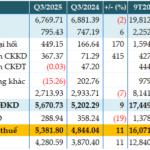

According to the Q3/2025 financial report, FPT Securities Corporation (FPTS, stock code: FTS) recorded an operating revenue of VND 284 billion, a 26.7% decrease compared to the same period last year.

During this period, the profit from the sale of financial assets surged to VND 45 billion due to the realization of gains from MSH shares. However, this was insufficient to offset the increased revaluation of financial assets through profit/loss. Consequently, proprietary trading resulted in a loss of VND 6 billion.

The primary contributor to revenue was interest income from loans and receivables, amounting to nearly VND 194 billion, a 27% increase. Brokerage activities generated VND 81 billion, a 43% rise year-over-year.

Operating expenses for the quarter climbed by 75% to VND 177 billion. As a result, FPTS reported a pre-tax profit of approximately VND 89 billion for Q3/2025, a 14% decline year-over-year. Of this, realized pre-tax profit exceeded VND 167 billion, a 48% increase compared to the same period last year.

For the first nine months of 2025, FPTS achieved an operating revenue of nearly VND 836 billion, a VND 7 billion increase year-over-year. Pre-tax profit reached over VND 346 billion, a 28.5% decrease; realized pre-tax profit stood at VND 388 billion, a VND 6.5 billion increase.

FPTS set a 2025 target of VND 500 billion in realized pre-tax profit. Thus, the company has achieved 78% of its goal after nine months.

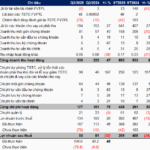

As of September 30, 2025, FPTS’s total assets were VND 13,686 billion, a 40% increase from the beginning of the year. Loans accounted for the largest share at VND 8,896 billion, up 26% year-to-date.

The FVTPL financial assets portfolio had a book value of VND 3,595 billion, 2.5 times higher than the start of the year. Bonds constituted VND 2,230 billion, 3.2 times more; time deposits nearly doubled to VND 1,359 billion.

In the equity portfolio, MSH (May Sông Hồng) held the largest and most profitable position, with a market value of VND 455 billion, 38 times its book value. In July 2025, FPTS sold 672,000 and 520,000 MSH shares consecutively.

On the funding side, FPTS’s debt reached nearly VND 8,087 billion, a 48% increase, primarily from bank loans.

Recently, FPTS announced a resolution approving its Q4/2025 business plan, targeting VND 345 billion in total operating and financial revenue, with a pre-tax profit of VND 160 billion.

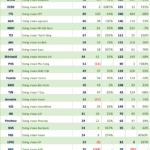

ACB Reports 11% Rise in Q3 Pre-Tax Profit as Bad Debt Improves

Asian Commercial Bank (HOSE: ACB) reported a pre-tax profit of nearly VND 5,382 billion in Q3/2025, marking an 11% year-on-year increase. This growth was driven by higher non-interest income and effective cost-cutting measures. Notably, the bank’s non-performing loans (NPLs) decreased by 15% compared to the beginning of the year, reflecting improved asset quality.

Q3/2025 Financial Report Deadline on October 21: Real Estate Firms Double Profits Year-on-Year, Fertilizer Companies Report Nearly 100 Billion VND in Losses

Two leading securities firms, SSI and VNDirect, have reported remarkable third-quarter profits exceeding 1,000 billion VND. SSI recorded a pre-tax profit of 1,782 billion VND, a 90% surge, while VNDirect achieved a pre-tax profit of 1,165 billion VND, marking an 88% increase compared to the same period last year.

Vietnam’s Top MG Car Dealer Reports 99% Drop in Q3 Profit to Less Than VND 400 Million

In the first nine months of 2025, net revenue continued its upward trajectory, climbing 13% year-over-year to reach 988 billion VND. However, net profit after tax for the period plummeted 63% to 34 billion VND, a stark contrast to the 92 billion VND recorded in the same period of 2024.