On October 17th, at the conference titled “The Fund Industry in the Development of the Stock Market and Attracting Indirect Investment Capital into Vietnam,” organized by the State Securities Commission (SSC) and chaired by Minister of Finance Nguyen Van Thang, leading experts and investment fund executives from both domestic and international sectors gathered to discuss new directions for the fund industry. The focus was on strategies to sustainably attract foreign capital into Vietnam, particularly in light of the recent upgrade of Vietnam’s stock market by FTSE Russell.

During the conference, Vice Chairman of the SSC Bui Hoang Hai announced that the SSC is exploring measures to expand the scale and diversity of Vietnam’s stock market. These measures include allowing foreign-invested enterprises (FIEs) to participate in initial public offerings (IPOs) and list on the stock exchange. “This step aligns with the ongoing reform and integration process, aiming to attract high-quality capital while enhancing market transparency,” stated Mr. Hai.

Notably, the SSC is also considering the introduction of gold-based derivative products, specifically gold ETFs, on the stock exchange. According to experts, this model would not only provide a legal and transparent investment channel for the public but also facilitate more effective management of gold flows within the economy.

Minister of Finance Nguyen Van Thang addressing the conference

Regarding gold ETFs, Mr. Hyun Dongsik, Chairman of KIM Vietnam Fund Management, shared insights from South Korea: “In South Korea, gold ETFs are regulated as securities, with a robust system for custody, settlement, and oversight. This ensures reliability, transparency, and convenience for investors. Vietnam can draw on this model to develop a secure, manageable, and internationally aligned investment channel.”

Ms. Nguyen Thi Ngoc Anh, CEO of SSI Fund Management, also highlighted the safety of gold ETFs within certain parameters. She emphasized that these products could “activate” dormant capital held in gold, rather than letting it remain idle in vaults. “With a robust legal framework, Vietnam can significantly leverage infrastructure, real estate, and ETF investment funds. Over the next 3-5 years, Vietnam’s fund industry is poised to attract a new wave of larger and more professional capital,” she added.

In his concluding remarks, Minister of Finance Nguyen Van Thang underscored the stock market upgrade as a pivotal opportunity to draw indirect foreign investment, bolstering economic development. “This is a critical juncture for qualitative transformation in the stock market, including a shift in investor structure to increase the proportion of institutional investors. Such changes will drive the professional growth and sustainability of the investment fund industry,” the Minister concluded.

VN-Index Poised to Target 1,800 Resistance Level, ABS Research Indicates

According to the October strategy report, An Binh Securities Analysis Center (ABS Research) anticipates the market will surpass the short-term peak of 1,700 points. ABS Research forecasts further upward momentum, targeting resistance levels at 1,740-1,780, and ultimately reaching higher resistance thresholds of 1,813-1,820.

Foreign Block Net Sells Over 2,000 Billion as VN-Index Plunges Nearly 36 Points: Which Stocks Were Hit Hardest?

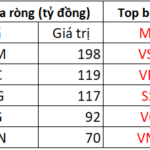

In the afternoon trading session, VHM stocks emerged as the most heavily net-bought securities across the entire market, with a total value of approximately 198 billion VND.