MARKET ANALYSIS FOR THE WEEK OF OCTOBER 13-17, 2025

During the week of October 13-17, 2025, the VN-Index reversed its trend, closing lower with the emergence of a Long Upper Shadow candlestick pattern. This was accompanied by trading volumes surpassing the 20-week average, indicating significant profit-taking pressure as the index approached new historical highs.

While the MACD has maintained a buy signal since May 2025, the weakening momentum of the Stochastic Oscillator in the overbought zone suggests the market is likely to experience short-term volatility.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Bearish Engulfing Pattern Emerges

On October 17, 2025, the VN-Index experienced a sharp decline, accompanied by a Bearish Engulfing candlestick pattern. Trading volumes exceeded the 20-session average, reflecting cautious investor sentiment.

Additionally, the Stochastic Oscillator continued to weaken after signaling a sell in the overbought zone. If conditions do not improve and the indicator exits this zone in upcoming sessions, short-term risks will escalate.

In the event of a bearish scenario, the previously broken September 2025 peak (equivalent to the 1,690-1,715 point range) is expected to provide strong support for the VN-Index.

HNX-Index – Consolidating Around the 50-Day SMA

On October 17, 2025, the HNX-Index closed slightly lower, with trading volumes surpassing the 20-session average, indicating investor indecision.

The index continues to consolidate around the 50-day SMA, with alternating up and down sessions. The ADX indicator remains weak below 20, signaling a fragile short-term trend.

Currently, the HNX-Index remains above the Middle Band of the Bollinger Bands, while the MACD continues to rise above the zero line after generating a buy signal. This suggests a positive short-term outlook.

Liquidity Analysis

Smart Money Flow Dynamics: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Investor Flow Dynamics: Foreign investors resumed net selling on October 17, 2025. If this trend continues in upcoming sessions, market sentiment will likely deteriorate further.

Technical Analysis Team, Vietstock Advisory Department

– 17:28 October 19, 2025

Market Experts Decode VN-Index’s 35-Point Plunge in Friday’s Session

According to Mr. Minh, this is not a sign of a “trend reversal,” but rather a likely technical adjustment within the broader upward trajectory.

Market Pulse 14/10: Blue-Chip Stocks Bolster Against Intense Selling Pressure

In stark contrast to the morning’s optimism, the VN-Index closed in the red as selling pressure dominated towards the end of the session. The HOSE index settled at 1,761.06 points, marking a 4-point decline. Similarly, the HNX-Index dipped slightly below the reference level, shedding 0.02 points to close at 275.33.

Vietstock Daily October 15, 2025: Momentum Slows

The VN-Index reversed its course, closing lower and snapping a four-session winning streak. With the Stochastic Oscillator potentially signaling a sell-off from overbought territory, the previously breached September 2025 peak (around 1,700–1,711 points) is poised to act as critical support should the correction extend in upcoming sessions.

Market Pulse 16/10: Persistent Tug-of-War as Gainers and Losers Balance Out

The VN-Index fluctuated within a narrow range of 1,757 to 1,763 points during the morning session, reflecting a highly polarized market landscape.

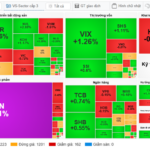

Market Pulse 16/10: VN-Index Expands Range in Afternoon Session, MSN Secures Massive Deal

In a continuation of the morning session, the market experienced heightened volatility during the afternoon, with significant fluctuations across various sectors. The divergence was particularly evident in major industry groups, showcasing a vibrant spectrum of performance. Notably, MSN stood out with a substantial block trade executed by foreign investors, further intensifying the market’s dynamic movements.