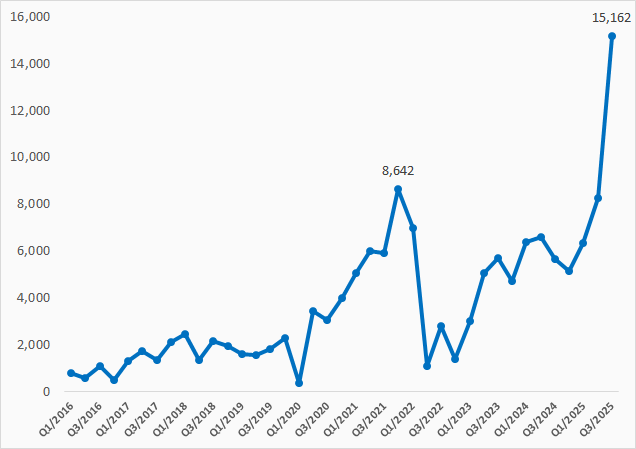

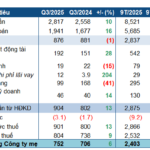

Securities firms’ profits surged in Q3/2025. According to VietstockFinance data, the total post-tax profit of 81 securities companies reached nearly VND 15.2 trillion. This figure represents an 80% increase compared to the previous quarter and a 170% rise year-over-year. With this result, securities firms set a new quarterly profit record, surpassing the VND 8.6 trillion mark from Q4/2021.

|

Post-Tax Profit of Securities Companies by Quarter

Unit: Billion VND

Source: VietstockFinance

|

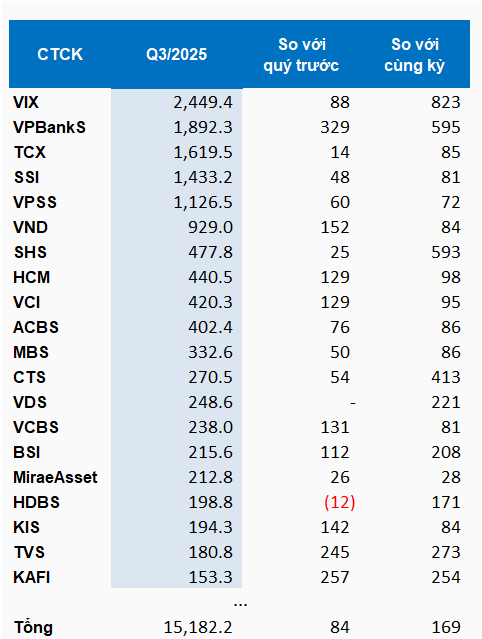

Riding the market’s wave, many securities firms saw significant profit growth in Q3. The group recorded five firms with post-tax profits exceeding VND 1 trillion. Among them, VIX Securities stood out with a net profit of over VND 2.4 trillion. Compared to the same period last year, VIX’s profit increased more than eightfold, leading the group in Q3 profitability.

In its profit variance explanation, VIX cited two main reasons for this outstanding performance: a strong stock market boosting proprietary trading profits and increased margin lending activity driving revenue growth in this segment.

According to financial statements, VIX earned VND 2.7 trillion from proprietary trading in Q3, a 12-fold increase year-over-year, driven by gains in financial assets measured at fair value through profit or loss (FVTPL).

At the end of Q3, VIX’s FVTPL portfolio included three major investments in listed stocks: EIB (VND 1.2 trillion), GEE (nearly VND 1.1 trillion), and GEX (nearly VND 1.6 trillion). These investments saw fair value increases of 47%, 62%, and 57%, respectively, compared to book value, and also rose significantly since the beginning of the year.

In lending activities, the company generated revenue of over VND 341 billion, triple the previous year. By the end of Q3, VIX’s margin loan balance reached over VND 16 trillion, nearly triple the beginning of the year. Besides these segments, brokerage activities also saw profit growth, reaching VND 52 billion, more than quadruple the same period last year.

|

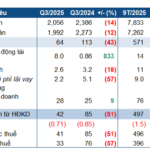

Top 20 Securities Firms by Post-Tax Profit in Q3/2025

Unit: Billion VND

Source: VietstockFinance

|

The profit rankings saw another surprise as VPBankS secured second place with a net profit of nearly VND 1.9 trillion. This firm’s profit soared 330% quarter-over-quarter and nearly 600% year-over-year.

With the strong performance of these two firms, Technocom Securities (TCBS) and SSI Securities fell to third and fourth place with profits of VND 1.6 trillion and VND 1.4 trillion, respectively. In fifth place, VPS Securities recorded a net profit of over VND 1.1 trillion.

Q3 was undeniably optimistic for securities firms. Almost all top-performing companies achieved growth compared to both the same period last year and the previous quarter. A favorable business environment fueled these results. The VN-Index closed Q3 at 1,661.7 points, up 21% from the start of the quarter and 31% year-to-date. This rally was accompanied by an average daily trading value of nearly VND 39.5 trillion, a significant improvement from VND 22 trillion in Q2 and VND 16.4 trillion in Q1.

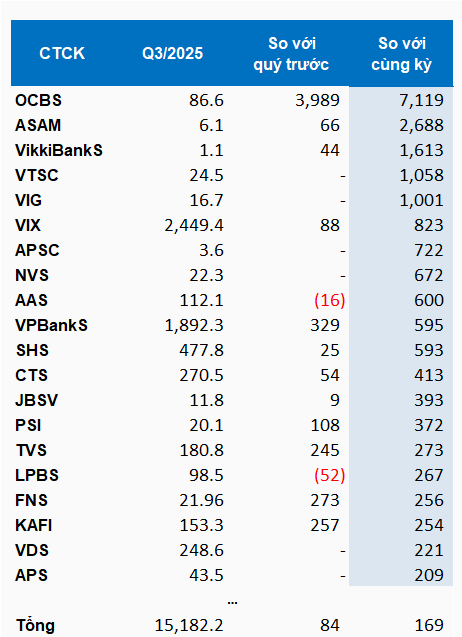

This quarter also saw remarkable growth among securities firms. VIX’s 800% year-over-year profit increase to top the group wasn’t the largest gain in Q3. Five firms recorded profit increases exceeding 1,000% year-over-year. OCBS Securities led with a 7,100% surge, reaching VND 86.6 billion.

Other firms also posted impressive gains: Asam Securities (up nearly 2,700%), VikkiBank Securities (over 1,600%), Viet Thanh Securities, and VIG Securities (both over 1,000%).

The high-growth group included several bank-affiliated securities firms. VPBankS, Saigon-Hanoi Securities (SHS), VietinBank Securities (CTS), LPBS Securities, and Kafi Securities all ranked among the top profit growers. Beyond their impressive growth rates, these firms also achieved substantial profit scales, with VPBankS reaching nearly VND 2 trillion.

|

Top 20 Securities Firms with Highest Profit Growth in Q3

Unit: Billion VND

Source: VietstockFinance

|

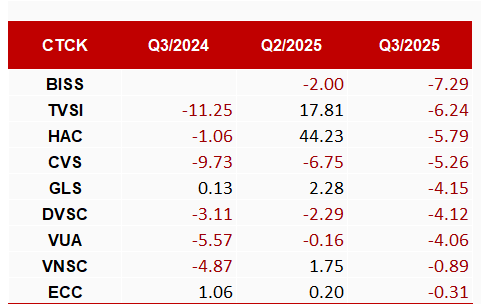

While the overall picture is positive, some firms faced challenges. Nine securities companies reported losses in Q3, with BIS Securities leading at over VND 7 billion. The remaining firms recorded losses between VND 4 billion and VND 6 billion.

|

Securities Firms Reporting Losses in Q3/2025

Unit: Billion VND

Source: VietstockFinance

|

– 10:00 23/10/2025

German Chemicals Giant Duc Giang (DGC) Posts Modest Profit Growth Through Cost-Cutting Measures

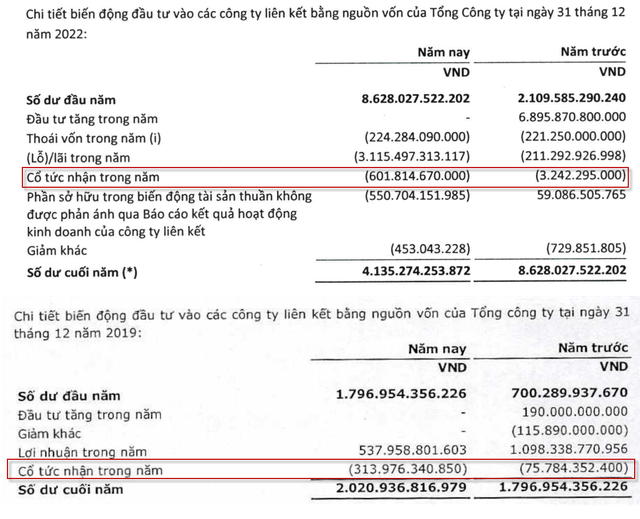

Leveraging its substantial cash reserves and streamlined sales expenses, Duc Giang Chemical Group Corporation (HOSE: DGC) reported a net profit of over VND 752 billion in Q3/2025, marking a slight increase year-over-year despite a modest decline in gross profit.

Market Pulse 23/10: Vingroup Once Again “Rescues” the Market

The afternoon session on October 23rd saw the VN-Index continue its volatile trend. At one point, it seemed poised to reclaim the 1,700-point mark, but mounting pressures forced the index to retreat, closing at 1,687 points. Despite the gains, the rally was largely driven by the influence of the Vingroup conglomerate.

How Do Investors Fare After a Memorable Stock Market Session?

Today (October 22nd), shares purchased at the market bottom during the VN-Index’s record 94-point plunge on October 20th have been credited to investor accounts and are now eligible for trading. However, hopes of quick profits through short-term trading have largely been unfulfilled for the majority.