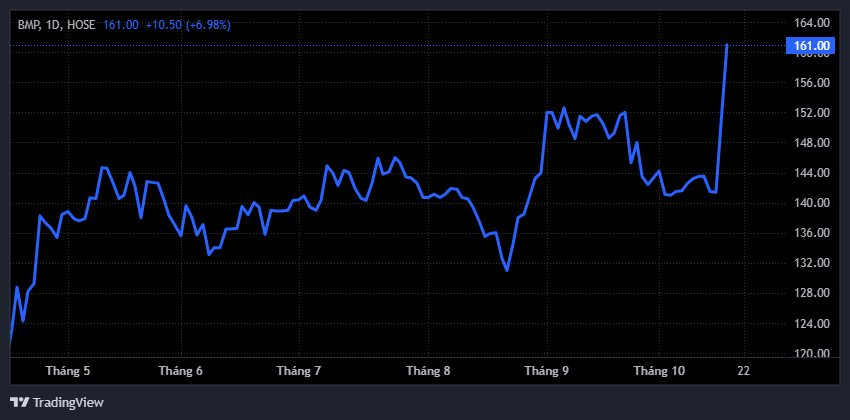

Amidst a broader market downturn, Binh Minh Plastic Joint Stock Company’s (BMP) shares have staged a remarkable rally in the final trading session of the week. The stock surged to its upper limit, reaching an all-time high of VND 161,000 per share. This impressive performance catapulted BMP into the top 5 highest-priced stocks on the HoSE, trailing only VCF, VIC, GEE, and VJC.

Over the past two months, BMP’s share price has climbed over 24%. The company’s market capitalization has also surpassed the VND 13,000 billion mark for the first time, solidifying its position as the leading player in the plastics industry on the stock exchange.

This surge in share price follows the company’s robust Q3 2025 financial results. Net revenue for the quarter reached VND 1,532 billion, a 9% increase compared to Q3 2024.

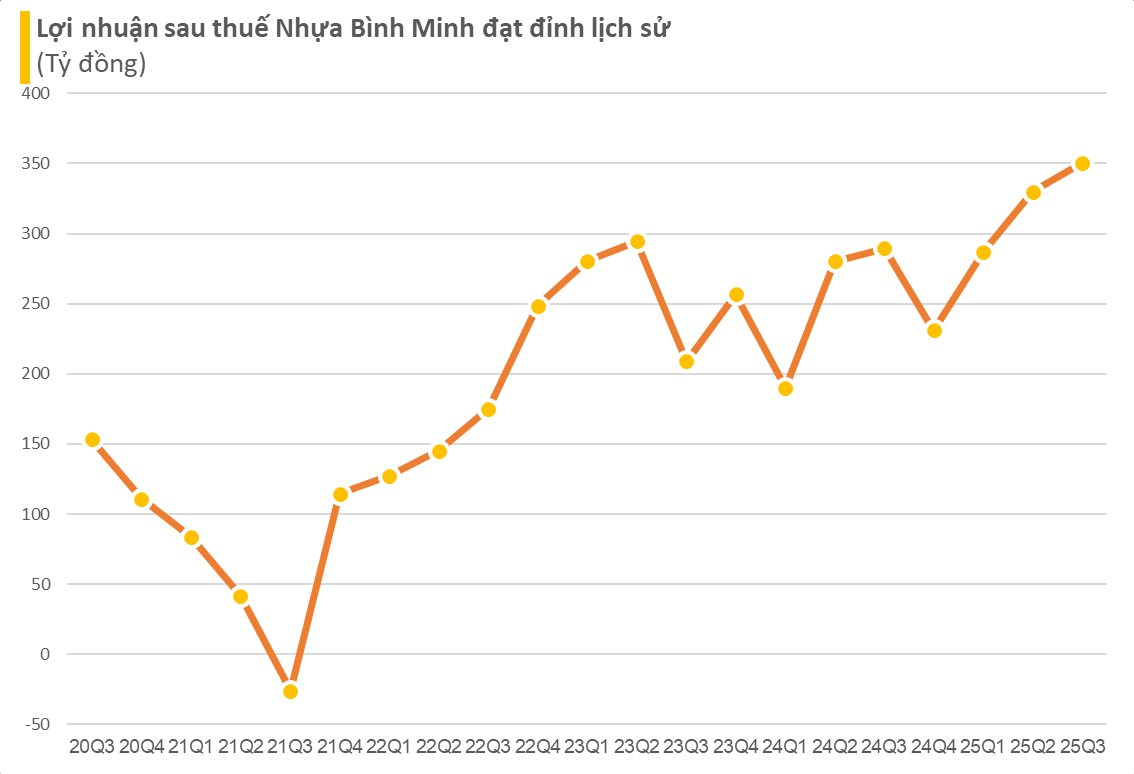

After-tax profit hit nearly VND 351 billion, a 21% year-on-year increase and the highest quarterly profit since BMP became a subsidiary of Nawaplastic Industries (a member of Thailand’s SCG Group) in early 2018.

A key highlight of the financial results was the record-high gross profit margin of 47.9% in Q3, despite rising discount costs. While the operating profit margin dipped slightly by 30 basis points to 32.1% compared to the previous quarter, it remains the second-highest in the company’s history. Year-on-year, this margin has surged by a significant 330 basis points.

According to Vietcap, BMP’s ability to maintain high profit margins is primarily attributed to favorable input costs, particularly the low price of PVC.

PVC import prices from China, which accounts for nearly 50% of global demand, have plummeted due to escalating US-China trade tensions. If this trend persists, BMP is poised to benefit further in Q4 2025 from continued reductions in input costs, further expanding its profit margins.

For the first nine months of 2025, BMP reported net revenue of VND 4,224 billion, a 19% increase, and after-tax profit of VND 967 billion, a 27% rise compared to the same period in 2024.

FPTS Securities forecasts that BMP’s 2025 net revenue and after-tax profit could reach VND 5,389 billion (+17% YoY) and VND 1,248 billion (+25.9% YoY), respectively, achieving 100% and 118% of the annual targets. Projected sales volume for 2025 is expected to increase by 17% year-on-year to 91,200 tons, driven by rising demand for plastic pipes in the second half of the year.

FPTS also anticipates that BMP will maintain its high pricing strategy in the latter half of the year, supported by recovering demand and a stabilizing distribution network. The 2025 gross profit margin is projected at 44.9%, a 1.8 percentage point increase from the previous year, assuming stable selling prices and an average PVC price decline of approximately 9.5% to USD 730 per ton.

Additionally, BMP’s debt-free status and lack of investment in expansion projects have enabled the company to maintain a high cash dividend payout ratio, nearly equivalent to 100% of after-tax profit. This factor continues to make the stock attractive to value investors.

The Leading Vietnamese Enterprise Sets a New Record, Thai Tycoon Reaps Rewards After 6-Year Takeover

This company’s market capitalization has soared to approximately VND 10,000 billion, a record high since its listing in 2006. This impressive growth showcases the enterprise’s thriving performance and potential, attracting investors and showcasing its prominence in the market.