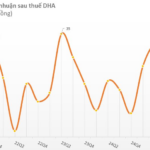

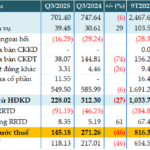

PetroVietnam Fertilizer and Chemicals Corporation (PVFCCo, HoSE: DPM) has released its Q3/2025 financial report, revealing a remarkable 21% year-over-year surge in net revenue to over VND 3,728 billion.

Notably, the company’s gross profit margin nearly doubled from 11.7% to 19.3% compared to the same period last year, driving gross profit for the quarter to exceed VND 718 billion.

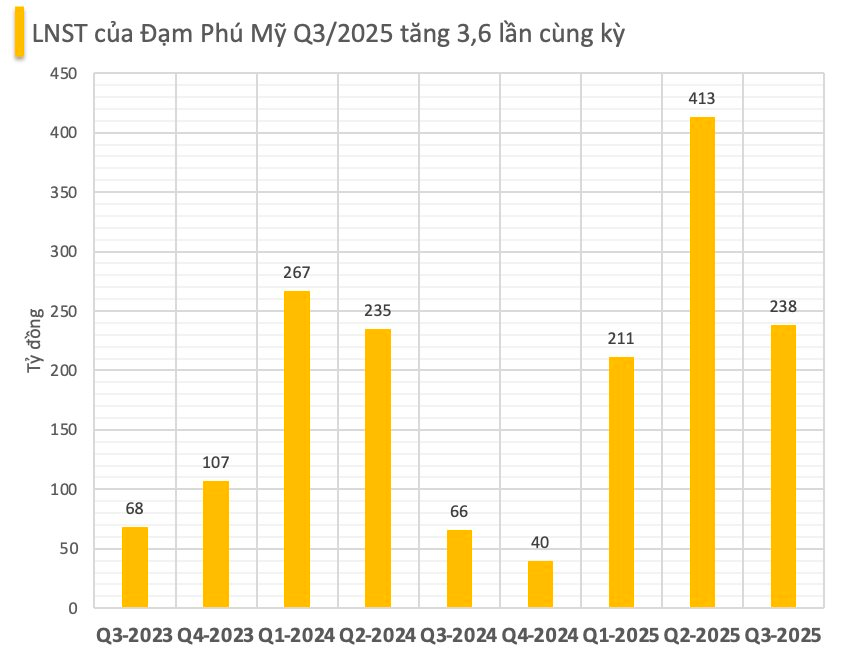

As a result, PVFCCo’s after-tax profit for Q3/2025 soared by 275% year-over-year, reaching over VND 238 billion (compared to VND 63 billion in the same quarter last year).

The company attributes this success to the robust performance of its core product lines, which significantly boosted both revenue and profitability.

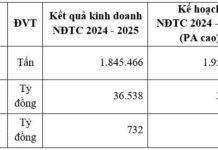

For the first nine months of 2025, PVFCCo recorded cumulative revenue of VND 13,150 billion, a 27% increase, and after-tax profit of VND 863 billion, 1.5 times higher than the same period in 2024.

PVFCCo’s 2025 targets include revenue of VND 12,876 billion and after-tax profit of VND 320 billion. With the current results, the company has not only met its revenue goal ahead of schedule but also surpassed its profit target by 270%.

As of September 30, 2025, PVFCCo’s total assets stood at over VND 18,818 billion, a 14% increase from the beginning of the year. Cash and cash equivalents totaled VND 788 billion, while bank deposits reached VND 9,712 billion, accounting for 58% of total assets.

The company’s short-term liabilities amounted to nearly VND 7,300 billion, with financial borrowings of VND 4,642 billion (short-term loans), reflecting a VND 1,220 billion increase from the start of the year.

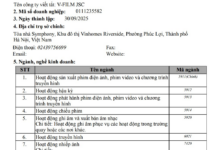

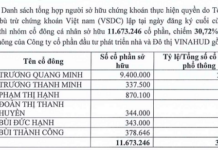

In other developments, on August 8, 2025, PVFCCo successfully distributed over 288 million bonus shares to 15,335 shareholders, increasing its chartered capital to nearly VND 6,800 billion.

Taseco Land Reports 40% Profit Surge, Strengthening Core Business Operations

Alongside a steady revenue stream from real estate development, Taseco Land is now reaping the rewards of its industrial infrastructure leasing segment—a strategic move that diversifies its income sources and strengthens long-term cash flow.

Historic Peak for Quarry Firm’s Stock: Company Reports Double Profit YoY, with Over 30% Assets in Stock Investments

With impressive business results, the company achieved 98% of its revenue target and surpassed its post-tax profit goal by nearly 60% for the year 2025.