Currently, the Stochastic Oscillator has issued a sell signal in the overbought territory, indicating heightened short-term correction risks. Should selling pressure persist, the index is likely to retest the 1,700–1,711 point range, aligning with the September 2025 peak.

October 17, 2025 Warrant Market: A Mixed Bag of Opportunities and Challenges

At the close of trading on October 16, 2025, the market saw 93 stocks rise, 132 fall, and 39 remain unchanged. Foreign investors continued their net selling streak, offloading a total of 5.21 million CW.