Early Completion of Chartered Capital Increase, Ensuring Operational Safety

The State Securities Commission has recently issued a document confirming the receipt of materials and reports regarding the private placement of 750 million shares by National Citizen Commercial Joint Stock Bank (NCB). Prior to this, NCB’s Board of Directors also announced a resolution approving the results of this share issuance.

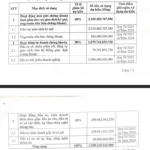

NCB successfully issued 100% of the offered shares to 17 domestic investors, totaling 750 million shares at a par value of VND 10,000 per share. The issuance concluded on October 20, 2025, raising a total of VND 7.5 trillion. This officially elevates NCB’s chartered capital to VND 19,280 billion, one year ahead of the schedule outlined in the Restructuring Plan (PACCL) approved by relevant authorities. This achievement not only reflects investors’ confidence in the bank’s strategy, development roadmap, and promising future but also underscores NCB’s commitment to proactively fulfilling the PACCL, ensuring safe, efficient, and sustainable operations.

The capital increase demonstrates NCB’s determination to complete the approved PACCL ahead of schedule.

This marks NCB’s third consecutive capital increase in four years (2022–2025), positioning the bank among the market leaders with high chartered capital. This fully complies with the safety ratios mandated by Circular No. 41/2016/TT-NHNN of the State Bank of Vietnam. Previously, in 2024, NCB impressed the market by increasing its chartered capital to nearly VND 11,780 billion, transitioning from a small-scale to a mid-sized bank.

This is a testament to NCB’s strategic vision and unwavering commitment to enhancing financial capacity, laying a robust foundation for business expansion and strengthening its competitive edge. Moving forward, NCB plans to continue increasing its chartered capital, aiming to drive innovation and differentiation, ultimately becoming one of the most reputable banks offering top-tier financial solutions and services.

Reaping the Rewards of a Well-Executed Development Strategy

Completing the capital increase one year ahead of the PACCL schedule not only highlights NCB’s robust restructuring efforts but also validates the effectiveness of its strategic choices and solutions.

Recently, NCB announced that it surpassed all 2025 business targets within just nine months. The bank’s after-tax profit for the first nine months of 2025 reached over VND 652 billion, marking a significant turnaround compared to the same period in 2024.

NCB is accelerating its restructuring and entering a new growth phase.

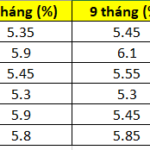

As of September 30, 2025, total assets reached over VND 154,100 billion, a 30% increase from the end of 2024 and 14% above the target. Mobilized capital (excluding issued securities) hit nearly VND 119,326 billion, and customer loans exceeded VND 94,956 billion, up 24% and 33% respectively from the end of 2024, surpassing the 2025 plan by 1% and 3%. NCB has effectively managed asset quality, maintaining non-performing loan ratios in line with the PACCL. New loan disbursements have kept bad debt below 1%, significantly improving credit quality and expanding the income-generating asset portfolio.

Building on this momentum, NCB is accelerating its comprehensive transformation, envisioning a new banking model through its Digital Wealth strategy. By redefining the banking experience with innovative thinking, NCB aims to lead financial service innovation, develop cutting-edge technology-driven products, and become a socially responsible bank contributing to the sustainable development of the communities it serves.

These early successes mark nearly five years of NCB’s relentless and synchronized implementation of comprehensive restructuring measures and new strategies, supported by an experienced and visionary leadership team and a world-class strategic consulting firm. They reflect the bank’s aspiration for a new era of prosperity, aligning with Vietnam’s journey toward a thriving and powerful nation.

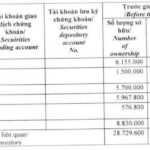

What Will TPS Do with the Anticipated 3.6 Trillion VND from Its Share Offering?

With nearly VND 3.6 trillion raised from its IPO, TPS plans to allocate the funds towards securities brokerage, proprietary trading, and other strategic initiatives.

NCB Ranked Among Top 10 Most Admired Financial & Banking Enterprises in Vietnam for 2025

National Citizen Commercial Joint Stock Bank (NCB) has been honored with four prestigious awards at the “Enterprise of Choice 2025” program, solidifying its reputation as a leading and trusted brand with one of the most attractive work environments in Vietnam’s financial and banking sector.