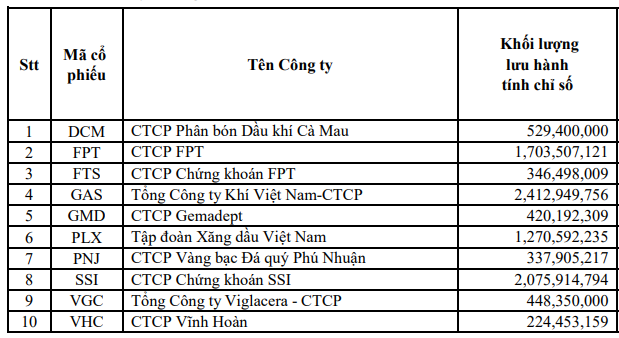

The Ho Chi Minh City Stock Exchange (HOSE) has recently announced the list of 10 constituent stocks, their circulating volumes, free-float ratios, and capitalization weight limits for the VNDIVIDEND index, effective from November 3, 2025.

The selected stocks include DCM, FPT, FTS, GAS, GMD, PLX, PNJ, SSI, VGC, and VHC.

HOSE stated that the VNDIVIDEND index is designed to measure the performance of companies with a consistent and growing cash dividend policy over several consecutive years.

The VNDIVIDEND index is calculated using the free-float adjusted market capitalization method, with a maximum capitalization weight limit of 15% for each stock and 40% for stocks within the same sector.

The index comprises 10 to 20 constituent stocks, selected from the VNAllshare basket, based on criteria such as free-float adjusted market capitalization, liquidity, and positive after-tax profits over the last 12 months in the most recent four quarters. Additionally, stocks must have a history of consistent cash dividend payments over the last three years and a minimum dividend growth rate of 80-100% to be considered for inclusion.

Thus, the VNDIVIDEND index enables investors to easily track the performance of financially stable companies with a history of growing and stable dividend payments.

Previously, HOSE also introduced two other new indices, VNMITECH and VN50 Growth. The launch of these indices not only enhances the structure of the stock index system but also strengthens the connection between indices, products, and investors, providing a foundation for diverse, transparent, and internationally aligned financial products.

With these additions, the market is expected to offer new investment products, providing investors with opportunities to access and diversify their portfolios effectively. This contributes to elevating Vietnam’s position and attracting significant international investment capital, particularly following the upgrade of the Vietnamese stock market from frontier to secondary emerging status, as announced by FTSE Russell on October 8, 2025.

Gold ETFs to Be Listed on Stock Exchanges as Government Expands Gold Investment Options

The State Securities Commission (SSC) is actively exploring the introduction of gold-based derivative products, specifically gold ETFs, to Vietnam’s stock market.

VN-Index Poised to Target 1,800 Resistance Level, ABS Research Indicates

According to the October strategy report, An Binh Securities Analysis Center (ABS Research) anticipates the market will surpass the short-term peak of 1,700 points. ABS Research forecasts further upward momentum, targeting resistance levels at 1,740-1,780, and ultimately reaching higher resistance thresholds of 1,813-1,820.

Market Outlook: Heightened Correction Pressures in Stocks for the Week of October 13–17, 2025

The VN-Index tumbled in the final session of the week, capping a week of correction with a decline of over 16 points compared to the previous week. Amidst a sharply polarized market, the weakening of leading stocks coupled with persistent net selling pressure from foreign investors continued to exert significant strain on investor sentiment.