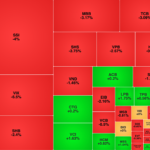

Vietnam’s stock market concluded the week on a bearish note, as weak buying pressure failed to counter widespread selling. At the close, the VN-Index dropped 3.88 points to 1,683.18, while the HNX-Index managed a slight gain of 0.5 points, closing at 267.28. The UPCoM-Index fell further by 0.17 points, ending at 110.87.

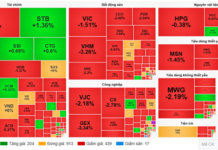

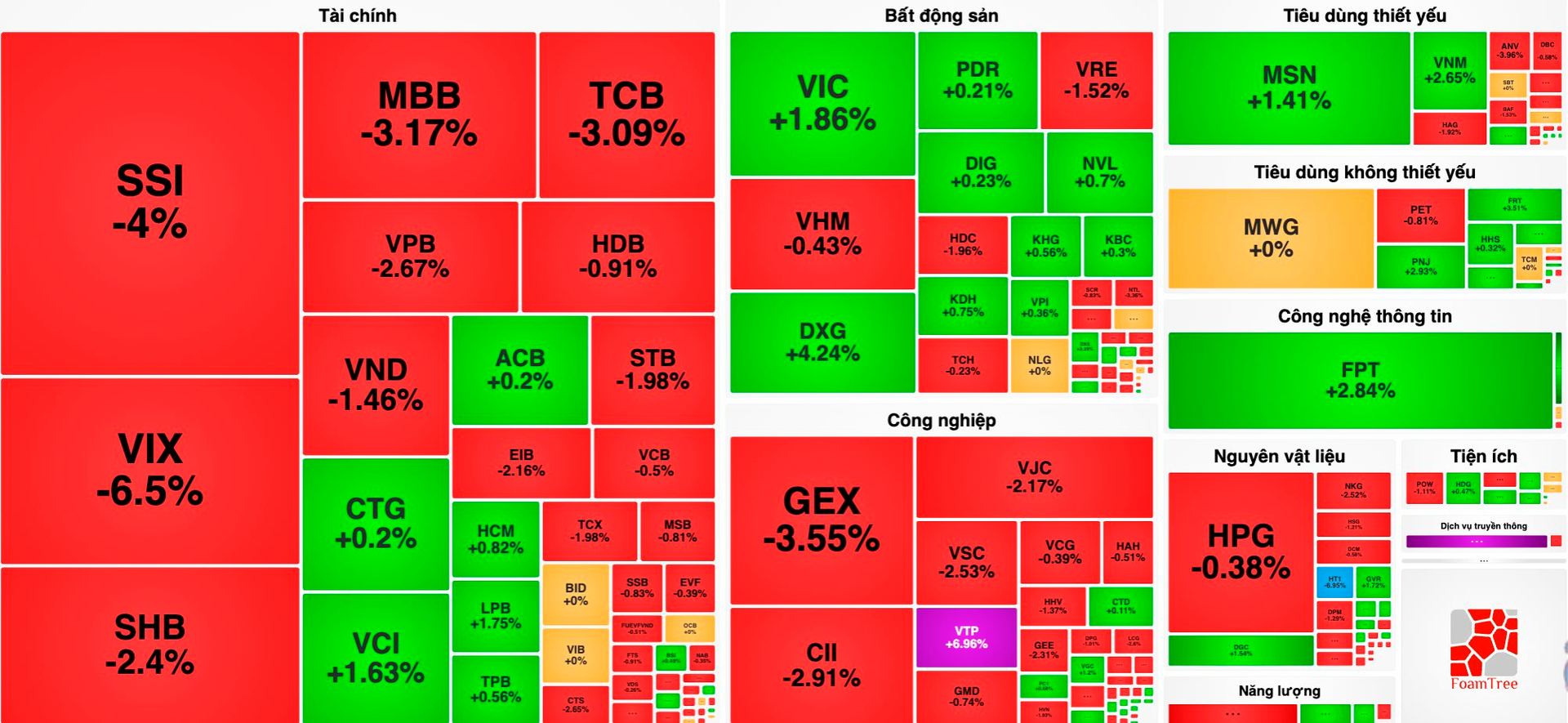

Large-cap stocks remained under pressure, with the VN30 index losing 1.18 points by the end of the session, as half of its constituents closed in the red.

Liquidity weakened significantly, reflecting investor caution. Total trading value across the three exchanges reached just over VND 32.7 trillion, with HoSE accounting for nearly VND 29.5 trillion, equivalent to more than 940 million shares traded. Market breadth favored sellers, with 190 decliners versus 117 gainers.

Bucking the trend, Viettel-affiliated stocks shone brightly in the final session of the week.

In the real estate sector, stocks remained divided, though red dominated. Leading gainers included VIC (+1.86%), alongside BCM, KDH, KBC, NVL, KFS, VPI, CRV, and PDR, all up slightly below 1%.

Notable outperformers were CEO (+2.67%) and DXG (+4.24%). Conversely, VHM (-0.43%), VRE (-1.52%), and SJS (-2.13%) led the declines, with TCH, SIP, SNZ, and SZC also losing ground.

Banking stocks faced headwinds as capital flowed out of leading shares: VCB (-0.5%), VPB (-2.67%), TCB (-3.09%), MBB (-3.17%), HDB (-0.91%), STB (-1.98%), and SSB (-0.83%). Only six stocks managed modest gains: CTG, ACB, TPB, LPB, BVB, and PGB, while BID, VIB, OCB, ABB, and TIN held steady.

Securities stocks continued to face selling pressure as investors offloaded holdings: TCX (-1.98%), SSI (-4%), VIX (-6.5%), VND (-1.46%), SHS (-3.75%), and CTS (-2.65%). Only a few maintained slight gains, including HCM (+0.82%), MBS (+1.04%), and BSI (+0.49%), while VCI fell 1.63%. Red dominated the sector.

A rare bright spot emerged from Viettel-affiliated stocks, which surged impressively: VGI (+4.26%), CTR and VTP (both hitting ceiling prices), and VTK (+2.73%).

Similarly, the technology sector saw FPT (+2.84%) advance, while consumer staples stood out with MSN (+1.41%), VNM (+2.65%), and PNJ (+2.93%). Conversely, industrials faced significant pressure, with GEX, VJC, CII, and VSC all losing over 2%.

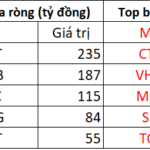

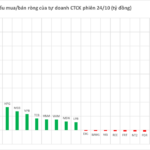

Foreign investors continued to sell aggressively, weighing on sentiment. Today, they net sold VND 1,767 billion, primarily in SSI (-759 billion), MBB (-346 billion), VCI (-199 billion), VIX (-141 billion), and SHB (-124 billion). STB, CII, VCB, VHM, BID, and CTG also saw net selling below VND 100 billion.

On the flip side, foreign inflows favored FPT (+246.8 billion) and MSN (+154 billion), with modest net buying in ACB, FRT, PNJ, and DXG, all below VND 100 billion.

Why Many Stock Traders’ Accounts Are Bleeding Red

The VN-Index closed the final trading session of the week (October 24) with a nearly 4-point decline, leaving many investors’ portfolios in the red. Sellers dominated the market, with a staggering 190 stocks on the HoSE exchange experiencing price drops.

Securities Firms Group Sets Record with Over 15 Trillion VND in Profits

The robust wave in the stock market during Q3 2025 has painted a rosy picture for securities companies, delivering a stellar quarter of performance. This surge has even reshuffled the rankings at the top, redefining the profit landscape for the entire sector.