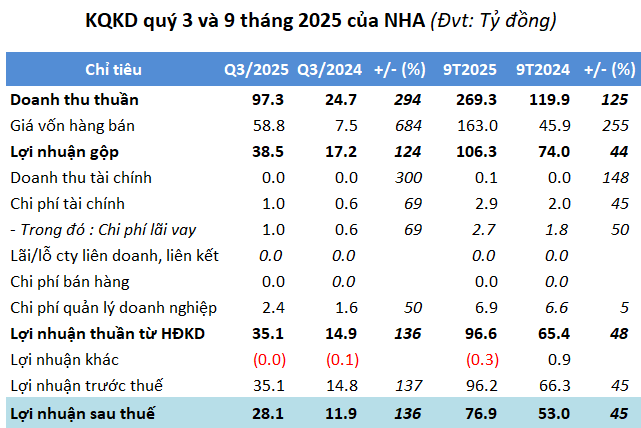

Nam Hanoi Investment and Urban Development Joint Stock Company (HOSE: NHA) has released its Q3 financial report, showcasing a record-breaking net revenue of over 97 billion VND, nearly four times higher than the same period last year. The primary drivers were construction activities, contributing more than 57 billion VND (no revenue recorded in the same period last year), and real estate sales, which increased by 62% to nearly 40 billion VND.

After deducting the cost of goods sold, gross profit reached nearly 39 billion VND, a 2.2-fold increase. However, the gross profit margin narrowed from 70% to 40%.

| NHA Business Results from Q1/2020 to Q3/2025 |

Financial and administrative expenses rose by 55% but remained insignificant at around 3 billion VND. As a result, the company’s net profit exceeded 28 billion VND, a 2.4-fold increase year-over-year.

NHA attributed this growth in Q3 to the transfer of land use rights at the Moc Bac Residential Area project and the completion of various construction projects.

For the first nine months, cumulative net revenue surpassed 269 billion VND, a 2.2-fold increase, with after-tax profit nearing 77 billion VND, up 45%. In 2025, NHA aims for a revenue of 260 billion VND, a 62% increase compared to 2024, and an after-tax profit of 50 billion VND, a 21% decrease. With this plan, NHA has already exceeded its revenue target by 4% and its profit target by 54%.

Source: VietstockFinance

|

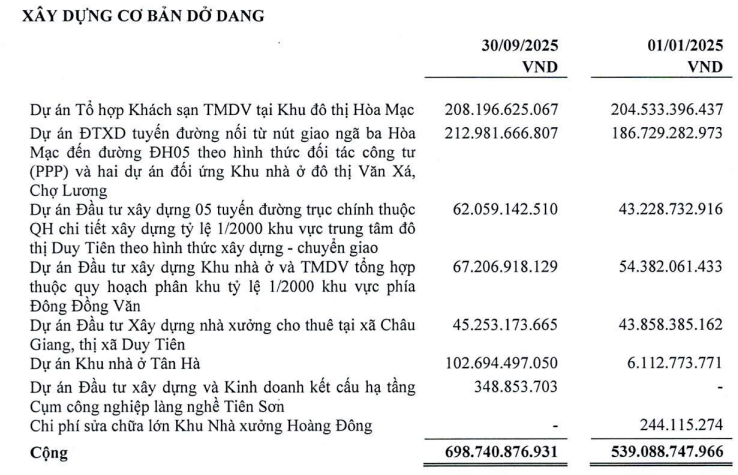

As of the end of Q3, NHA’s total assets reached nearly 900 billion VND, a 12% increase since the beginning of the year. Of this, construction in progress accounted for the largest share at nearly 700 billion VND, up 30%, primarily focused on the Hoa Mac Urban Area commercial hotel complex project (over 208 billion VND); the PPP road project connecting Hoa Mac junction to DH05 road (over 213 billion VND); and the Van Xa Urban Housing and Luong Market projects (nearly 103 billion VND).

Source: NHA

|

Total liabilities stood at over 306 billion VND, an 8% increase, with financial loans exceeding 215 billion VND, up 62%, accounting for 70% of total debt.

– 11:14 17/10/2025

Technical Analysis for the Session on November 26: Investor Sentiment Improves

The VN-Index and HNX-Index rose in tandem, with a significant surge in trading volume during the morning session, indicating a renewed optimism among investors.