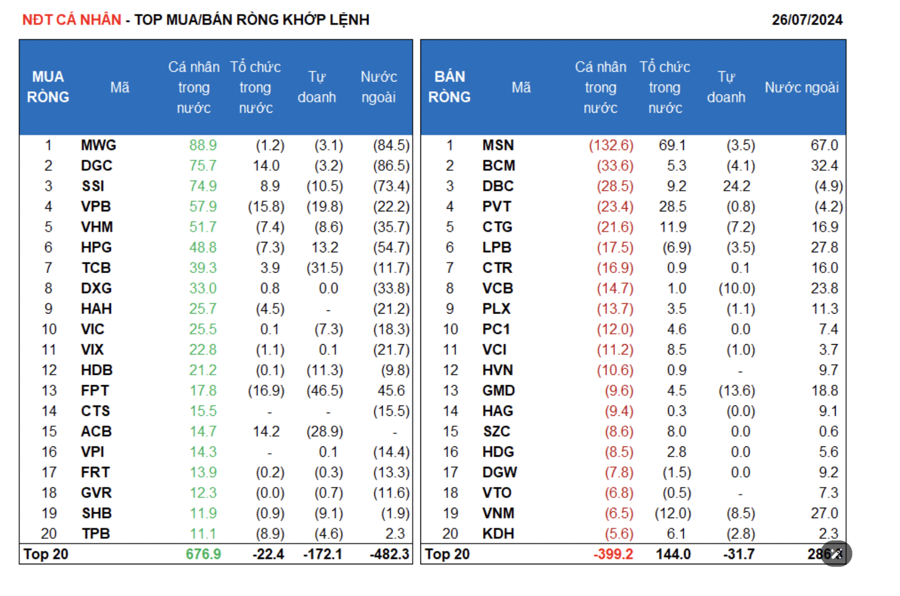

After hovering near the peak for several sessions, the market entered the final trading day of the week with caution. Buyers were mostly probing, placing small, incremental orders, while sellers proactively lowered prices, creating pressure that quickly led to a prolonged tug-of-war.

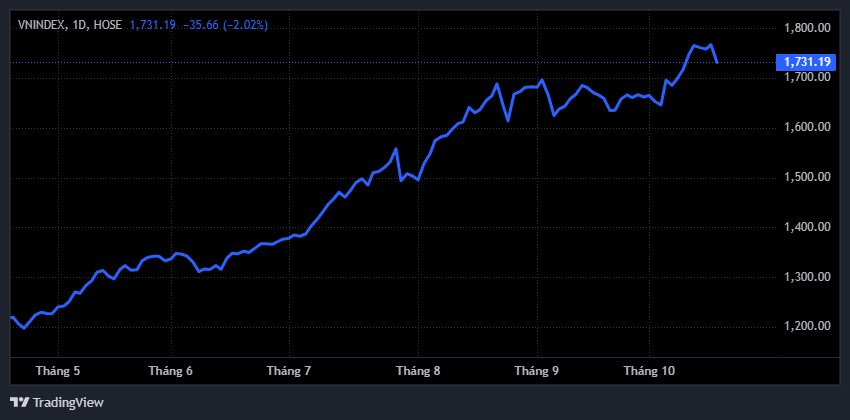

However, selling pressure intensified rapidly in the afternoon session, particularly in large-cap stocks, tilting the balance decisively in favor of sellers. Vingroup stocks were the focal point of the correction, facing heavy selling after a hot streak of gains, dragging the VN-Index downward. The index closed the session on October 17th down 35 points, or 2.02%, at 1,731 points.

Notably, market liquidity also surged, with trading volume nearing 1.2 billion shares. The order-matching value on the HOSE alone exceeded 40 trillion VND, up nearly 20% from the previous session.

Market Has Not Confirmed a Downtrend

According to Mr. Nguyen The Minh, Director of Securities Analysis at Yuanta Vietnam, the negative session was largely driven by external factors.

Specifically, the U.S. market fell sharply due to concerns about bad debt risks in the banking system, seen as a hurdle to economic recovery in the near term. Simultaneously, tensions between the U.S. and China resurfaced late last week, causing Asian markets to decline in unison during the afternoon session. These developments quickly impacted domestic investor sentiment, already sensitive after a hot rally.

Beyond international factors, the sharp correction in Vingroup stocks was a primary driver of the VN-Index’s deep decline. After a rapid rise, many investors had secured good profits and did not hesitate to “take profits” as correction risks emerged.

However, Mr. Minh believes current market valuations are not overly high, and no significant technical resistance levels have emerged to trigger strong internal selling pressure. The session’s dynamics were largely technical, combined with psychological impacts following the derivatives expiration, which typically brings short-term volatility.

Still, Mr. Minh noted a silver lining in the session. High liquidity without widespread panic selling indicates that price-supporting demand remains. According to Mr. Minh, this is not a “trend reversal” signal but likely a technical correction within a medium-term uptrend. Excluding Vingroup’s influence, actual downward pressure was not excessive.

1,720 Support Level Gains Importance

Technical analysis highlights the 1,720-point region as a critical short-term support level for the VN-Index. If the index holds above this area, the medium-term uptrend remains intact. However, if this support is breached, investors should prioritize defensive strategies.

In the current context, Mr. Minh advises investors with strong positions to maintain high stock allocations but temporarily limit new investments to observe further corrections in upcoming sessions. If the market holds the support zone, it could present an opportunity to reasonably increase exposure.

In reality, not all stocks have risen during this period. Therefore, selecting the right sectors and stocks remains crucial. Stocks with strong fundamentals and attracting capital flows will better withstand current corrections. For portfolios meeting these criteria, a 1–2% decline does not pose significant risk.

Derivatives Market Update 14/10/2025: Bulls Maintain Dominance

On October 13, 2025, futures contracts for the VN30 and VN100 indices predominantly closed in positive territory. The VN30-Index surged notably, forming a bullish Three White Soldiers candlestick pattern, accompanied by trading volumes surpassing the 20-session average, signaling heightened investor optimism.

Market Pulse 14/10: Blue-Chip Stocks Bolster Against Intense Selling Pressure

In stark contrast to the morning’s optimism, the VN-Index closed in the red as selling pressure dominated towards the end of the session. The HOSE index settled at 1,761.06 points, marking a 4-point decline. Similarly, the HNX-Index dipped slightly below the reference level, shedding 0.02 points to close at 275.33.

Vietstock Daily October 15, 2025: Momentum Slows

The VN-Index reversed its course, closing lower and snapping a four-session winning streak. With the Stochastic Oscillator potentially signaling a sell-off from overbought territory, the previously breached September 2025 peak (around 1,700–1,711 points) is poised to act as critical support should the correction extend in upcoming sessions.

Market Pulse 16/10: Persistent Tug-of-War as Gainers and Losers Balance Out

The VN-Index fluctuated within a narrow range of 1,757 to 1,763 points during the morning session, reflecting a highly polarized market landscape.