TND Development Corporation (TND) has officially announced the successful issuance of private bonds, as detailed in their document No. 28/2025/TN submitted to the Hanoi Stock Exchange (HNX) and bondholders. Between October 22 and 28, 2025, TND issued 29,500 bonds under the code TND12501 in the domestic market, each with a face value of 100 million VND, totaling 2.95 trillion VND.

Illustrative image

These bonds have a 5-year maturity, set to expire on October 22, 2030. Details regarding bondholders, issuance purposes, and collateral were not disclosed in the HNX submission. However, HNX confirmed an annual interest rate of 8.75% for this issuance.

Established in October 2002, TND is headquartered at 33 Tay Ho Street, Tay Ho District, Hanoi. Its registered capital once peaked at 3.52 trillion VND but unexpectedly dropped to 1.496 trillion VND in July 2020. The shareholder structure remains undisclosed.

Ms. Nguyen Thi Ngoc Anh (born in 1970) serves as the legal representative and Director of TND. She also holds positions in other entities, including TND Development Hanoi Co., Ltd. and TND Development Hai Phong Co., Ltd.

At TND Development Hai Phong, Ms. Ngoc Anh represents a 635.7 billion VND (46.31%) stake held by Hoa Loi Trading and Investment Co., Ltd. Other shareholders include Minh Loc Service Development JSC (40.2%) and Hanoi Railway Tourism Service JSC (13.49%).

Notably, TND previously owned 70% of Opera Hotel Co., Ltd., the owner of Hilton Hanoi Opera Hotel. The remaining 30% was held by Thang Long GTC, a subsidiary of Hanoi Tourism Corporation. In September 2020, TND’s 70% stake was transferred to TND Development Hanoi Co., Ltd., also led by Ms. Ngoc Anh.

TND is also a major shareholder in Hanoi Tourism Service JSC (Hanoi Toserco), holding 26.74% of its charter capital as of June 30, 2025. Hanoi Toserco operates in various sectors, including international and domestic travel, office and residential leasing, airline ticketing, logistics, hospitality, tourism services, entertainment, and import-export.

Another significant shareholder in Hanoi Toserco is Hanoi Tourism Corporation, a state-owned enterprise holding 45.19% of the company’s capital. Mr. Nguyen Van Dung, Chairman of Hanoi Toserco’s Board, represents 28% of the state-owned capital, while Mr. Nguyen Manh Hung, Deputy General Director, represents 17.19%.

Prominent Vietnamese Businesswoman’s Affiliated Companies Delayed on Over VND 2.4 Trillion in Bond Payments

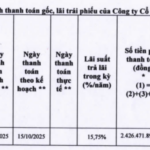

Bông Sen Corp, a company linked to Trương Mỹ Lan, has delayed the repayment of over 2.4 trillion VND in bonds due to the freezing of its accounts.