|

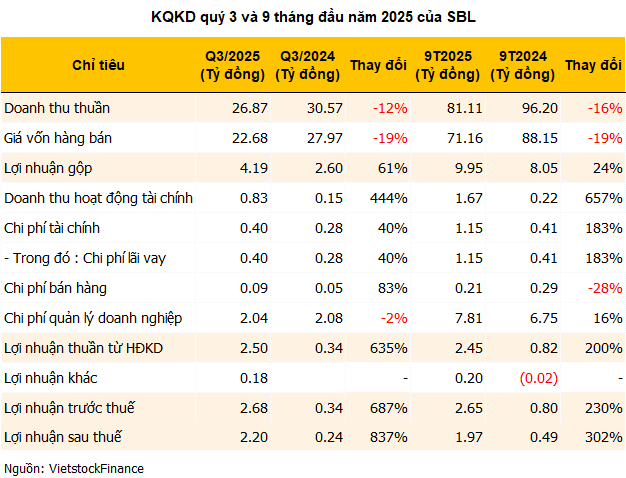

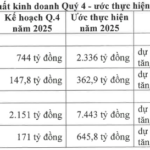

In Q3/2025, SBL recorded its highest net profit in two years, reaching over 2.2 billion VND, a staggering 837% increase year-over-year, despite a 12% decline in revenue to under 17 billion VND. This remarkable achievement is attributed to lower raw material costs and a significant surge in financial revenue. Gross profit margin saw a notable improvement, rising to 15.6% from 8.5% in the same period last year.

Additionally, the company recognized nearly 179 million VND in other income from the disposal of unused assets, a category absent in the corresponding period last year.

| SBL’s Quarterly Business Results for 2023-2025 |

For the first nine months of the year, SBL achieved revenue exceeding 81 billion VND, a 16% decrease year-over-year, marking the lowest nine-month revenue in its history and fulfilling 60% of the annual plan. Despite losses in the first half, the company reported a cumulative nine-month profit of nearly 2 billion VND, four times higher than the same period last year and almost 124 times the annual target of 16 million VND in profit.

However, the cash flow statement reveals a notable shift, with net cash from investing activities turning negative at over 50 billion VND, compared to a positive 130 million VND in the same period last year. This change is primarily due to a 54.1 billion VND outflow for loans and purchases of debt instruments from other entities.

As of the end of September 2025, SBL‘s total assets amounted to nearly 242 billion VND, a 6% decrease from the beginning of the year. Bank deposits accounted for over 61 billion VND. Total liabilities exceeded 65 billion VND, down 15%, with short-term loans and finance leases constituting approximately 55%.

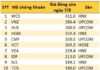

On the UPCoM market, SBL shares closed at 5,400 VND per share on October 16, reflecting a 15% decline over the past three months and a slight 2% drop over the year. Trading volume remains extremely low, with only over 3,000 shares matched per session.

| SBL Stock Price Movement Over the Past Year |

– 15:41 16/10/2025

Steel Company Surpasses 58% Profit Target in First Nine Months

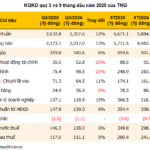

Thuduc Steel JSC – VNSTEEL (UPCoM: TDS) has announced robust Q3 2025 financial results, driven by strengthened core operations and additional profit streams.

Phú Tài Aims to Surpass 2025 Profit Target by Over 35%

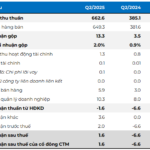

The Board of Directors of Phu Tai Corporation (HOSE: PTB) has approved the estimated consolidated business results for the first nine months of 2025, reporting a revenue of VND 5,292 billion and pre-tax profit of nearly VND 475 billion. This represents a 15% increase in revenue and a 36% surge in pre-tax profit compared to the same period last year.

VPD Boosts 2025 Profit Target by 59%

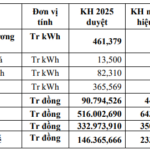

On October 9th, the Board of Directors of Vietnam Power Development Joint Stock Company (HOSE: VPD) approved adjustments to its 2025 business plan, increasing its commercial electricity output target from 461 million kWh to nearly 579 million kWh, representing a growth of over 25% compared to the previous target.