Quietly, without fanfare or boasting profits, these special investors choose to stick with the market with an amazing calm and tenacity. The way they live with stocks conveys many lessons for millions of F0 investors – those who are used to investing with their emotions.

Investing helps ‘anti-aging’

Mr. Ngo Truyen Trung, formerly an associate professor at an economic university in Hefei city (Anhui province), started participating in the market in 1993 with the purpose of “preventing memory loss” in the elderly, according to The Paper.

“Playing stocks requires brain activity, which can help prevent aging and dementia,” he said.

The special story of two investors over 100 years old is often shared by Chinese netizens. Photo: Baidu |

Over the past 30 years, he has been present at the securities company at 8:30 am every day to monitor the market and leaves when the trading session ends at 3:00 pm.

Interestingly, he has withdrawn his original capital long ago, and the money he invests now is entirely from accumulated profits. To him, the market is not just a place to make money, but a part of his daily routine that helps train his thinking and keep his mind sharp, as well as follow the movements of the economy through every small fluctuation on the board.

“But investing can’t be reckless, seeing others buy and then jumping in is wrong. It has to be stable and have principles,” he emphasized.

According to Anhui News, Mr. Ngo has never missed a trading day, except when the weather is too harsh. His eldest son said that his father is a very diligent person, eager to learn and always exercising his brain.

Mr. Ngo Truyen Trung considers stock investment as a way to prevent dementia. Photo: Baidu |

“My father gets up at 6 am every day, exercises, reads the newspaper, follows the news and always watches the evening news,” he said.

Although his son advised him to stay home and monitor the electronic board instead of going out to avoid risks, Mr. Ngo refused. He said that if he only watched the market at home, he would lose interest, and going out was to meet and talk to other “investors.”

Meanwhile, at the age of over 100, Ms. Chu Hong Bao – an experienced investor from the time of “old eight stocks” (the pioneering stage of the Chinese stock market) still regularly monitors the market every day in Shanghai.

She does not follow the technical analysis school, nor does she look at price charts or read complex analysis reports. She only chooses to buy stocks that are familiar in daily life such as Dong Phuong Minh Chau (a media and tourism company) and Luc Gia Tuy (a real estate company) – two well-known enterprises in Shanghai.

“Starting with about 2,000-3,000 CNY (about VND 7.3-10.9 million), after many years, her account once reached a profit of 100,000 CNY (about VND 363.8 million). However, she doesn’t care about profits and losses. “I don’t pay attention to how much is left in the account, I consider it a form of entertainment,” she said.

Ms. Chu Hong Bao considers playing stocks as a spiritual hobby. Photo: Baidu

|

Her son shared: “For my mother, playing stocks is a spiritual hobby. My mother can sit for hours just to watch the fish swim slowly in the pond, just as she observes the market: calmly, without haste, without being swept away by emotions.”

Due to her old age, Ms. Chu does not use a computer or phone, and her buy and sell orders are transferred via notes or phone calls to her son. With such a calm mindset, she has gone through many market cycles, living healthily and with a clear mind, and living a long life.

Once, the securities company where she opened an account suspected that the account showed signs of abnormality related to money laundering. After verifying at her house, they saw that the old lady was really watching the board and giving orders through her son.

Amid market turmoil, staying strong is already a victory

Most investors enter the stock market with one goal: to make a profit. But the story of the two centenarian investors opens up a different perspective: what’s important is not how much profit you make, but how long you can stay in the market.

The old lady still relies on her son to update market news. Photo: Baidu |

The stock market is notoriously unforgiving. Whether on Wall Street or in Shanghai, whether a small investor or an institutional investment fund, the law of “survival of the fittest” always exists.

Those who lack discipline, are easily swayed by rumors or expectations of getting rich quick are often weeded out early. Financial leverage, emotional trading, and a “must-win” mentality are the three factors that most often lead to serious mistakes.

Instead of chasing short-term trends, long-term investors often choose to stick with familiar stocks, understand the business, and only act when the odds of winning are high. They don’t need to “know the whole market”, they just need to focus on a few key codes.

Another key principle is to only use idle money. Many people have lost their careers and futures because they dared to risk borrowing money to invest in the market. When risks occur, the consequences are not only financial losses but also the breakdown of many personal plans.

The two centenarian investors do not react emotionally to every market correction, nor are they swept up in the “hot” advisory groups. They maintain a steady pace of life, observing the market as part of their daily life. Without haste, without greed, it is this calmness that helps them stand firm amid decades of fluctuations.

Long-term investment is not only a strategy but also a discipline in psychology: controlling emotions, reducing unrealistic expectations, and maintaining discipline in all market conditions.

Tu Huy (According to The Paper, Baidu)

The Little Engine That Could: Small-Cap Stocks Chugging Along Nicely

The optimistic sentiment continues to bolster the market’s slow but steady ascent, despite lackluster performances from leading stocks. While the blue-chips struggled to keep pace with the indices, the small and mid-cap stocks witnessed notable price advancements. Trading liquidity on the two exchanges witnessed a 10% increase, indicating a potential shift in investor appetite.

Market Beat: Foreigners Turn Net Buyers, VN-Index Hits 2-Year High

The trading session concluded with the VN-Index climbing 4.63 points (+0.34%), reaching 1,376.07. Meanwhile, the HNX-Index witnessed a rise of 1.41 points (+0.62%), closing at 229.22. The market breadth tilted towards the bulls, as advancers outnumbered decliners by a margin of 469 to 269. Similarly, the VN30 basket echoed this bullish sentiment, displaying 16 gainers, 10 losers, and 4 unchanged stocks.

Vietstock Daily: Liquidity Recovery Anticipated

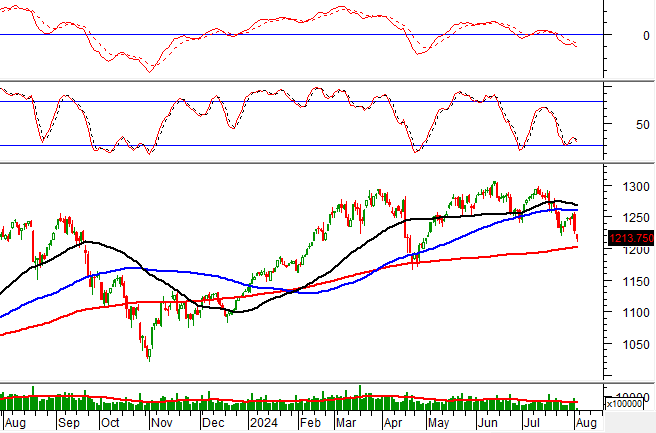

The VN-Index sustains its upward momentum, closely hugging the upper band of the Bollinger Bands. The MACD indicator continues to widen the gap with the signal line, providing a bullish signal and indicating sustained positive short-term sentiment. However, a caveat lies in the trading volume, which has not yet surpassed the 20-session average, reflecting investors’ lingering caution. If this trend persists in upcoming sessions, the risk of a corrective shake-up warrants attention.

“Stocks This Week: VN-Index Surges Past 1,370 Points, a Stealth Stock Peaks 14 Times This Year”

The stock market is on fire with the VN-Index surging past 1,370 points. Amid this frenzy, a stealthy stock has quietly soared to new heights, recording a staggering 14 peak visits since the year’s turn, with its share price now flirting with the 170,000 VND mark. As foreign investors offload hundreds of billions in the week of June 23-27, what’s the underlying story here? And why is Vietcap’s CEO splashing billions on VCI stock?