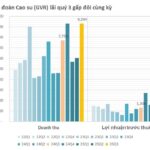

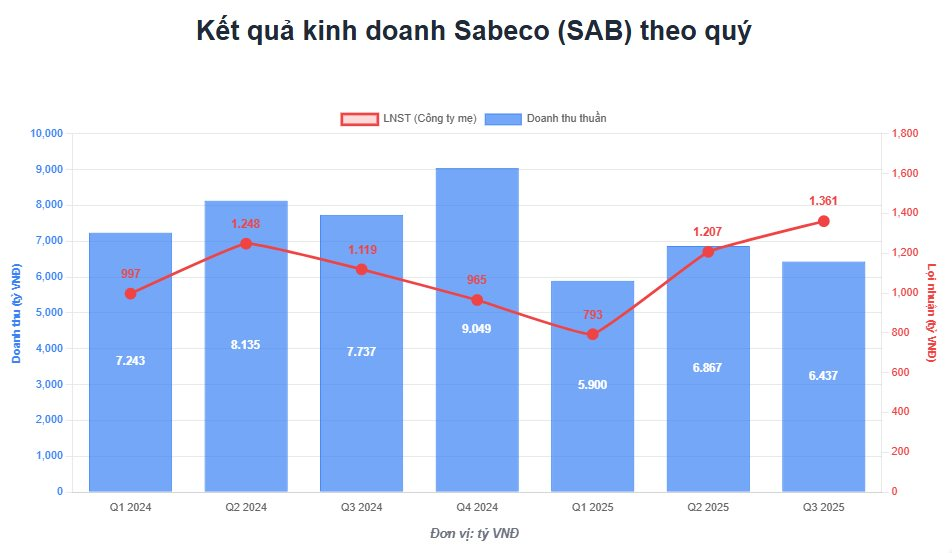

Saigon Beer-Alcohol-Beverage Corporation (Sabeco, HOSE: SAB) has released its Q3/2025 financial report, revealing contrasting trends in revenue and profit.

According to Sabeco’s consolidated financial statements, net revenue for Q3 reached VND 6,437 billion, a 16.1% decline compared to the same period in 2024. However, post-tax profit attributable to the parent company’s shareholders surged by 21.6%, hitting VND 1,360.5 billion—the highest quarterly profit in the last 13 quarters.

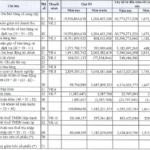

Sabeco’s Business Performance from Q1-2024

This profit growth stems from exceptionally effective cost control. Despite the revenue drop, the cost of goods sold in the quarter plummeted by 24.9% to VND 4,050 billion, boosting Sabeco’s gross profit by 5% year-over-year to VND 2,386 billion.

Gross profit margin significantly improved from 29.7% in Q3/2024 to 37.1%. The company attributes this to reduced input costs for raw materials like malt and rice, coupled with enhanced material utilization efficiency.

Strengthened core business profitability drove a 6% year-over-year increase in net profit from operations, reaching VND 1,563 billion. Non-core activities further bolstered this result: financial expenses recorded a negative VND 78.2 billion (compared to VND 12.5 billion in expenses last year), and other income contributed VND 132.9 billion (versus a loss of VND 6.8 billion last year). Sabeco noted that reduced financial expenses resulted from completing the purchase price allocation for the Sabibeco consolidation.

In its explanatory statement, Sabeco attributed the revenue decline to reduced overall output and accounting impacts from reclassifying Sabibeco from an associate to a subsidiary.

Illustrative Image

For the first nine months of 2025, Sabeco reported net revenue of VND 19,052 billion, a 17% decrease compared to the same period in 2024. Post-tax profit of the parent company remained stable at VND 3,361 billion, a slight 0.1% dip year-over-year, achieving 71% of the annual profit target.

Financial statement notes reveal that Sabeco paid VND 10,416 billion in various taxes to the state budget over the nine months.

In late July 2025, Sabeco disbursed VND 3,848 billion for the second dividend payment of 2024 at a 30% rate, bringing the total annual cash dividend to 50%, equivalent to VND 6,413 billion.

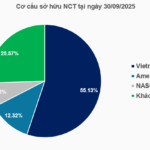

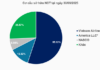

Financially, as of September 30, 2025, Sabeco’s total assets stood at VND 31,335 billion. Inventory was recorded at VND 1,744 billion, an 11.8% decrease from the beginning of the year, primarily due to reduced raw material and finished product inventories.

Cash, cash equivalents, and term deposits remained exceptionally high, accounting for 64% of total assets at VND 20,027 billion. Interest income from deposits in the nine months totaled VND 741 billion, averaging over VND 2.7 billion daily.

Electric Quang Group Overcomes Stock Warning and Control Status

Electrical Equipment Joint Stock Company Dien Quang (DQC) has released a report detailing its efforts to address the warning and periodic control status of its stock for Q3/2025.