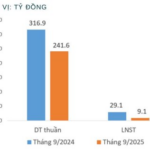

With VND 6.85 trillion in revenue for the first nine months of this year, the Soc Trang-based shrimp company has surpassed its annual plan (VND 6.54 trillion). However, the company has only achieved approximately 58% of its pre-tax profit plan (VND 245 billion out of VND 420 billion), amidst a complex business environment for the shrimp industry due to tariff challenges.

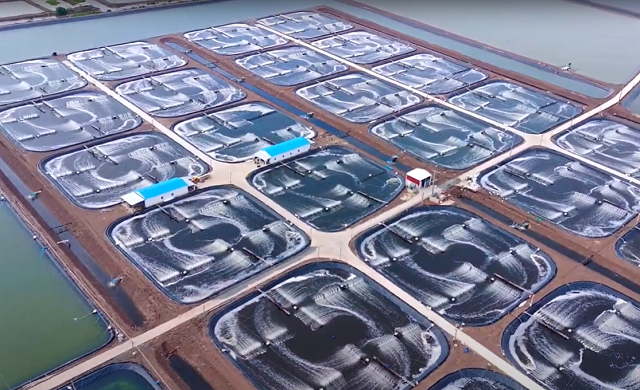

Shrimp farm of Khang An Foods – a subsidiary of Sao Ta

|

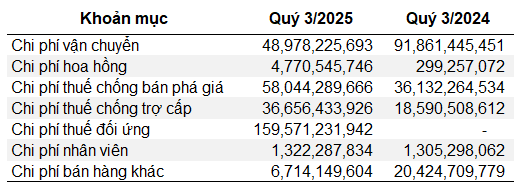

According to the recently released financial report, in Q3 alone, Sao Ta recorded nearly VND 160 billion in countervailing duties, a non-existent expense in the same period last year. This new type of duty was imposed by the US government on imported goods, effective from August 7, 2025.

In addition to countervailing duties, Sao Ta’s anti-dumping and anti-subsidy duties also increased by 61% and 97%, respectively, in Q3. Currently, the US Department of Commerce (DOC) is imposing a preliminary anti-dumping duty of up to 35% on most Vietnamese shrimp exporters. The final duty rate is expected to be announced in December, following a review and assessment by DOC experts.

The heavy tariff burden has led Sao Ta to report selling expenses of VND 316 billion in Q3, an 87% increase compared to the same period last year.

|

Soaring selling expenses due to tariffs

Unit: VND

Source: Sao Ta’s Consolidated Financial Report

|

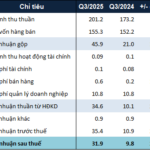

Nevertheless, thanks to improved gross margins and financial activity revenue, the Soc Trang-based shrimp company still reported a 22% increase in net profit, reaching VND 97 billion.

According to the company, the settlement of self-farmed shrimp this year has reduced the cost of goods sold. The gross margin in Q3/2025 reached 14%, compared to 10.8% in the same period last year.

Income from deposit interest, loan interest, and exchange rate differences all increased, helping Sao Ta’s financial activity revenue reach over VND 43 billion, 4.8 times higher than the same period last year.

– 2:28 PM, October 21, 2025

SMB to Distribute Remaining 2025 Dividends, Sabeco Poised for Significant Gains

On October 21, the Board of Directors of Saigon Beer – Central Joint Stock Company (HOSE: SMB) passed a resolution to pay the second dividend installment of 2025 in cash at a rate of 20% (VND 2,000 per share). The ex-dividend date is set for November 13, with the dividend payment scheduled for November 26.

National Securities Eyes 10 Million More SAM Shares Despite Nearly 50% Paper Loss

Amidst a 15% decline in SAM shares over the past month, National Securities Corporation (NSI) plans to invest over 70 billion VND to acquire an additional 10 million shares of SAM Holdings (HOSE: SAM), increasing its ownership stake to 4.31%. As of the end of September 2025, this investment in SAM is currently reflecting a loss of nearly half its value.

Textile Success (Parent Company) Reports September 2025 Profits at Just 31% of Previous Year’s Level

The company attributed the decline in revenue and profit in September 2025 to the fact that the end of Q3 remains a traditionally slow season for the fashion textile industry. Additionally, lingering inventory resulted from customers requesting early shipments in previous months to circumvent new retaliatory tariffs imposed by the U.S. market.