Addressing Flight Delays: A Pressing Issue

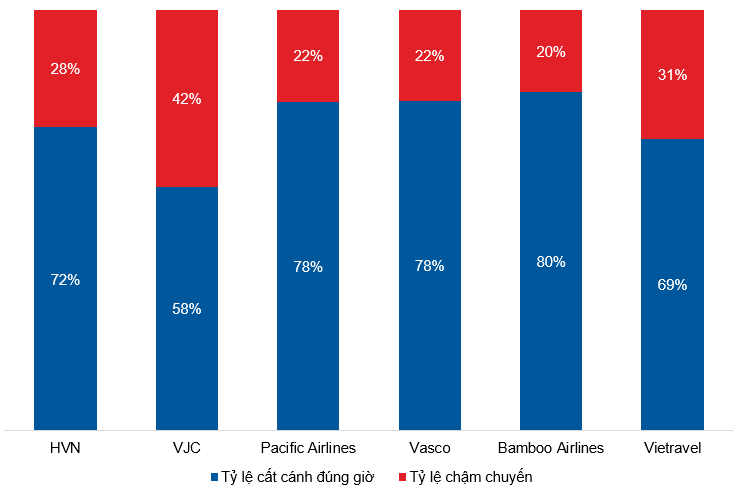

According to the Civil Aviation Authority of Vietnam (CAAV), Vietjet holds the largest domestic market share but also leads in flight delays. In the first seven months of 2025, VJC operated 64,047 flights, with only 58% departing on time, while 42% experienced delays. This is the highest delay rate in the industry, surpassing HVN by 14%.

On-Time Performance and Delay Rates of Airlines in the First Seven Months of 2025

Source: CAAV

Projected Growth Through International Expansion and New Financial Contracts

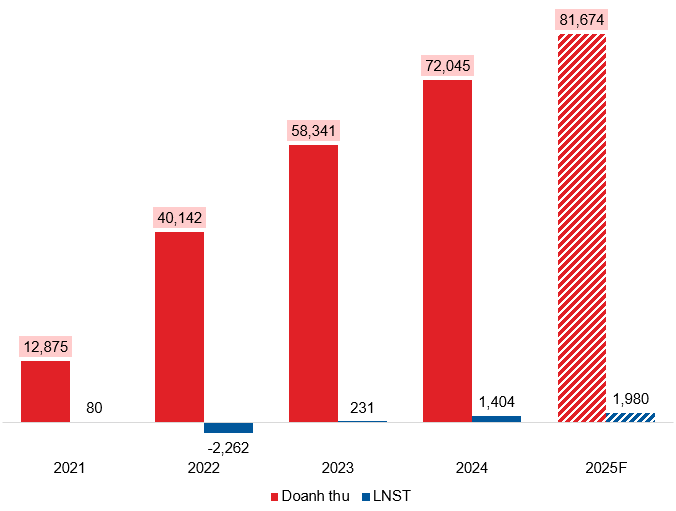

In 2025, it is anticipated that VJC’s revenue will reach 81,674 billion VND, with post-tax profit at 1,980 billion VND, marking a 13.4% and 41% increase respectively compared to 2024. This growth is supported by a 300 million USD financial contract with AV AirFinance and the addition of fuel-efficient A330 wide-body aircraft, enabling the airline to expand its long-haul international routes, boost revenue, and improve profit margins.

VJC’s Business Performance from 2021-2025F

(Unit: Billion VND)

Source: VJC

New Target Range: 190,000-192,000 VND

Currently, VJC’s stock price is trading above key moving averages such as the 50-day SMA and 100-day SMA, indicating a strong long-term upward trend. Trading volume has significantly increased since July 2025 compared to the first six months of the year.

The stock price has decisively broken through previous highs from February 2022 and August 2025 (around 147,000-152,000 VND). The new target range is set at 190,000-192,000 VND.

Corporate Analysis Department, Vietstock Advisory Division

– 09:00 22/10/2025