The Ho Chi Minh City Stock Exchange (HOSE) has announced the listing and first trading day of NTC shares, issued by Nam Tan Uyen Industrial Park Joint Stock Company.

Specifically, nearly 24 million NTC shares will commence trading on HOSE on October 28, 2025. The reference price for the first trading day is VND 161,470 per share, with a price fluctuation range of ± 20% compared to the reference price.

On the stock market, NTC closed its final trading session on UPCOM on October 15 at VND 165,000 per share. Thus, the listing price on HOSE is 2% lower than the closing price on UPCOM.

Established in 2004, Nam Tan Uyen’s shareholder structure includes three major shareholders holding 73.22% of the charter capital: Phuoc Hoa Rubber Joint Stock Company (32.85%), Vietnam Rubber Industry Group – Joint Stock Company (GVR) (20.42%), and Saigon VRG Investment Joint Stock Company (19.95%).

Nam Tan Uyen is the infrastructure developer of three key industrial parks (IPs) in Tan Uyen City, Binh Duong Province: Nam Tan Uyen IP (332 ha), Nam Tan Uyen Expanded IP (288.52 ha), and Nam Tan Uyen Expanded IP Phase 2 (346 ha).

Additionally, the company invests in several intra- and inter-industry projects, including Binh Long Rubber IP (Binh Phuoc, 37.79% ownership), Bac Dong Phu IP (Binh Phuoc, 40% ownership), Truong Phat Rubber Joint Stock Company (20% ownership), and Dau Giay IP (Dong Nai, 22.17% ownership).

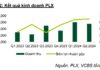

In terms of business performance, in the first six months of 2025, Nam Tan Uyen recorded VND 277 billion in net revenue and VND 166 billion in post-tax profit, up 124% and 27% year-on-year, respectively. For 2025, the company targets VND 793 billion in revenue and VND 284 billion in post-tax profit. Thus, NTC has achieved approximately 59% of its annual profit goal.

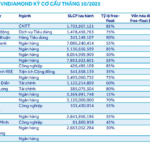

As of June 30, 2025, total assets reached over VND 6,164 billion, down 16% from the beginning of the year. This includes VND 27 billion in cash and cash equivalents, and over VND 535 billion in term deposits with banks. Long-term prepaid expenses account for 72% of total assets at VND 4,470 billion. Construction in progress increased nearly threefold to over VND 45 billion due to increased investment in Nam Tan Uyen Expanded IP Phase 2.

Total liabilities at the end of Q2 decreased by 22% from the beginning of the year to nearly VND 4,889 billion. Outstanding loans were VND 950 billion, while customer advances and unearned revenue totaled VND 3,819 billion, accounting for 78% of total liabilities.

DIC Corp Yet to Disburse Full Proceeds from 2021 Share Offering

As of October 7, 2025, DIC Corp has disbursed approximately VND 1,422.8 billion out of the total VND 1,499.9 billion raised from its 2021 share offering, leaving nearly VND 77.1 billion yet to be allocated.

International Dairy Brand Lof Seeks $65 Million Bank Loan

International Dairy Lof seeks additional funding of VND 700 billion from BIDV and VND 800 billion from VietinBank to bolster working capital and support ongoing production and business operations.