|

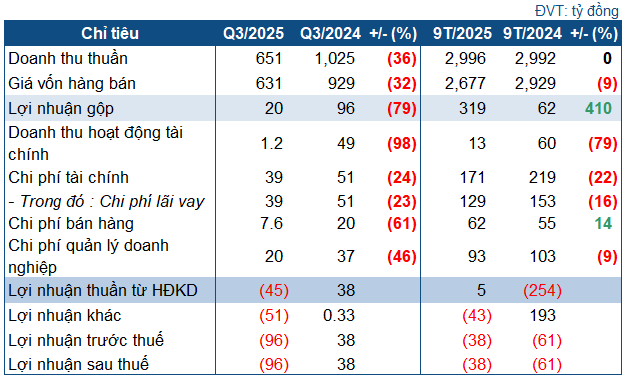

DHB’s Q3 2025 Business Targets

Source: VietstockFinance

|

Specifically, DHB’s Q3 net revenue reached only VND 651 billion, a 36% decrease compared to the same period last year. Despite positive global urea price trends, the company faced production challenges due to equipment issues requiring reinforcement and replacement. DHB decided to halt operations for an extended period to conduct a comprehensive overhaul and maintenance of its entire production line, including mid-term repairs and equipment replacements. This reduction in production time significantly lowered output and sales revenue.

The cost of goods sold decreased at a slower rate than revenue, dropping by 32% to VND 631 billion, resulting in a gross profit of only VND 20 billion—an 80% decline year-over-year.

Financial revenue for the quarter plummeted by 98% to just VND 1.2 billion. Financial expenses decreased by 24% to VND 39 billion, primarily due to reduced interest payments. Selling and administrative expenses also saw notable reductions. However, the company reported other losses of nearly VND 51 billion, compared to a profit of VND 327 million in the same period last year.

Consequently, DHB recorded a post-tax loss of VND 96 billion, in contrast to a profit of over VND 38 billion in the same quarter last year.

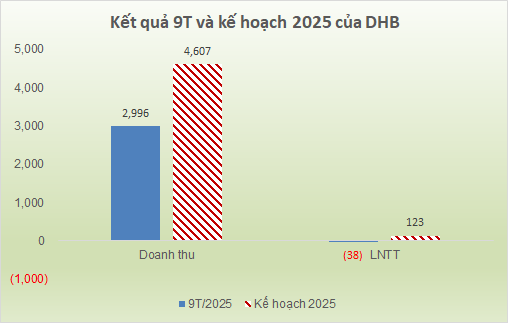

The unexpected Q3 loss significantly impacted DHB’s year-to-date performance. Over the first nine months, DHB’s net revenue remained nearly flat year-over-year at approximately VND 3 trillion. The company shifted from a first-half profit to a nine-month post-tax loss of VND 38 billion, though this loss was still lower than the VND 61 billion loss recorded in the same period last year. DHB achieved 65% of its revenue target and remains far from its pre-tax profit goal of VND 123 billion set by the 2025 Annual General Meeting.

Source: VietstockFinance

|

By the end of Q3, DHB’s total assets amounted to over VND 5.5 trillion, an 11% decrease from the beginning of the year. Cash and cash equivalents stood at more than VND 283 billion, down 33%. Short-term receivables decreased by 31% to VND 170 billion. Inventory slightly declined by 6.4% to VND 504.5 billion.

On the capital side, total liabilities decreased by 12% to nearly VND 5 trillion. Of this, VND 840 billion was short-term debt, down 28%, primarily due to significant reductions in customer prepayments and other short-term payables.

Short-term loans slightly decreased to VND 378 billion, while long-term loans remained at over VND 2 trillion. Other long-term payables, mainly interest on loans from the Development Bank, totaled nearly VND 2.1 trillion.

– 11:43 23/10/2025

Unprecedented Milestone: Stock Group Achieves Record-Breaking $810 Million Pre-Tax Profit in Q3

The third quarter of 2025 marks a historic milestone as the stock market’s profits surged by 171%, fueled by vibrant liquidity and record-high margin debt levels.

VLB Stone Mining Giant Surpasses 43% Profit Target in 9 Months

Biên Hòa Construction and Building Materials Production JSC (UPCoM: VLB) has announced robust Q3 2025 financial results, showcasing a 20% year-over-year profit surge.