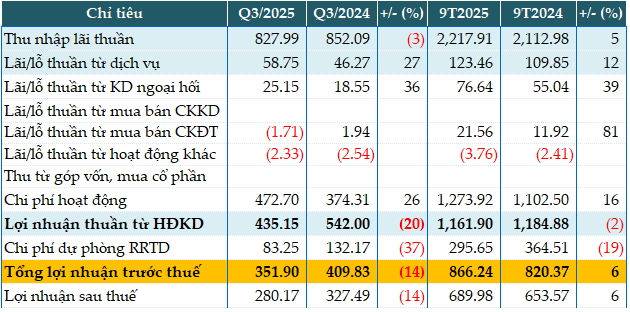

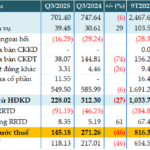

In Q3, net interest income dipped by 3%, reaching approximately VND 828 billion.

Non-interest income streams showed mixed growth. Service fees surged by 27% to VND 59 billion, and foreign exchange earnings climbed 36% to VND 25 billion.

Conversely, securities trading shifted from profit to a loss of VND 1.7 billion, while other operations also reported losses.

Additionally, Vietbank’s operating expenses rose by 26% to VND 473 billion, resulting in a 20% decline in net operating profit to over VND 435 billion.

Despite a 37% reduction in credit risk provisions to just over VND 83 billion in Q3, pre-tax profit still fell by 14% to nearly VND 352 billion.

For the first nine months of the year, the bank’s pre-tax profit exceeded VND 866 billion, a modest 6% increase year-on-year, primarily due to lower risk provisions. Compared to the 2025 target of VND 1,750 billion in pre-tax profit, Vietbank has achieved only 49% of its goal.

|

Q3 and 9-month 2025 business results of VBB. Unit: Billion VND

Source: VietstockFinance

|

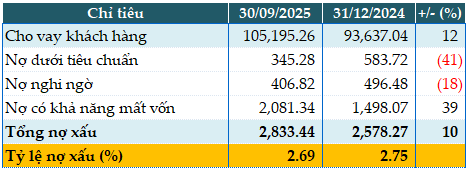

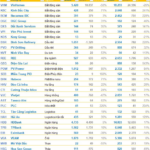

As of Q3-end, Vietbank’s total assets grew by 16% year-to-date to VND 188,133 billion. Customer loans increased by 12% to VND 105,195 billion; deposits at the State Bank fell by 40% to VND 4,244 billion; deposits at other credit institutions rose by 33% to VND 45,286 billion; and loans to other credit institutions plummeted by 80% to VND 500 billion.

On the funding side, government and State Bank debt stood at VND 2,550 billion at Q3-end, up from just VND 222 billion at the start of the year; deposits from other credit institutions increased by 49% to VND 49,396 billion; and customer deposits rose by 6% to VND 100,829 billion.

Total non-performing loans as of September 30, 2025, increased by 10% to VND 2,844 billion. There was a shift from substandard and doubtful debts to potential loss debts. As a result, the NPL ratio decreased from 2.75% at the beginning of the year to 2.69%.

|

Loan quality of VBB as of September 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

– 13:28 31/10/2025

Soaring Operational Costs Slash Vietbank’s Q3 Pre-Tax Profit by 14%

Vietbank (UPCoM: VBB) reported a pre-tax profit of nearly VND 352 billion in Q3/2025, reflecting a 14% year-on-year decline. This decrease is attributed to lower net interest income and higher operating expenses, as indicated in the bank’s consolidated financial statements.

Q3 Profits Plummet 46%: What’s Unfolding at Bac A Bank?

Bac A Bank (HNX: BAB) reported a consolidated profit of over VND 145 billion in Q3/2025, a 46% decline compared to the same period last year, as most revenue streams experienced setbacks.