Looking to buy an apartment in Vinhomes Smart City urban area? You’ll likely need to settle for a resale unit, paying a premium of VND 500 million to VND 1 billion above the original price the seller paid to the developer,” shared broker T. with Ms. Thuy Ngan (33), who is seeking to invest in an apartment in Vinhomes Smart City.

Ms. Ngan explained, “I’ve worked with dozens of brokers in Vinhomes Smart City, and they all confirm that primary units are sold out, even in under-construction buildings like The Sola Park. If I’m determined to invest, I’ll have to buy a secondary unit with a premium of hundreds of millions to billions of dong, depending on the floor, direction, and view.”

Broker T. introduced Ms. Ngan to a 43m² 1N+ unit in G5 Tower of The Sola Park, scheduled for handover in 2027. The tower is close to the elevated parking area and offers a beautiful view, not overlooking the nearby cemetery. It’s currently listed at VND 4.3 billion.

“When I asked the broker for details, they mentioned that the seller bought this unit to take advantage of early payment discounts. If sold at the current asking price, the seller would pocket a VND 1.2 billion premium,” Ms. Ngan recounted.

Currently, all towers in The Sola Park have reached their rooftops. Units with views of the cemetery offer the best value compared to others.

In addition to this project, Ms. Ngan was advised by the broker to consider other completed subdivisions like Sapphire, Miami, and Masteri Lake Side, which can be rented out immediately for cash flow. Notably, Studio and 1N+ units in these subdivisions are in short supply due to high demand from investors seeking rental income.

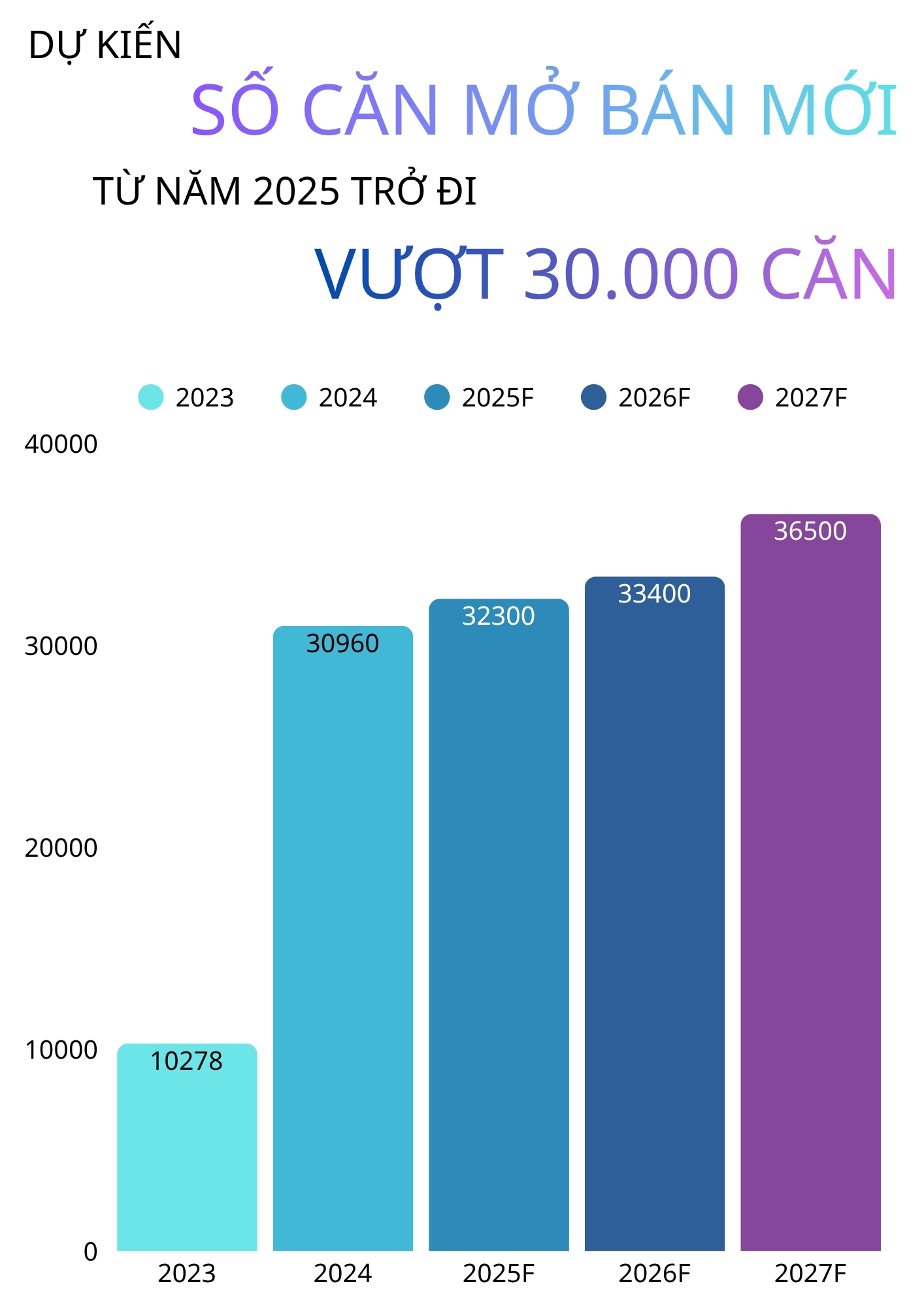

As of Q3/2025, Hanoi’s new apartment supply reached over 10,300 units, marking the second quarter in five years to surpass the 10,000-unit milestone. In the first nine months, the total supply hit nearly 21,100 units, a 10% increase compared to the same period in 2024, according to CBRE data.

In the final months of 2025, Hanoi’s apartment market is expected to remain vibrant. The projected new supply for Q4 is over 11,100 units, bringing the total for 2025 to an estimated 32,300 units, surpassing 2024 figures. “In the coming years, new supply is expected to consistently remain above 30,000 units annually,” said Ms. Nguyen Hoai An, Senior Director of CBRE Hanoi.

Data source: CBRE

According to the Vietnam Association of Realty Brokers (VARS), Hanoi’s average primary apartment price is VND 95 million/m², with over 43% of units priced above VND 120 million/m². Rising primary prices have pushed overall market prices higher, as many use real estate investment to hedge against inflation.

In the secondary market, Hanoi apartment prices are increasing daily, with many projects seeing jumps of hundreds of millions to billions of dong in short periods. Urban area projects have seen the strongest price growth.

Mr. Le Dinh Chung, a member of VARS’ Market Research Task Force, noted that newly launched projects, despite higher prices, are being absorbed well, even selling out on launch day. This is due to increased demand for both living and investment purposes, driven by cheap credit and inflationary pressures. Most transactions involve second-time property buyers.

Mr. Nguyen Van Dinh, Chairman of VARS, warned of emerging risks in the market. Recent observations indicate some developers and distributors are controlling supply by releasing units in small batches, creating artificial scarcity to drive buyer urgency.

Additionally, speculative groups are hoarding units to create artificial shortages and profit from price differences. These trends are concerning and require caution from investors entering the market.

Clash of Titans: Unveiling the Fascinating Flow of Year-End Capital in Vietnam’s Two Largest Apartment Markets

Vietnam’s real estate market is witnessing a significant capital shift between its two largest economic hubs: Hanoi and Ho Chi Minh City. While the apartment segment in the capital continues to maintain impressive growth, many Hanoi investors are increasingly turning their attention to Ho Chi Minh City, drawn by its high profit potential.

Why Are Planned Urban Area Land Plots Making a Comeback?

Amidst market volatility, investment capital is gravitating toward safer assets. Master-planned urban land plots, boasting complete legal frameworks, synchronized infrastructure, and steady appreciation potential, are emerging as a steadfast haven for investors.

Dual Benefits: Luxurious Living & Prosperous Investment in Vietnam’s Coffee Capital

Following the signing ceremony for the development of an international standard education system, combined with the appealing Tesla townhouses and Cantata shophouses, Coffee City has emerged as a magnet for investment, residency, and asset accumulation.