|

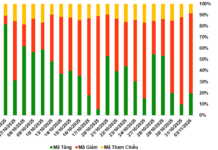

DCM’s Q3/2025 Business Targets

Source: VietstockFinance

|

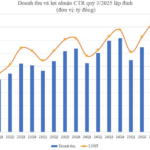

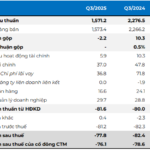

In Q3, DCM achieved nearly VND 3.1 trillion in net revenue, a 16% increase year-over-year. Meanwhile, the cost of goods sold rose slightly to VND 2.3 trillion. After deductions, gross profit reached VND 657 billion, up 75%. Gross margin significantly improved from 14.2% to nearly 22%.

Financial revenue tripled compared to the same period last year, hitting VND 129 billion, offsetting a 100% surge in financial expenses (recorded at VND 28 billion). Despite rising selling and administrative costs, substantial gross profit enabled DCM to report a net profit of VND 328 billion, 2.7 times higher than the previous year.

According to the company’s explanation, this growth primarily stems from revenue increasing faster than the cost of goods sold.

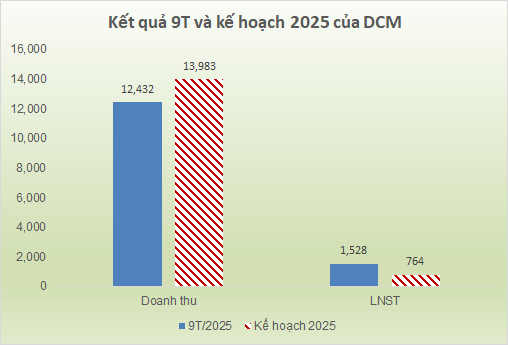

For the first nine months, the fertilizer giant recorded over VND 12.4 trillion in revenue, a 35% increase; net profit exceeded VND 1.5 trillion, growing by 45%. These results equate to 89% of the revenue target and 200% of the post-tax profit plan approved by the 2025 Annual General Meeting.

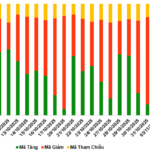

However, it’s worth noting that DCM often sets conservative targets and then exceeds them, as seen in previous years. CEO Văn Tiến Thanh shared at the AGM that the cautious planning reflects the strategy inherited from the parent group (PVN). Annually, DCM must develop scenarios based on oil and urea price forecasts to determine revenue and profit. Yet, actual market conditions often differ significantly from projections.

Source: VietstockFinance

|

As of September, DCM’s total assets reached VND 16.5 trillion, a 5% increase year-to-date, with over VND 13.5 trillion in current assets (up 5%). Cash and deposits, though down 23%, still stood at nearly VND 6.9 trillion, generating VND 236 billion in deposit interest for the nine months (up 10% year-over-year). Inventory surged 56%, reaching nearly VND 4.6 trillion.

On the capital side, total liabilities rose slightly to over VND 5.95 trillion, while total debt and finance lease obligations (short and long-term) increased 48% year-to-date to nearly VND 2 trillion, primarily due to higher short-term borrowing.

In recent developments, DCM plans to hold an Extraordinary General Meeting on November 5, 2025, at its Ho Chi Minh City office. The agenda includes renaming the company from “Cà Mau Petroleum Fertilizer JSC” to “PetroVietnam Cà Mau Fertilizer Corporation JSC.”

The company stated that the name change supports its strategy to expand production, broaden its agricultural and fertilizer value chain, and reflect its parent-subsidiary model. It also aims to enhance brand recognition and align with plans to grow its agricultural, chemical, and logistics ecosystem.

The rename is expected to facilitate M&A activities, market share expansion, and export growth.

Additionally, the meeting will address amendments to gas purchase agreements for PM3 CAA and Cái Nước Block 46, transferring all rights and obligations from PetroVietnam (PVN) to PV GAS.

– 11:02 01/11/2025

Vietnam Airlines Surges Ahead with Impressive Q3 2025 Performance

On October 30, Vietnam Airlines Corporation (stock code: HVN) released its Q3 2025 financial report, showcasing remarkable growth. Key metrics including output, revenue, and profit not only met but exceeded targets, underscoring robust financial stability and laying a solid foundation for its 2026-2030 development strategy.

GEG Reports Q3 Profit of VND 75 Billion, Attributed to Electricity Price Lock-In; 9-Month Net Profit Surges 7x Year-on-Year

With the official electricity prices set for the Tan Phu Dong 1 (TPD1) wind power plant and the A7 turbine of the VPL Wind Power Plant, Gia Lai Electricity Joint Stock Company (HOSE: GEG) has reported a remarkable third-quarter performance compared to the same period last year, which saw losses. This positive shift has significantly brightened the company’s cumulative financial outlook.

DICERA Holdings (DC4) Reports 70% Surge in Q3 Profits, Partners with Energy Giant in Oil & Gas Sector

Under this agreement, DICERA Holdings will explore and develop investment opportunities on the land fund currently managed and owned by PVChem.