Seizing the opportunity, ACB officially launches its Deposit Certificate product on the ACB ONE app, offering a daily interest rate of up to 5.8% per annum. This innovative solution allows customers to maintain liquidity while earning profits based on the actual holding period.

ACB introduces Deposit Certificates on ACB ONE with yields up to 5.8% per annum.

Earn Interest While Keeping Funds Flexible

For small business owners and entrepreneurs, cash flow often fluctuates with seasonal demands. During periods of surplus cash, leaving funds in a checking account is inefficient, while long-term savings lack the flexibility needed for sudden capital requirements.

Mr. Nguyen Van Minh, owner of an electronics center in Ho Chi Minh City, shares: “During peak seasons, I often have a few hundred million VND idle. Instead of traditional online savings, I now invest in ACB’s Deposit Certificates—enjoying high yields while retaining the ability to withdraw funds for inventory needs. This approach optimizes my capital utilization significantly.”

Beyond entrepreneurs, this product appeals to risk-averse investors seeking steady returns. Mrs. Ho Hoang Lan (55), a long-time ACB customer, states: “I avoid risky assets like stocks or real estate. ACB’s Deposit Certificates offer clear interest rates, daily earnings, and withdrawal flexibility—all managed seamlessly via my phone.”

Contrasting Mrs. Lan’s view, Mr. Thanh, a seasoned investor, notes: “My capital moves across stocks, gold, and real estate based on market conditions. ACB’s Deposit Certificates align perfectly with my need for liquidity and superior returns during transitional phases.”

ACB’s Deposit Certificates offer unparalleled advantages, delivering superior returns for businesses and individual investors.

High Yields – Flexibility – Seamless Online Experience

ACB’s Deposit Certificates provide fixed yields up to 5.8% per annum, starting from just 10 million VND. The unique time-weighted interest calculation ensures earnings accrue daily, even before maturity.

All transactions—investment, management, and withdrawal—are executed entirely on the ACB ONE app. Digital certificates display clear terms, including tenure, rates, issuance dates, and real-time earnings. Customers enjoy high liquidity, transparency, and convenience.

Smart Investment Solutions within ACB’s Financial Ecosystem

According to Mr. Tu Tien Phat, ACB’s CEO, this launch underscores the bank’s commitment to expanding intelligent investment options: “With Deposit Certificates, ACB empowers customers with secure, proactive, and efficient wealth management. Every moment becomes an opportunity to generate value.”

Complementing offerings like gold bars, fund certificates, insurance, and flexible financial solutions, Deposit Certificates are integral to ACB’s comprehensive investment ecosystem.

With over 30 years of trusted growth, ACB reaffirms its dedication to supporting customers in safe, flexible, and effective wealth accumulation and asset management.

Key Advantages of ACB Deposit Certificates:

– Attractive yields up to 5.8% per annum, earning daily interest.

– Capital flexibility with time-based interest retention.

– Fully digital: Invest, manage, and withdraw via ACB ONE.

– Security and transparency: Clear e-contracts backed by ACB’s reputation and technology.

Transform Every Moment into “Golden Time”

In volatile markets, those who value time maximize every second. ACB’s Deposit Certificates redefine investing as a daily smart habit, where idle funds consistently generate returns while adapting to life’s demands.

Unlock Exclusive Privileges with OCB Priority Banking: Elevating the Premium Customer Experience

Oriental Bank (OCB) has officially launched the “Diamond Privilege – Elite Living” program, a curated collection of exclusive products and premium experiences tailored specifically for OCB Priority Banking members.

The Art of Investing: Strategies for the Ultra-Wealthy

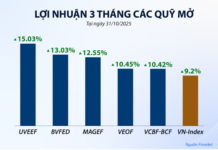

The ultra-wealthy population in Vietnam is witnessing a rapid surge, accompanied by a diversifying range of investment needs. Elevation Talks, a unique investment event series, is the brainchild of BIDV and Dragon Capital. This collaborative initiative serves as an intellectual hub, fostering connections and providing a platform for in-depth market insights and effective investment strategies. Modeled after the renowned investment clubs worldwide, Elevation Talks offers a space for like-minded individuals to engage, exchange ideas, and explore lucrative opportunities.

The Power of Choice: Navigating a Path to Success

In a strategic shift to navigate the post-crisis landscape, National Citizen Bank (NCB) has embarked on a transformative journey, recording notable milestones along the way.

“From a $300 Million Stock Investment Profit of $1.8 Billion, to a Phu Quoc Land Deal that Netted $2.7 Billion: A Conversation with Dr. Le Xuan Nghia on His Humble Money Management Struggles”

“Despite his successful investment ventures, Dr. Le Xuan Nghia, an economics expert, admits that he lacks the ability to manage cash flow and has no business acumen. This candid confession highlights an intriguing paradox, as one would assume that financial prowess and entrepreneurial skills go hand in hand.”