Real Estate Searches Surge in Former Binh Duong (Now Part of Ho Chi Minh City)

At the Q3/2025 real estate market report event, Mr. Dinh Minh Tuan emphasized that the former Binh Duong (now part of Ho Chi Minh City), particularly the northeastern area of HCMC, has emerged as the “new star” of the Southern real estate market. Searches have tripled compared to 2023, accounting for approximately 5% of total interest from Hanoi residents. This significant growth is driven by Binh Duong’s integration into HCMC.

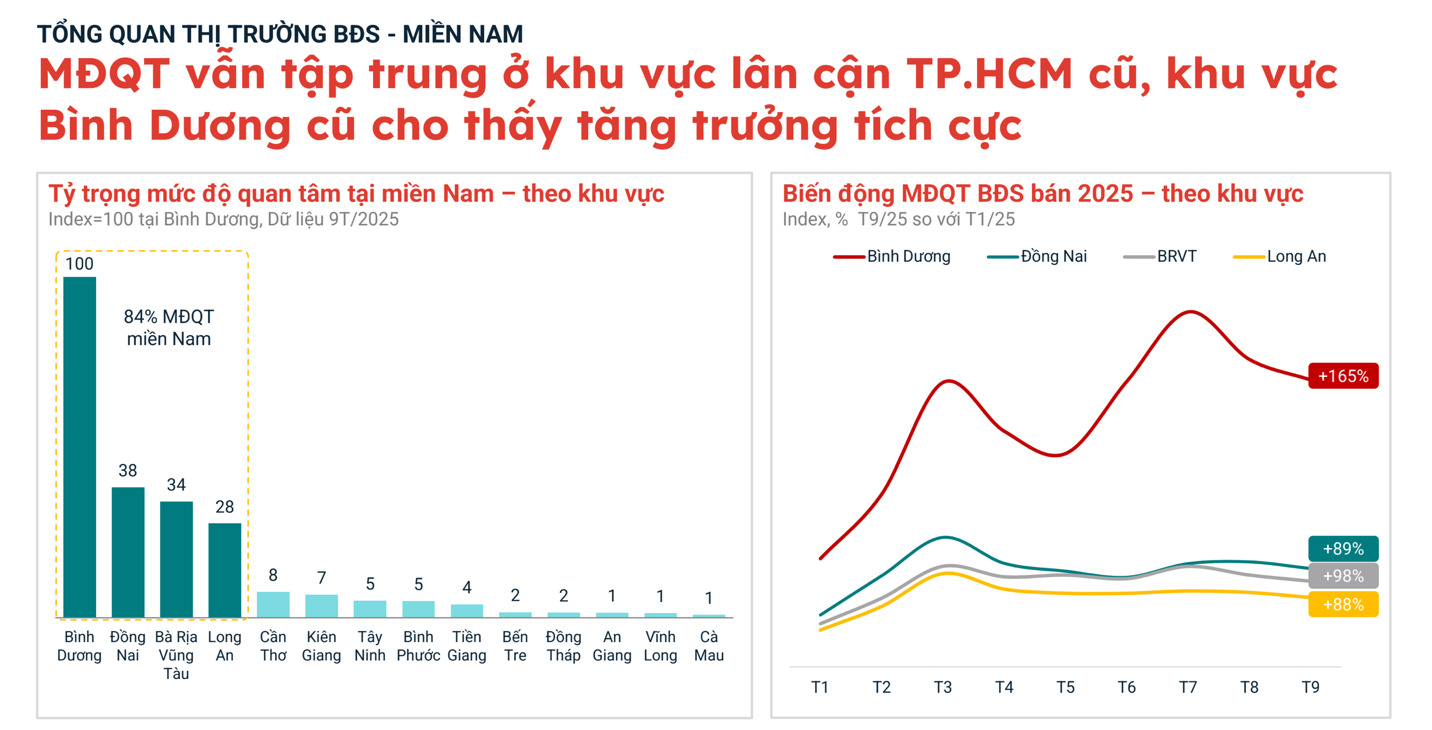

Batdongsan.com.vn’s Q3/2025 report highlights that in the South, real estate activity is concentrated in satellite markets surrounding pre-merger HCMC. Specifically, the four former provinces—Binh Duong, Dong Nai, Ba Ria-Vung Tau, and Long An—account for 84% of Southern interest (excluding HCMC). Among these, former Binh Duong leads with an index of 100, followed by Dong Nai (38), Ba Ria-Vung Tau (34), and Long An (28), forming a vibrant “satellite belt” around HCMC.

Compared to the beginning of the year, interest in former Binh Duong has skyrocketed by 165%, far outpacing other areas. Dong Nai saw an 89% increase, Ba Ria-Vung Tau 98%, and Long An 88%. This surge reflects a strong shift of investment away from HCMC’s core toward areas with improving infrastructure, ample land, and price growth potential.

Amid growing Southern real estate interest, Mr. Dinh Minh Tuan noted that Hanoi home prices rose 80-100% over the past two years. Now, HCMC is entering a new growth phase, particularly in newly integrated areas with significant price appreciation potential.

Recently, capital from Hanoi has been flowing into the South, especially projects near key infrastructure. Mr. Tuan observed that Northern investor interest in HCMC real estate has peaked after six years, signaling a new dynamic cycle for the Southern property market.

“Out of every 10 real estate searches, 2 target HCMC—the highest since 2019, when the market boomed with condo and land speculation. Former Binh Duong, especially HCMC’s northeast, is the ‘shining star,'” he stressed.

Buyers Shift Demand from Core to Adjacent Areas

According to Vo Huynh Tuan Kiet, Residential Director at CBRE Vietnam, infrastructure development has fueled urban sprawl. Buyers are now moving from the core to adjacent areas to capitalize on price increases.

Recently, infrastructure investment and urban sprawl have driven rapid property price growth. Primary home prices in former HCMC, Binh Duong, and Ba Ria-Vung Tau rose 14-29% year-over-year. Prices will continue rising as infrastructure improves.

“Planning, transportation infrastructure, and new land pricing are key drivers of home prices. Connectivity is critical for urban development, driving sprawl and boosting real demand and buyer price expectations,” the CBRE expert emphasized.

Batdongsan.com.vn data shows that adjacent areas dominate new housing supply. Binh Hoa, Lai Thieu, Thuan An, and Di An lead with 13,000 units priced at 50–70 million VND/m², while former Thu Duc has 11,800 units at 80–120 million VND/m². Supply concentration along strategic routes like Ring Road 3, Ring Road 4, and metro lines underscores urban sprawl and satellite city development.

Binh Hoa, Lai Thieu, Thuan An, and Di An lead with 13,000 units priced at 50–70 million VND/m².

Giang Huynh, Director of Research and S22M at Savills Vietnam, agreed that land prices, development costs, and legal hurdles prevent price declines. Two to three years ago, 40–45 million VND/m² units were common; now, 50–60 million VND/m² is rare. Even in supply-rich former Binh Duong, 50–55 million VND/m² units are scarce. Strong demand and infrastructure-driven appreciation are key price drivers. Buyers now prioritize new projects with good locations, clear legal status, and future infrastructure-driven growth potential.

Transportation infrastructure’s impact on property prices is evident in the market’s history. Major infrastructure projects have significantly boosted prices. For example, along Hanoi Highway, where the Ben Thanh – Suoi Tien Metro runs, condo prices rose 50–70% in 4–5 years, with some projects up nearly 150%. National Highway 13 is in a similar growth phase. By early 2026, the Binh Trieu to Vinh Binh section will widen, cutting travel time from Binh Hoa and Lai Thieu to Hang Xanh to 15 minutes, likely pushing prices along the route to new highs.

At a recent seminar, Dr. Ngo Viet Nam Son, a planning and architecture expert, noted that post-merger, the new “megacity” of HCMC is developing as a multi-centered, modern, regionally connected, and sustainable city.

He highlighted that improved inter-regional connectivity is driving real estate demand. Post-merger, diverse urban models—seaport cities, industrial cities, airport cities, and TODs linked to high-speed rail, metro, and BRT systems—will be prioritized.

Key infrastructure projects like National Highway 13, HCMC Ring Road 3, Ring Road 4, Metro 3B, Bien Hoa – Vung Tau Expressway, HCMC – Thu Dau Mot – Chon Thanh Expressway, and the Can Gio – Vung Tau coastal road will drive Southern real estate growth.

Ministry of Construction Addresses Solutions to Cool Down Housing Prices

The Ministry of Construction highlights that property prices in many areas do not accurately reflect true supply and demand dynamics. Instead, they are heavily influenced by speculation, opaque planning information, administrative boundary adjustments, and herd mentality. Consequently, there is a pressing need to regulate the real estate market, particularly through measures that balance housing product structures and control land and property transaction prices.

Haunted Goods Street in Ho Chi Minh City Sees Few Visitors During Halloween

With just one day left until Halloween (October 31st), the familiar streets of Ho Chi Minh City known for their festive decorations, such as Hai Thuong Lan Ong and Do Xuan Hop, along with shopping malls, supermarkets, and bookstores, are bathed in the iconic orange and black hues of this spooky season. Despite the abundance of goods and stable prices, these stores remain eerily quiet, with few customers in sight.