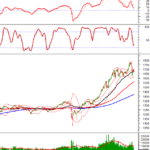

The stock market kicked off the new week on a relatively negative note, with the VN-Index shedding over 30 points. Shares in the Vingroup sector saw significant declines, with VRE and VHM hitting their lower limits. The sharp adjustment in these benchmark stocks dampened investor sentiment, triggering widespread selling across various sectors.

Numerous real estate stocks such as CII, GEX, CEO, and DIG also plummeted to their lower limits.

The real estate sector experienced a more pronounced downturn in the afternoon session, causing the VN-Index to rapidly decline, ultimately losing over 30 points by the close. Both VHM and VRE hit their lower limits, while VIC also dropped by more than 2%, contributing to a 12-point loss in the VN-Index. The downward trend in benchmark stocks weighed heavily on market sentiment, exacerbating selling pressure.

The real estate sector was particularly hard-hit, with stocks like CII, GEX, CEO, and DIG all hitting their lower limits.

Large-cap stocks, particularly banking shares, added to the market’s woes, with VPB, CTG, TCB, HDB, and MBB declining and ranking among the most negatively traded stocks of the day. Securities firms showed clear polarization, with SSI, SHS, HCM, VND, TCX, and CTS all adjusting downward. SSI fell by over 3%, leading the market in trading value with more than 2,508 billion VND. Since their recent peaks, many banking and securities stocks have seen discounts of 15-20%.

On a positive note, the technology and telecommunications sectors outperformed the broader market, with FPT rising by 0.3%, despite an earlier decline of over 1%. Viettel-affiliated stocks also maintained their gains.

At the close, the VN-Index fell by 30.64 points (1.82%) to 1,652.54 points. The HNX-Index dropped by 1.92 points (0.72%) to 265.36 points, while the UPCoM-Index gained 0.37 points (0.33%) to 111.24 points.

Foreign trading activity remained a negative factor, with net selling nearing 1,200 billion VND, concentrated in stocks like SSI, MBB, MWG, VCI, and PDR.

Will Financial Reports and Stock Market News Signal a Market Recovery?

After a “forgettable” trading week marked by a record plunge of over 94 points, the VN-Index staged a modest recovery but still closed the week below the 1,700 threshold. Next week, analysts anticipate the VN-Index may experience volatility as it tests demand levels, while capital is expected to shift toward fundamentally strong stocks with positive Q3 earnings results.

Vietstock Daily 28/10/2025: Significant Short-Term Risks Loom Large

The VN-Index reversed sharply after failing to breach the middle line of the Bollinger Bands. A prominent Big Black Candle pattern emerged, accompanied by trading volume remaining below the 20-session average. The MACD indicator continued to weaken following its sell signal and is now approaching the zero threshold. This signals a heightened risk of short-term correction.

Technical Analysis Afternoon Session 27/10: Testing the Middle Line of Bollinger Bands

The VN-Index experienced intense volatility as it retested the Middle line of the Bollinger Bands. The outcome of this critical test will shape the index’s trajectory in the coming period. Meanwhile, the HNX-Index saw modest gains, forming a High Wave Candle pattern.