I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

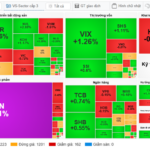

I.1. Market Trends

VN30 futures contracts showed mixed movements during the trading session on October 14, 2025. Specifically, 41I1FA000 (I1FA000) rose by 0.03%, reaching 2,014.2 points; 41I1FB000 (I1FB000) declined by 0.05%, closing at 2,009.9 points; the VN30F2512 (F2512) contract fell by 0.1%, settling at 2,008 points; and 41I1G3000 (I1G3000) increased by 0.05%, hitting 1,983 points. The underlying index, VN30-Index, ended the session at 2,013.69 points.

Additionally, VN100 futures contracts exhibited mixed performance on October 15, 2025. Notably, 41I2FA000 (I2FA000) gained 1.03%, reaching 1,949.8 points; 41I2FB000 (I2FB000) rose by 0.42%, closing at 1,933.9 points; 41I2FC000 (I2FC000) advanced by 1.1%, settling at 1,926 points; and 41I2G3000 (I2G3000) dropped by 0.1%, ending at 1,915 points. The underlying VN100-Index concluded the session at 1,937.17 points.

During the October 14, 2025 session, the 41I1FA000 contract opened positively but soon entered a prolonged tug-of-war, with the Long side holding the advantage for most of the morning. In the afternoon, buyers lost their edge, and increasing selling pressure caused I1FA000 to weaken, closing just above the reference level with a marginal gain of less than 1 point.

Intraday Chart of 41I1FA000

Source: https://stockchart.vietstock.vn/

At the close, the basis of the 41I1FA000 contract narrowed compared to the previous session, reaching 0.51 points. This indicates a less optimistic sentiment among investors.

Movements of 41I1FA000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated using the formula: Basis = Futures Contract Price – VN30-Index

Trading volume and value in the derivatives market increased by 26.07% and 29.15%, respectively, compared to the October 14, 2025 session. Specifically, I1FA000 trading volume rose by 24.71%, with 344,928 contracts matched. I2FA000 trading volume fell by 21.02%, with only 139 contracts traded.

Foreign investors continued to sell, with a net selling volume of 833 contracts during the October 14, 2025 session.

Daily Trading Volume Trends in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

I.2. Futures Contract Valuation

Based on the fair pricing method as of October 15, 2025, the reasonable price range for actively traded futures contracts is as follows:

Valuation Summary Table for Derivatives Contracts of VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with appropriate term adjustments for each futures contract.

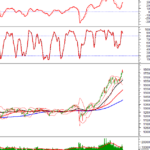

I.3. Technical Analysis of VN30-Index

During the October 14, 2025 session, the VN30-Index edged up slightly, accompanied by a small-bodied candlestick pattern and above-average trading volume (20 sessions), indicating investor hesitation.

Currently, the index remains close to the Upper Band of the Bollinger Bands, while the MACD indicator continues to rise after generating a buy signal. This suggests the medium-term uptrend remains intact.

However, the Stochastic Oscillator has issued a sell signal in the overbought zone. If conditions do not improve and the indicator exits this zone in upcoming sessions, short-term correction risks will increase.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of October 15, 2025, the reasonable price range for actively traded bond futures contracts is as follows:

Valuation Summary Table for Government Bond Futures Contracts

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with appropriate term adjustments for each futures contract.

According to the above valuation, the GB05F2512, 41B5G3000, and 41B5G6000 contracts are currently attractively priced. Investors should focus on and consider buying these futures contracts in the near term, as they offer excellent value in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:28 14/10/2025

Market Pulse 16/10: VN-Index Expands Range in Afternoon Session, MSN Secures Massive Deal

In a continuation of the morning session, the market experienced heightened volatility during the afternoon, with significant fluctuations across various sectors. The divergence was particularly evident in major industry groups, showcasing a vibrant spectrum of performance. Notably, MSN stood out with a substantial block trade executed by foreign investors, further intensifying the market’s dynamic movements.

Technical Analysis Afternoon Session 16/10: Intense Tug-of-War

The VN-Index experienced a tug-of-war session, while the Stochastic Oscillator continued its downward trajectory, reaffirming a sell signal. Meanwhile, the HNX-Index formed a pattern resembling a Long Upper Shadow, indicating persistent selling pressure.