VPBank’s Billion-Dollar Deal Expertise

Vietnam Prosperity Joint Stock Commercial Bank (VPBank; HoSE: VPB) has consistently made its mark in Vietnam’s financial sector by executing two consecutive billion-dollar deals with Sumitomo Mitsui Banking Corporation (SMBC), Japan’s leading financial conglomerate.

In 2021, VPBank transferred 49% of FE CREDIT’s capital to SMBC Consumer Finance (SMBC CF) at a valuation of approximately $2.8 billion—the largest M&A transaction in Vietnam’s consumer finance history. Two years later, VPBank issued 15% of its charter capital to strategic partner SMBC, valued at around $1.5 billion—the largest foreign investment deal in Vietnam’s banking sector.

Behind these monumental deals lies a journey of building a robust foundation and developing an ecosystem that has propelled VPBank to become Vietnam’s leading private bank, topping both banking and consumer finance sectors. It has also strengthened its position in other high-potential areas such as securities, insurance, and digital banking.

At the “VPBankS: Driving Prosperity, Leading with Confidence” seminar, VPBank CEO Nguyen Duc Vinh emphasized, “Our leadership, major shareholders, and strategic partners are committed to leading the market, fostering growth, and seizing opportunities. In every committed endeavor, VPBank strives to be at the forefront.”

VPBank has consistently maintained a leading growth rate in the banking industry. From 2010 to 2024, its total assets grew 19-fold, with a compound annual growth rate (CAGR) of 22%—an unparalleled achievement over more than a decade. Rising from 8th place, VPBank became Vietnam’s largest private bank with consolidated assets of VND 1,180 trillion by Q3/2025.

In Q3/2025, VPBank’s profit reached nearly VND 9.2 trillion, the highest among private banks. Key metrics such as charter capital, equity, and capital adequacy ratio (CAR) have consistently led the industry for years.

In consumer finance, VPBank pioneered the establishment of FE CREDIT, quickly becoming the market leader with a market share exceeding 50% for many years. FE CREDIT boasts total assets of VND 66 trillion, a network of over 13,000 sales points nationwide, a workforce of 12,000 employees, and serves more than 14 million customers.

Additionally, entities like VPBankS, OPES, and CAKE by VPBank are poised to lead in their respective domains, reinforcing VPBank’s pioneering position across its ecosystem of over 30 million customers.

Continuing to Make History

The successes of VPBank’s 30-year journey have laid a solid foundation for VPBank Securities (VPBankS) to successfully execute its initial public offering (IPO).

VPBankS’s IPO is expected to make a significant impact, backed by the reputation and support of its parent bank, reasonable valuation, and strong growth potential.

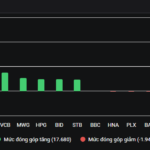

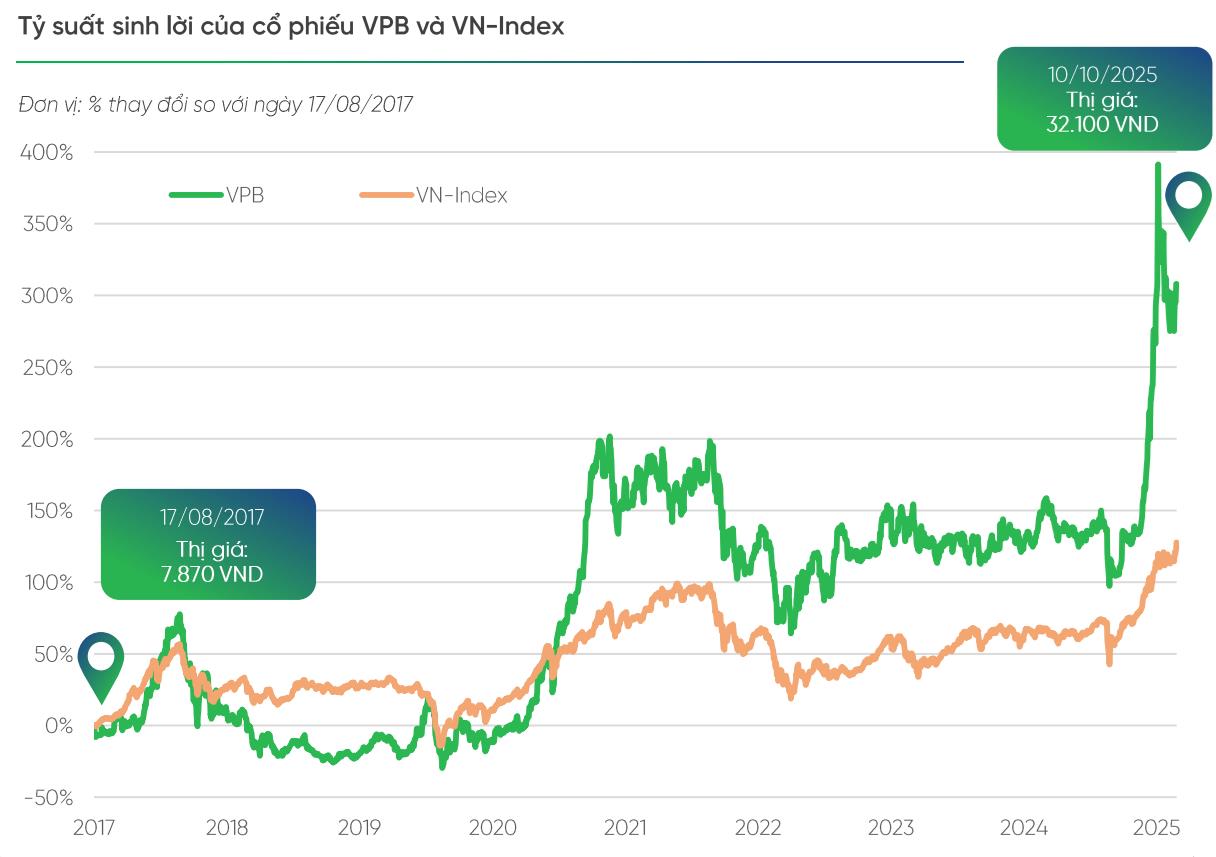

Through two of the largest deals in banking and consumer finance, VPBank has solidified its reputation among investors. Since its 2017 IPO, VPB shares have quadrupled, delivering returns double that of the VN-Index. By late August 2025, VPBank’s market capitalization reached nearly VND 310 trillion ($12 billion), ranking it second in the banking sector.

VPB shares have quadrupled since listing, with returns double the VN-Index. (Image: VPBankS)

VPBankS leverages the extensive experience of its parent bank to strengthen key areas such as investment banking (IB) and margin lending. The VPBank-SMBC ecosystem provides support in technology, governance, and capital mobilization. Recently, VPBankS appointed SMBC as the lead arranger for a record syndicated loan of up to $200 million. In 2025, the company aims to raise $400 million through bilateral and syndicated loans led by SMBC.

Operating within an ecosystem of over 30 million customers, including 634,000 Diamond Banking clients and 160,000 SMEs, VPBankS enjoys a significant advantage in cross-selling investment products. This is particularly relevant as household incomes rise and asset accumulation demand grows.

At an offer price of VND 33,900 per share, VPBankS is valued at a projected 2025 P/E of 14.3x and P/B of 2.4x (pre-issuance as of Q3/2025), both below market averages. Its PEG ratio of 0.5x highlights an attractive valuation relative to its strong profit growth potential.

Vu Huu Dien, Board Member and CEO of VPBankS, emphasized that with support from its parent bank and strategic partners, VPBankS aims to become a leading securities firm with the highest growth rate over the next five years.

“After three years of foundation-building, VPBankS is poised for robust and sustainable growth in 2025. Our 9-month results demonstrate that VPBankS is now among the market leaders: top 3 in total assets and margin lending, and top 2 in IB,” he stated. The company will focus on four pillars—IB, proprietary trading, margin lending, and brokerage—aiming to lead the market in these segments by 2030 and achieve top rankings in total assets and pre-tax profit.

Investors have less than three days to register and deposit for VPBankS shares, as the registration portal closes at 4:00 PM on October 31.

Shares are distributed directly by VPBankS and through three agents: Vietcap Securities, SSI Securities, and SHS Securities, along with 12 supporting units.

Following the IPO, VPBankS is expected to list on HoSE in December 2025.

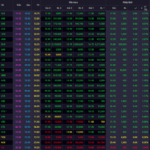

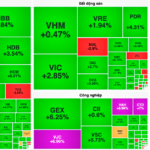

Why Are Stock Investors Hesitant Despite Corporate Profit Reports?

Several stocks are signaling optimism following robust third-quarter earnings reports, yet the market continues to exhibit signs of stagnation as liquidity declines. At today’s close (October 29), the VN-Index edged up slightly, surpassing the 1,685-point mark.

Stock Market Thrills: A Rollercoaster Ride Like No Other

The stock market witnessed a dramatic trading session on October 28th, as the VN-Index staged a remarkable turnaround. After plunging to around 1,620 points, it unexpectedly rebounded, closing above 1,680 points. This rollercoaster-like movement highlighted the emergence of bottom-fishing demand during the afternoon session, fueling a spectacular market reversal.