|

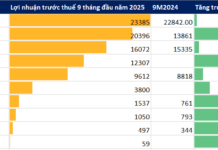

GSM’s Q3/2025 Business Targets

Source: VietstockFinance

|

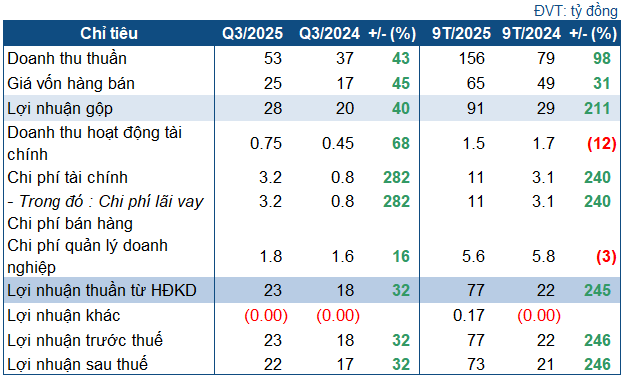

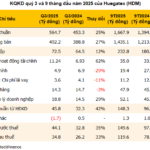

In Q3/2025, GSM recorded a revenue of nearly VND 53 billion, a 43% increase year-over-year. The cost of goods sold rose by 45% to VND 25 billion. Despite this, gross profit surged by 40%, reaching VND 28 billion.

According to the company’s explanation, the Huong Son – Huong Son 2 Hydropower Plant complex began commercial operation under the Power Purchase Agreement (PPA) based on the avoided cost tariff from November 1, 2024. Additionally, higher water inflows into the reservoir during Q3/2025 compared to the same period last year contributed to the revenue growth.

Financial activities were less favorable, with financial revenue reaching only VND 751 million, while financial expenses skyrocketed 3.8 times to nearly VND 3.2 billion due to interest expenses. Selling and administrative expenses increased by 16% to VND 1.8 billion.

Nevertheless, thanks to the robust revenue growth, GSM’s after-tax profit exceeded VND 22 billion, a 32% year-over-year increase.

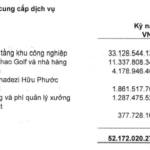

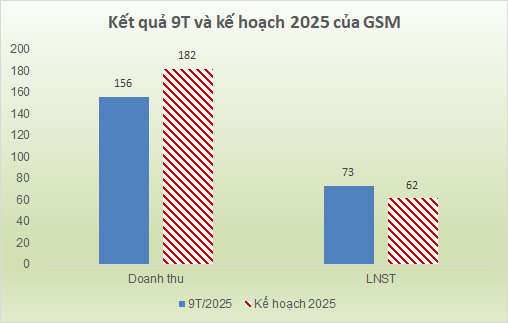

For the first nine months of the year, GSM achieved VND 156 billion in net revenue, nearly double the same period last year, and VND 73 billion in after-tax profit, 3.5 times higher year-over-year. Compared to the 2025 Annual General Meeting (AGM) plan, the company has achieved 86% of its revenue target and surpassed the after-tax profit target by nearly 19%.

Source: VietstockFinance

|

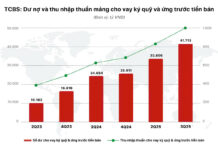

As of the end of Q3, GSM’s total assets reached VND 775 billion, a slight increase from the beginning of the year. Current assets rose by 7.6% to VND 142 billion, with cash and cash equivalents soaring to over VND 97 billion, 16 times higher than at the start of the year. Conversely, accounts receivable decreased sharply by 61% to VND 44 billion, primarily due to reduced customer receivables.

On the liabilities side, total liabilities decreased by 24% to VND 193 billion, with only VND 34 billion being short-term liabilities (a 61% reduction). Short-term loans plummeted by 72% to VND 18 billion, while long-term loans decreased slightly by 5% to VND 159 billion.

– 15:43 21/10/2025

Unusual Trends in Hanoi’s Villa and Townhouse Market

According to CBRE, the majority of new land-attached real estate supply in Q3 was concentrated in projects located farther from city centers. This shift resulted in an average primary market selling price of approximately VND 186 million per square meter of land during the quarter—a 19% decrease from the previous quarter and 21% lower than the same period last year.

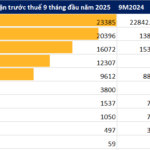

Bầu Đức Celebrates: Hoàng Anh Gia Lai (HAG) Reports 25% Surge in Q3 Net Profit Despite 80% Revenue Plunge in Pig Farming Sector

In the first nine months of the year, cumulative net revenue surpassed 5.6 trillion VND, marking a 34% increase compared to the same period in 2024. Post-tax profit recorded an impressive 1.312 trillion VND, reflecting a robust 54% growth year-over-year.

Hue Garment Sets 9-Month Profit Record, Yet Faces Hefty Penalty from Tax Authority

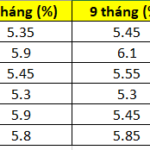

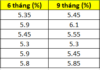

Fueled by rising yarn prices and lower input costs, Hue Textile Joint Stock Company (Huegatex, UPCoM: HDM) reported a net profit of VND 120 billion in the first nine months of 2025, surpassing its full-year 2024 profit of VND 109 billion. However, during the same period, the company was fined and required to pay nearly VND 1 billion in back taxes by the Hue Tax Department.