VRE attributes its success to the sustained recovery in occupancy rates across its shopping center network and the steady contributions from newly launched centers in the latter half of 2024 and 2025.

Additionally, the significant increase in foot traffic to shopping centers since the beginning of the year indicates a notable improvement in consumer sentiment compared to the previous year. Specifically, the number of visitors to Vincom shopping centers in Q3 rose by 18% year-over-year.

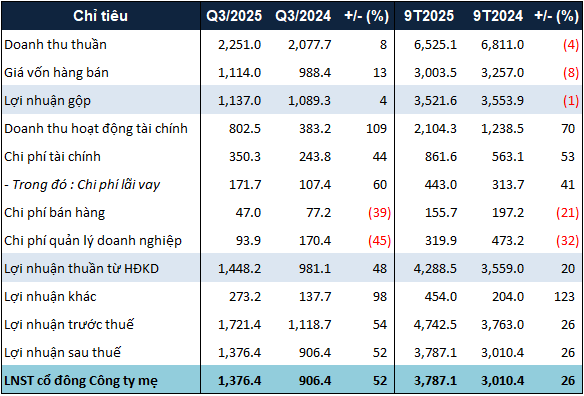

Not only did net revenue grow, but financial revenue in Q3 also saw a substantial increase, doubling from the same period last year to nearly 803 billion VND, entirely from interest on deposits, loans, and deposits.

Despite higher revenues, VRE reduced selling expenses by 39% and legal costs by 45%, to 47 billion VND and 94 billion VND, respectively, thanks to lower marketing and provisioning expenses.

As a result, VRE achieved a net profit of nearly 1.4 trillion VND in Q3, a 52% increase year-over-year. This brought the cumulative net profit for the first nine months to almost 3.8 trillion VND, up 26%.

|

VRE’s 9-Month Business Results in 2025. Unit: Billion VND

Source: VietstockFinance

|

Compared to the annual post-tax profit target of 4.7 trillion VND, VRE has achieved nearly 81% of this goal after nine months.

VRE plans to launch two flagship shopping centers, Vincom Mega Mall Ocean City (Hung Yen) and Vincom Mega Mall Royal Island (Hai Phong), in early October. These centers, developed under the “One-Stop Shoppertainment” model, offer a comprehensive modern lifestyle experience, encompassing shopping, dining, entertainment, and leisure.

On the balance sheet, VRE‘s total assets as of September 30, 2025, reached nearly 61.3 trillion VND, an 11% increase from the beginning of the year. Short-term cash holdings rose by 31% to over 3.9 trillion VND. Notably, the company recorded a 6.2 trillion VND deposit in Q3 related to agreements to acquire or gain priority rights to purchase shopping centers from partners, with interest rates ranging from 10-13% per annum.

Liabilities also increased by 17% to nearly 15.6 trillion VND, primarily due to outstanding loans of over 6.4 trillion VND. A highlight is the 3.3 trillion VND in deposits received under shopping center business cooperation contracts.

Vincom Retail transfers Nguyen Chi Thanh shopping center for over 3.6 trillion VND

– 08:57 30/10/2025

Phong Phú Reports 30% Surge in Q3 Profits, Driven by Improved Performance of Affiliated Companies

In Q3/2025, Phong Phu Corporation (UPCoM: PPH) reported a net profit of over 93 billion VND, marking a 30% increase. This growth was driven by reduced production costs and significant earnings from affiliated companies. After nine months, the company has achieved nearly 90% of its annual profit target.

Tanimex Announces 12.5% Cash Dividend Payout

Tanimex (HOSE: TIX) has announced the record date for its second dividend payment of 2025, offering a 12.5% cash dividend (VND 1,250 per share). The ex-dividend date is set for November 21, with payments expected to commence on December 24.