Vocarimex (VOC), a leading Vietnamese vegetable oil producer, announced its extraordinary shareholders’ meeting resolution on October 17, 2025. The company has decided to revoke its public company status, delist from the UPCoM, and implement measures to protect shareholder interests.

As of June 30, 2025, Vocarimex boasts a chartered capital of VND 1,218 billion and owner’s equity nearing VND 2,073 billion. Its shareholder structure, as of September 17, 2025, comprises 1,099 shareholders, with two major shareholders holding 92.99% of the capital, leaving 1,097 minority shareholders with only 7.01%.

This shareholder composition fails to meet the regulatory requirements for the number and proportion of minority shareholders, prompting the Board of Directors to approve the revocation of public company status and delisting.

Following the State Securities Commission’s announcement of the public company status revocation, the Hanoi Stock Exchange (HNX) will delist all 121.8 million VOC shares, and the Vietnam Securities Depository (VSDC) will subsequently cancel the corresponding securities registration.

Vocarimex previously owned Tuong An Vegetable Oil Company before transferring it to Kido Group.

To safeguard shareholder interests, Vocarimex has proactively requested its largest shareholder, Kido Group (KDC, listed on HoSE), to acquire all shares from other shareholders wishing to sell post-delisting. Kido Group, currently holding 87.3% of Vocarimex’s capital, may increase its ownership to 100% by purchasing the remaining shares. The group has agreed to consider this proposal.

Vocarimex initially proposed revoking its public company status at an extraordinary shareholders’ meeting on December 12, 2023, receiving 100% approval. However, implementation has only begun now.

Established in 1976 as the Southern Vegetable Oil Company, Vocarimex has been a key player in the edible oil production and trading sector. In 2015, the company transitioned to a joint-stock model and began trading on UPCoM on September 12, 2016.

Kido Group became a strategic shareholder in 2014 and gained control in 2017 by increasing its stake to 51%. Since 2021, KDC has held 87.3% of VOC’s capital.

Vocarimex previously owned Tuong An Vegetable Oil Company, which was later transferred to Kido Group. The company was also a founding shareholder of Calofic Vegetable Oil, known for brands like Neptune, Simply, and Meizan. Vocarimex fully divested from Calofic in 2023.

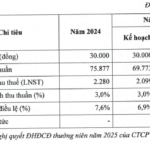

In the first half of 2025, Vocarimex reported revenue of nearly VND 220 billion, a 90% year-on-year increase, and a net profit of over VND 33 billion, up 85%. The company has achieved 44% of its annual revenue target and 79% of its profit goal.

Industrial Real Estate Giant Sets HOSE Listing Date with a Shocking Price

Nearly 24 million NTC shares are set to debut on the Ho Chi Minh City Stock Exchange (HOSE) on October 28, 2025, marking a significant milestone for the company and investors alike.

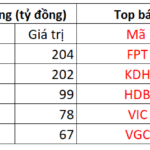

Foreign Investors’ 14/10 Session: Over 1.4 Trillion VND Sold – Which Stocks Faced the Heaviest Dumping?

Foreign investors’ net selling of 1.429 trillion VND has once again become a significant drawback in the market.