The stock market surged, led by robust gains in banking and technology sectors. By the close of October 28th, the VN-Index climbed 27.96 points to 1,680.50, while the HNX-Index rose 1.42 points to 266.78. Conversely, the UPCoM-Index bucked the trend, dipping slightly by 0.28 points to 110.96.

Despite the positive session, trading volume remained subdued, with total market turnover exceeding VND 32.6 trillion. The HoSE alone accounted for over VND 29.5 trillion, equivalent to 932 million shares traded. Buyers dominated, with 219 stocks advancing, 94 declining, and 55 unchanged. The VN30 basket also rallied, gaining over 48 points, with 28 out of 30 constituents in the green.

The market staged a dramatic reversal in the afternoon session, with the VN-Index soaring nearly 60 points from its intraday low.

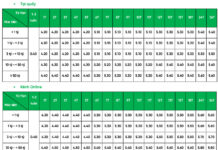

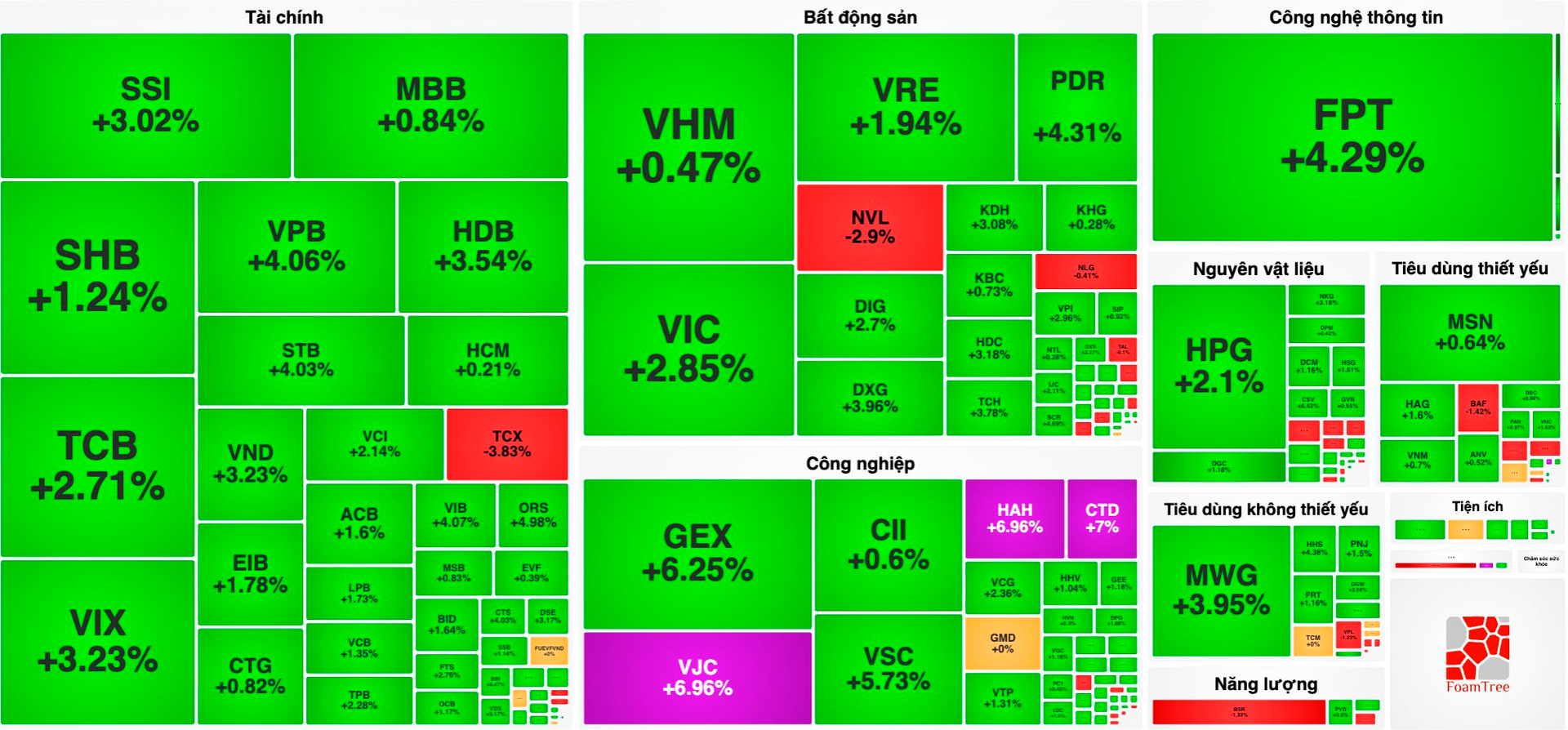

Banking stocks emerged as the market’s primary drivers, with widespread gains: VPB +4.06%, STB +4.03%, VIB +4.07%, HDB +3.54%, TCB +2.71%, TPB +2.28%. State-owned giants also maintained their upward momentum: VCB +1.35%, BID +1.64%, CTG +0.82%. Mid- and small-cap banks followed suit, with LPB +1.73%, EIB +1.78%, SHB +1.24%, OCB +1.17%, SSB +1.14%, ACB +1.6%. Only a few declined slightly, including NVB -1.33%, ABB -0.76%, BAB -6.15%.

The banking sector’s rally was underpinned by robust Q3 2025 earnings, with many institutions reporting double-digit growth fueled by expanding credit in a low-interest-rate environment and rebounding consumer and housing loan demand.

Techcombank, MB, and VPBank each posted pre-tax profits exceeding VND 20 trillion, with VPBank soaring 47% year-on-year. TPBank, SHB, and LPBank also set new records. According to the State Bank of Vietnam, national credit growth surpassed 13% and is projected to reach 20% by year-end, bolstering bank stocks.

Real estate stocks also rebounded strongly, with Vingroup’s VIC +2.85%, VHM +0.47%, and VRE +1.94% leading the charge. Mid-cap property stocks were equally vibrant: PDR +4.31%, DXG +3.96%, TCH +3.78%, CRV +3.9%, SJS +3.72%, KDH +3.08%, VPI +2.96%.

Industrial zone stocks maintained their upward trajectory, with BCM +1.53%, KBC +0.73%, IDC +2.22% staying in the green. Conversely, NVL -2.9%, CEO -2.52%, NLG -0.41%, TAL -0.1% saw minor declines, with selling pressure negligible.

Securities stocks rallied across the board, painting the sector green. Major players posted impressive gains: VIX +3.23%, VND +3.23%, SSI +3.02%, SHS +3.91%, CTS +4.03%, MBS +2.73%, VCI +2.14%, FTS +2.76%, DSE +3.17%. ORS +4.98%, BSI +0.47%, E1VFVN30 +1.47%, AGR +1.25% further bolstered the trend, while only TCX -3.83%, VFS -0.58% dipped slightly.

The IT sector surged, spearheaded by FPT +4.29%, buoyed by solid Q3 results and strong software export prospects. Peers ELC +1.52%, CMG +0.94%, ITD +1.07% also advanced.

A standout feature of the session was foreign investors’ net buying of over VND 1.5 trillion. FPT led with a remarkable VND 1,264.86 billion net buy, followed by VRE +235.55 billion, VPB +143.02 billion, GEX +93.94 billion, CII +92.60 billion, TCB +78.50 billion. On the sell side, MBB saw the heaviest net outflow at -397.01 billion, trailed by SSI -102.06 billion, PDR -66.04 billion, HCM -58.11 billion.

FLC Group Stages Powerful Comeback Post-Historic Legal Case: Takes Over Bamboo Airways, Launches New Real Estate Projects

Emerging from a tumultuous period, FLC, under the leadership of former Chairman Trinh Van Quyet, is poised for a strategic restructuring. The acquisition of Bamboo Airways and the launch of new real estate projects mark the initial steps in the conglomerate’s revival journey.

Market Pulse 29/10: Foreign Investors Resume Net Selling, VN-Index Narrows Gains

At the close of trading, the VN-Index climbed 5.33 points (+0.32%) to reach 1,685.83, while the HNX-Index rose 1.26 points (+0.47%) to 268.04. Market breadth favored the bulls, with 490 advancing stocks outpacing 211 decliners. Similarly, the VN30 basket saw green dominate, as 22 constituents advanced, 7 retreated, and 1 remained unchanged.

On His 63rd Birthday, Billionaire Bầu Hiển’s Wealth Surges by Tens of Billions of Dong

The combined stock assets of the three father-son members of the Hiển family are estimated to reach approximately VND 6,947 billion, marking a remarkable 100% increase compared to 2024, when their holdings were valued at around VND 3,400 billion.