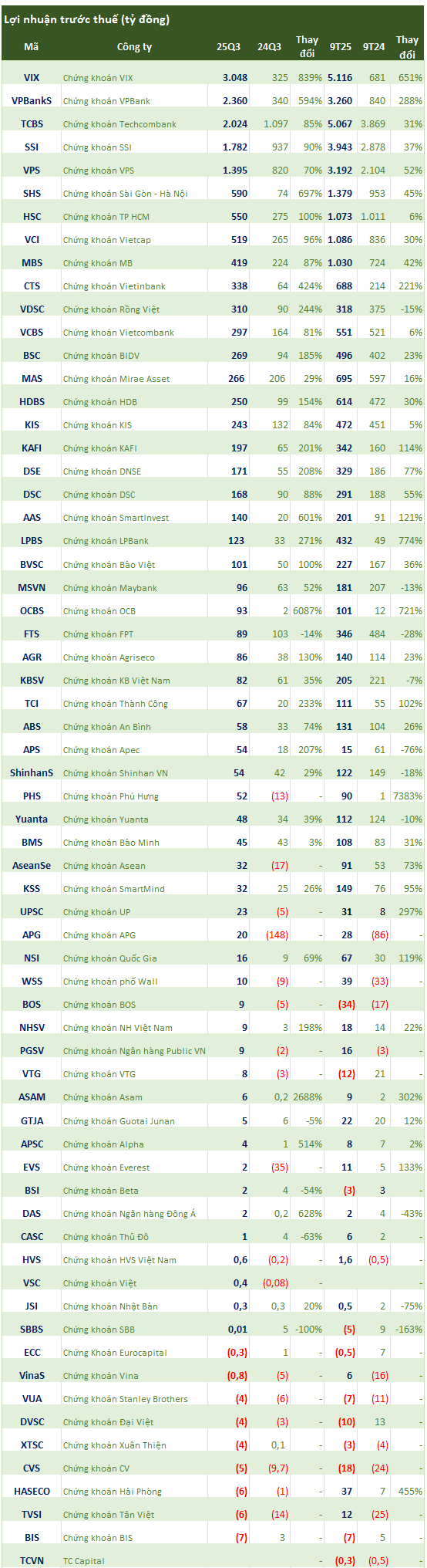

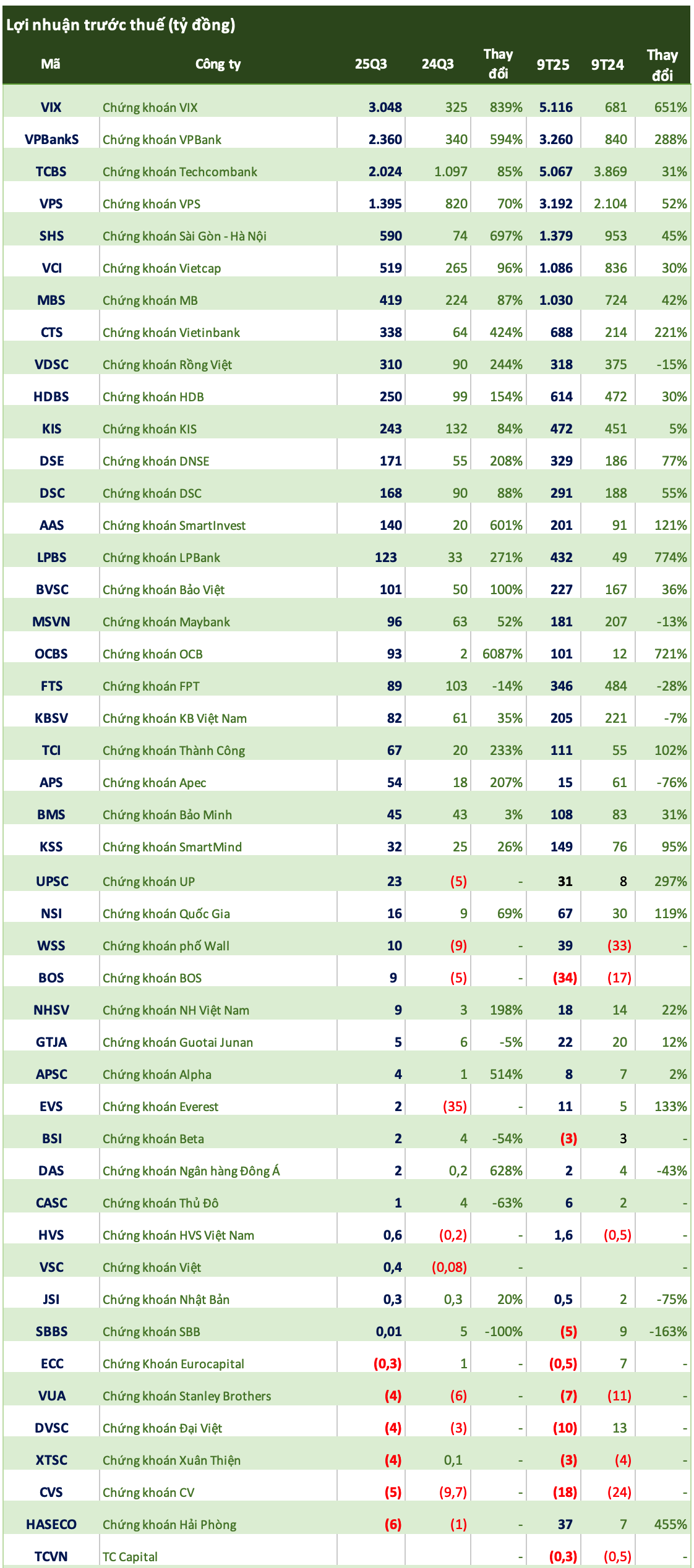

As of the evening of October 20, 65 securities companies have released their Q3/2025 financial statements.

SSI Securities announced its Q3 financial report, recording an operating revenue of VND 4,081 billion, a 107% increase compared to the same period last year. The Securities Services segment contributed VND 1,950 billion, accounting for 47% of total revenue.

Margin lending and advance payment services generated nearly VND 1,006 billion, a 21% rise from the previous quarter. SSI’s outstanding margin loans and advances reached over VND 39,231 billion, up 50.6% quarter-on-quarter. Investment activities yielded VND 2,025 billion, a 42% growth.

Consequently, SSI reported a pre-tax profit of VND 1,782 billion in Q3, a 90% surge year-over-year and the highest quarterly profit ever. In the first nine months, the company’s pre-tax profit totaled VND 3,943 billion, a 37% increase compared to the same period in 2024, achieving 96% of the plan approved by the 2025 Shareholders’ Meeting.

Mirae Asset Securities recorded Q3 operating revenue of VND 916 billion, with interest income from loans and receivables contributing VND 453 billion, a 13% growth. Fair value through profit or loss (FVTPL) assets generated over VND 222 billion, while brokerage revenue reached VND 208 billion. Operating expenses amounted to VND 598 billion, resulting in a pre-tax profit of VND 266 billion for Q3, a 29% increase from Q3/2024.

In the first nine months, operating revenue reached VND 2,209 billion, a 16% growth year-over-year. Pre-tax profit stood at VND 695 billion, up 16%.

Among smaller-cap companies, ASAM Securities reported a staggering 2,700% increase in Q3 pre-tax profit to VND 6 billion.

——————————————————————————-

As of the morning of October 20, 46 securities companies have released their Q3/2025 financial statements.

LPBank Securities (LPBS) recorded over VND 430 billion in operating revenue, more than six times higher than the same period last year. FVTPL assets contributed VND 187 billion, while held-to-maturity (HTM) assets added VND 110 billion. The company earned VND 81 billion from interest income on loans and receivables.

Q3 operating expenses reached VND 123 billion, a 515% increase from Q3/2024. As a result, LPBS reported a pre-tax profit of over VND 123 billion in Q3, a 217% surge year-over-year. In the first nine months, the company’s pre-tax profit totaled VND 432 billion, nearly nine times higher than the same period in 2024.

HD Securities also demonstrated positive performance in Q3, with operating revenue reaching VND 395 billion, a 6% decline year-over-year. This decrease was primarily due to an 87% drop in underwriting and securities distribution revenue to VND 27 billion. Conversely, FVTPL assets generated VND 270 billion, a 42% increase.

Operating expenses were halved compared to the same period last year, from VND 267 billion to VND 137 billion. After deducting expenses, HD Securities reported a Q3 pre-tax profit of VND 250 billion, 2.5 times higher than the previous year, bringing the nine-month pre-tax profit to VND 614 billion.

In contrast, FPT Securities (FTS) experienced a decline in Q3 profits. The company’s Q3 operating revenue was VND 294 billion. After deducting expenses, FTS’s pre-tax profit reached VND 89 billion, a 14% decrease year-over-year. Net profit after tax was over VND 55 billion, down 31.69% from the same period last year. While realized after-tax profit in Q3 increased by 48% due to the sale of FVTPL financial assets and improved market liquidity, unrealized after-tax profit decreased due to the revaluation of financial assets, primarily from the MSH stock.

In the first nine months, FTS reported a pre-tax profit of VND 346 billion, a 28% decline year-over-year.

Where Does the Massive Capital from High-Profile IPOs Ultimately Flow?

The stock market is entering an unprecedentedly vibrant phase following a period of scarcity, as numerous companies, particularly in the securities sector, are launching initial public offerings (IPOs) worth trillions of dong. With such massive capital influx post-IPO, the question arises: how will these funds be utilized, and will the securities industry’s cash flow face dilution amid the recent surge in IPO activities?

October 17th Update: Securities Firms Report Earnings, with One Company Posting a Staggering 6,000% Growth

Several leading securities companies have unveiled their Q3 and 9-month 2025 business performance reports, offering valuable insights into their financial standing and operational achievements.