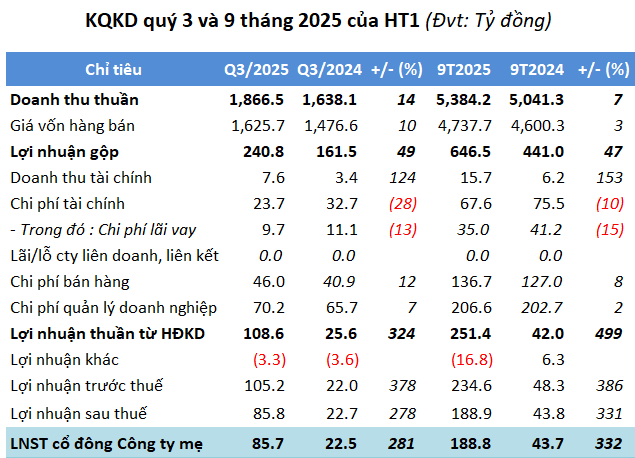

In Q3, Ha Tien 1 Cement JSC (HOSE: HT1) reported net revenue of nearly VND 1,867 billion, a 14% increase year-over-year. With a slightly lower rise in cost of goods sold, gross profit reached nearly VND 241 billion, up 49%. Consequently, the gross margin improved from 10% to 13%.

Financial revenue stood at nearly VND 8 billion, doubling from the same period last year, while financial expenses, selling expenses, and administrative expenses remained stable at VND 140 billion. Ultimately, Ha Tien 1 Cement JSC achieved a net profit of nearly VND 86 billion, 3.8 times higher than the previous year.

HT1 attributed this growth to an 18% increase in cement sales volume, coupled with effective control over production costs and input material prices. Additionally, revenue from capital recovery fees for the construction of a road connecting Nguyen Duy Trinh Street to Phu Huu Industrial Park in Ho Chi Minh City contributed to the profit surge.

For the first nine months, net revenue exceeded VND 5,384 billion, a 7% increase, while after-tax profit reached nearly VND 189 billion, 4.3 times higher. Compared to the 2025 consolidated revenue target of VND 7,162 billion and after-tax profit of VND 184 billion, HT1 has achieved 75% of its revenue goal and surpassed the after-tax profit target by 3%.

Source: VietstockFinance

|

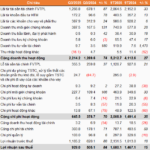

As of the end of Q2, HT1‘s total assets amounted to over VND 8,137 billion, a slight 1% decrease from the beginning of the year. Inventory reached more than VND 680 billion, up 4%. Construction in progress costs exceeded VND 654 billion, a 24% increase, primarily concentrated in the Kien Luong project (over VND 261 billion), the employee housing project at Binh Phuoc Cement Plant (over VND 200 billion), and the Binh Phuoc project (over VND 159 billion).

Total liabilities stood at nearly VND 3,134 billion, down 6% from the beginning of the year. Financial debt decreased by 27% to over VND 1,100 billion, accounting for 35% of total liabilities.

– 16:43 21/10/2025

Techcombank Sets Record Q3 Profit, Sustaining Strong Growth Momentum

Techcombank (HOSE: TCB) has unveiled its Q3 2025 and 9-month financial results, showcasing record-breaking performance and underscoring the success of its comprehensive transformation strategy. The bank reported pre-tax profits of VND 23.4 trillion for the first nine months, with Q3 alone contributing VND 8.3 trillion—a 14.4% year-on-year increase and the highest quarterly profit in its history.

VNDIRECT’s Q3 Net Profit Surges 84% Amid Favorable Market Conditions

VNDIRECT Securities Corporation (HOSE: VND) has released its Q3/2025 financial report, revealing a remarkable post-tax profit of VND 929 billion, marking an 84% surge compared to the same period last year. The company’s core business segments, including proprietary trading, brokerage, and margin lending, all experienced significant growth amidst favorable market conditions.

LPBank Surges Ahead in Profit Race, Reporting Over 9.6 Trillion VND in Earnings After 9 Months

LPBank (Loc Phat Bank) has unveiled its financial report for the first nine months of 2025, boasting a pre-tax profit of 9.612 trillion VND—an unprecedented high in the bank’s history. Surging ahead in the profit race, LPBank is setting new benchmarks, solidifying its sustainable growth foundation, and striving toward long-term objectives.

Viettel Celebrates Wave of Success: Viettel Telecom Sets Unprecedented Goals as Viettel Stocks Surge to Record Highs

Stock liquidity surged to impressive levels compared to previous sessions. By the end of the morning session, over 1.5 million VTP shares, 576,900 VGI shares, 877,900 CTR shares, and 15,300 VTK shares had changed hands.