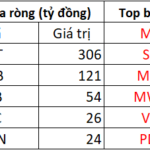

A late-session sell-off erased the morning’s recovery efforts in the stock market. Intense selling pressure at the close dragged the VN-Index sharply lower, with Vingroup stocks VHM and VRE leading the decline, both hitting their lower limits and leaving millions of sell orders unmatched at the floor price.

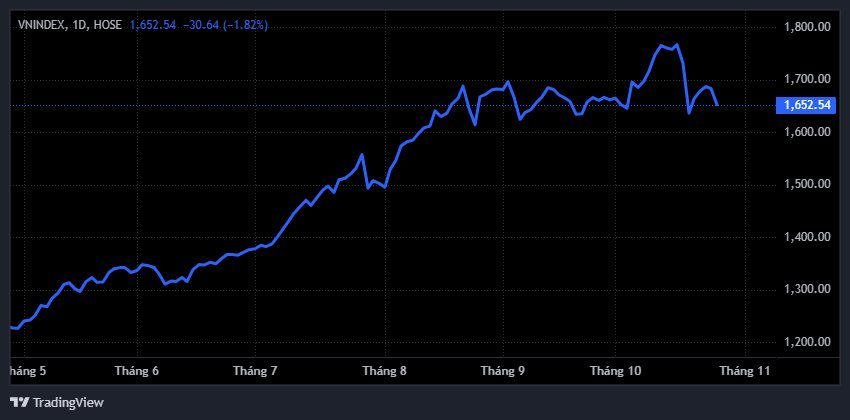

At the close, the VN-Index shed 30.64 points, or 1.84%, to end at 1,652. This starkly contrasted with the bullish trend across Asian markets, fueled by expectations of a Fed rate cut and easing U.S.-China tensions.

Commenting on the market’s steep decline, Mr. Nguyen The Minh, Director of Securities Analysis at Yuanta Vietnam, attributed it to the interbank interest rates, which have risen steadily in recent sessions and continued to edge up today, making investors cautious.

The upward trend in interest rates has significantly pressured real estate stocks, pulling the overall index downward. Investors fear that further rate hikes could increase borrowing costs, directly impacting the prospects of companies in this sector.

Meanwhile, today’s session initially held positive expectations, supported by favorable international market news and trade policy developments. However, when “good news failed to lift the market,” profit-taking sentiment spread, triggering widespread selling.

The sharp decline in the ATC session is seen as a lingering defensive reaction from the previous session’s 95-point loss. Despite minor rebounds, liquidity remained low, indicating new capital is hesitant to re-enter the market.

The failed recovery session has made investors even more cautious. Many stocks that had rallied recently were quickly sold off as the rebound lacked strength, leading to rapid profit-taking to secure gains.

VN-Index Unlikely to Breach 1,600

Regarding margin pressure, Mr. Minh noted that after the 95-point drop, many investors proactively reduced their leverage ratios. Liquidity is currently low, and margin calls have not yet occurred. However, another sharp decline like today’s could trigger forced liquidations. He believes the current drop is heavily influenced by Vingroup stocks, while the market’s breadth is not overly negative.

Updated data shows margin debt in Vietnam’s stock market hit a new record in Q3/2025, though growth slowed to 69.47% year-on-year, significantly lower than Q2/2021’s 137%. The margin-to-equity ratio stands at 1.1 times, below the 2-times cap and the 2021 peak of 1.5 times. This indicates that while margin levels are high, key ratios remain within safe limits, leaving room for market growth.

Looking ahead, Mr. Minh expects a potential V-shaped recovery, but if the rebound is weak with low liquidity, the VN-Index may retest the 1,600–1,640 support zone. However, the index breaching 1,600 is considered unlikely, given the favorable international and domestic macro backdrop. He anticipates the market will soon stabilize and resume its upward trajectory.

For investment strategies, experts advise investors to maintain safe margin levels and avoid high leverage during volatile periods. Investors with available capital should avoid panic selling and instead monitor market stabilization signals before acting.

Real Estate Stocks Underperform Expectations

The sharp decline in blue-chip stocks today (October 27) triggered a widespread sell-off across the stock market. Real estate shares were the hardest hit, with numerous stocks such as CII, GEX, CEO, and DIG plummeting to their lower limits.

Vietstock Daily 28/10/2025: Significant Short-Term Risks Loom Large

The VN-Index reversed sharply after failing to breach the middle line of the Bollinger Bands. A prominent Big Black Candle pattern emerged, accompanied by trading volume remaining below the 20-session average. The MACD indicator continued to weaken following its sell signal and is now approaching the zero threshold. This signals a heightened risk of short-term correction.

Gold and Silver Poised for Another Dip Before Stabilizing

According to an independent metals trader, price movements indicate that gold, and particularly silver, require one more pullback before stabilizing.