Q3 Pre-Tax Profit Surges Eightfold Year-on-Year, Exceeding 2025 Annual Plan by 100.7%

According to the report, as of September 30, 2025, SHS’s total assets surpassed VND 20 trillion, marking a 57% increase compared to the same period in 2024. This growth stems from financial investment activities, margin lending, and expanded equity capital, highlighting the company’s continued operational expansion and strengthened financial capabilities. Q3 2025 pre-tax profit reached VND 590 billion, an 8-fold increase (697% growth) year-on-year.

For the first nine months, SHS’s pre-tax profit totaled VND 1,379 billion, a 45% increase compared to the same period in 2024, surpassing the 2025 annual plan set by the Shareholders’ Meeting. Estimated EPS for four consecutive quarters reached VND 1,682 per share, with ROAE at 12.5% and ROAA at 8.7%, demonstrating superior profitability and capital efficiency compared to industry averages.

Alongside impressive business results, in August 2025, SHS’s market capitalization surpassed USD 1 billion for the first time, ranking the company among the top 60 largest enterprises on the Vietnamese stock market and the top 6 securities firms by market cap. This milestone underscores investor confidence and solidifies SHS’s position as a leading financial institution with a robust foundation and long-term growth potential.

Growth Driven by Diversified Business Activities

SHS’s positive Q3 2025 results were fueled by balanced contributions from core business segments, including brokerage, margin lending, proprietary trading, and corporate finance advisory. Securities brokerage revenue reached VND 137 billion, a 179% increase year-on-year, driven by improved market liquidity and expanded market share among both retail and institutional clients. Margin lending maintained steady growth, with outstanding loans reaching VND 9,136.66 billion, up 135% year-on-year, reflecting robust trading demand and effective risk management.

SHS focuses on developing an Investment Advisory and Personal Wealth Management ecosystem.

Proprietary trading recorded a net profit of approximately VND 393 billion, a 24-fold increase year-on-year, benefiting from favorable market conditions and a flexible investment portfolio with optimized equity-bond allocation. Corporate finance advisory (IB) also achieved positive results, with revenue reaching VND 12.67 billion, up 64% year-on-year, supported by a rebounding M&A market and strong corporate issuance and capital structuring activities. SHS’s strategy of diversifying revenue streams, optimizing capital efficiency, and leveraging technology in management and operations has maintained stable profit margins, enhanced productivity, and strengthened its competitive position.

Financially, SHS’s debt ratios and debt-to-equity remain at safe levels, consistent with the previous period, ensuring a healthy financial structure and high liquidity. Short-term debt as a percentage of total capital is well-managed, providing room for investment and service expansion. Key financial metrics have improved, reflecting effective risk management and sustainable financial health. Stable operating cash flows and flexible capital allocation enable SHS to invest in new products and technology while maintaining stable shareholder returns. Standardized internal controls and risk management systems, aligned with international best practices, further enhance investor and strategic partner confidence.

SHS achieved a pre-tax profit of over VND 1,379 billion in the first nine months, surpassing the 2025 plan set by the Shareholders’ Meeting.

Beyond financial success, SHS continues to invest heavily in infrastructure, technology, and human resources, aiming to build a comprehensive and integrated financial ecosystem. To date, the company has established a Head Office, 3 Branches, 1 Transaction Office, and 2 Representative Offices in key economic hubs such as Hanoi, Ho Chi Minh City, Da Nang, Hai Phong, and Can Tho, expanding market reach and enhancing nationwide customer service. As of September 2025, SHS employs over 350 staff, a 14.4% increase year-on-year. The Investment Advisory segment accounts for 46% of the workforce, reflecting a focus on developing high-quality, specialized talent capable of adapting to digital transformation demands.

Concurrently, SHS is expanding its financial product portfolio, notably with Margin S30, SH69 packages, and Wealth Management solutions tailored to individual and institutional investors. Regularly published strategic reports and industry/company analyses provide valuable insights, helping investors make informed, timely, and effective decisions.

The first nine months of 2025 clearly demonstrate SHS’s sustainable development strategy, effective management, and sound direction. SHS remains committed to its Service Branding strategy, prioritizing service quality over price or scale competition. By focusing on customer experience, deep advisory expertise, and transaction dedication, SHS aims to maintain steady growth, strengthen its market position, and become Vietnam’s leading financial and investment group.

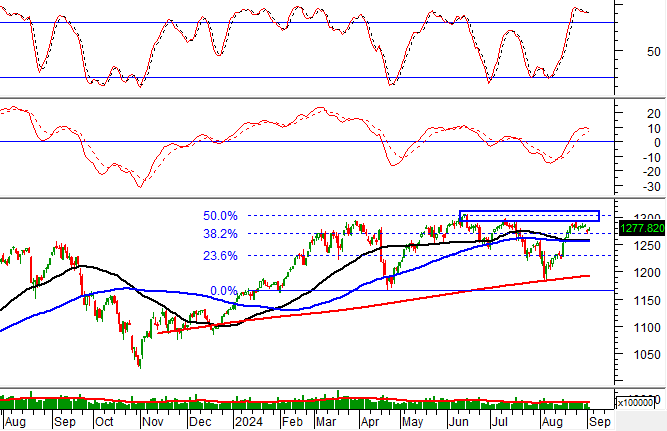

Stock Market Shatters All Records

The opening session of the week (October 13th) marked a historic milestone for Vietnam’s stock market, as the VN30-Index breached the 2,000-point threshold for the first time ever.

MBS Joins the “Billion-Dollar Club” for the First Time, Surging to Top 6 Market Share on HOSE

MBS Securities Corporation has unveiled its Q3 2025 financial results, reporting a remarkable profit of VND 418 billion, a 1.9-fold increase compared to the same period last year. With a cumulative nine-month profit of VND 1,030 billion, MBS has achieved a significant milestone by joining the prestigious “Thousand Billion Club” and securing a position among the top 6 brokerage firms on the Ho Chi Minh City Stock Exchange (HOSE).