In a recent report, Dragon Capital provided insights into the fluctuations of Vietnam’s stock market.

According to Dragon Capital, profit-taking activities and net foreign capital outflows have impacted market sentiment, but the active participation of domestic investors has helped control the market correction.

As a result, the VN-Index has risen by 28.1% year-to-date (in USD terms), supported by robust domestic liquidity and stable corporate earnings.

With the Q3 2025 earnings season underway, analysts forecast strong profits for the Financial sector, driven by credit growth and trading activities, while the Real Estate sector continues its recovery with improved project launches and absorption rates.

For the Top 80 stock basket, the fund predicts a 21% profit growth in 2025 and 17% in 2026. Key factors to monitor include profit quality (core vs. one-off profits) and growth broadening to mid-cap stocks, reflecting improved fundamentals rather than short-term liquidity-driven rallies.

Moving into Q4 2025, market focus will shift to the timing and scale of capital inflows as Vietnam is expected to be included in the FTSE index in 2026, alongside ongoing reforms to achieve MSCI Emerging Market status.

Another critical milestone is the upgrade of Vietnam’s credit rating to “Investment Grade,” which is anticipated to reduce capital costs, enhance the appeal of the bond market, and attract global institutional investors.

Coupled with a projected IPO pipeline of over $40 billion from 2026 to 2028, these developments position Vietnam to transition from a high-growth frontier market to a key investment destination within the global emerging market group, according to Dragon Capital.

Vietnam’s Macroeconomic Foundation Shines

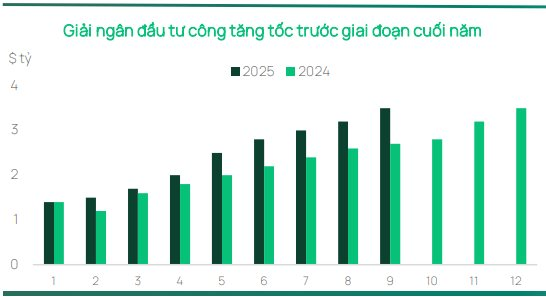

On the macroeconomic front, analysts highlight Vietnam’s robust economic foundation. GDP grew by 7.85% in the first nine months of 2025 (with Q3 at 8.23%), placing Vietnam among the world’s fastest-growing economies. Public investment disbursement in September rose 30% year-on-year to $21 billion, while FDI disbursement increased 8.5% to $18.8 billion, the highest in five years.

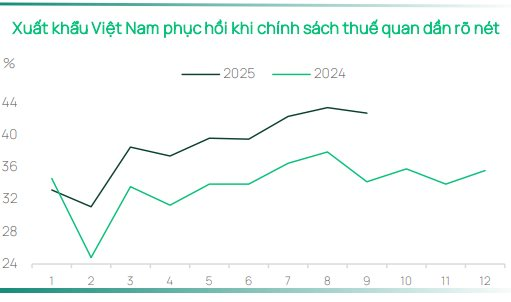

Trade activities remained strong, with both exports and imports rising approximately 25% year-on-year, resulting in a $2.9 billion monthly trade surplus. Inflation was contained at 3.4%, with core inflation stable at 3.2%, both within the government’s 4.5% ceiling. Industrial production grew 9.1% year-to-date, and the PMI remained in expansionary territory at 50.4 for the third consecutive month.

To ease pressure on the VND exchange rate, the State Bank of Vietnam continued to deploy cancellable forward contracts, stabilizing the market amid a 4.0% year-to-date depreciation of the local currency. These measures bolster short-term confidence, though the VND remains sensitive to U.S. policy shifts, import-driven FX demand, and FDI profit repatriation.

Regarding Vietnam’s FTSE Russell upgrade, Dragon Capital analysts believe this could attract billions in passive and active capital, expand institutional participation, and strengthen market pricing.

Long-term, this upgrade marks a significant leap but not the final destination, as the government has outlined a clear roadmap for MSCI Emerging Market and FTSE Developed Market status by 2030, including further easing of foreign ownership limits, derivative product development, and market infrastructure upgrades.

Vietnam’s Securities Regulator Outlines Market Development Roadmap Post-Upgrade

On October 16, 2025, the State Securities Commission (SSC) of Vietnam, in collaboration with the JICA Project, hosted a conference in Ho Chi Minh City titled “Dissemination of Amendments and Supplements to the Securities Law and Detailed Implementing Regulations” for the Southern region. During the event, a key question emerged regarding the policy direction for market development following FTSE’s upgrade of Vietnam’s market classification.

The Storm Within: A Martyr’s Heart

Investors anticipated a booming year as the VN-Index surged 60% from its tariff-driven lows, yet underlying anxieties continue to simmer among market participants.