I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON NOVEMBER 3, 2025

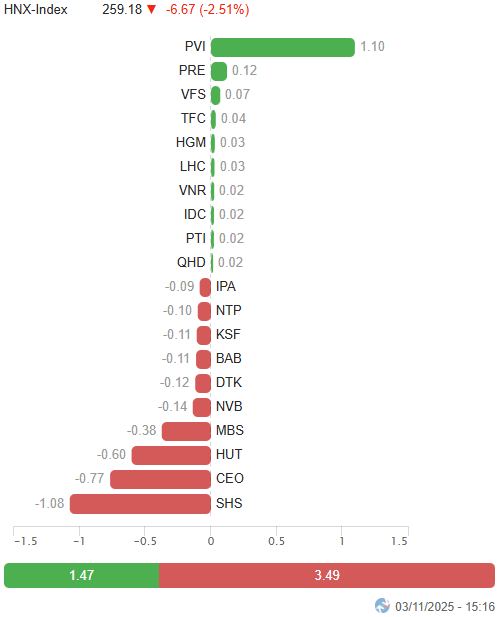

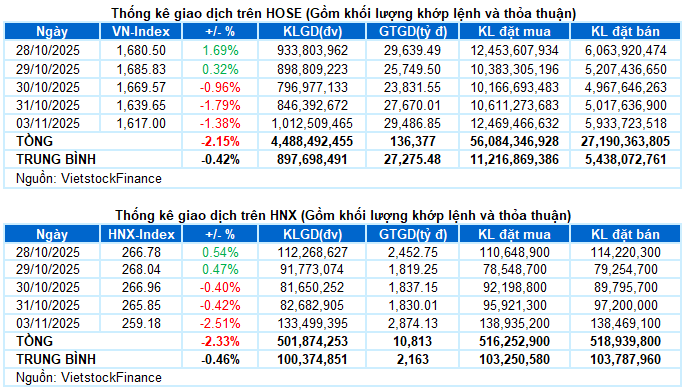

– Major indices continued to decline sharply in the November 3 trading session. Specifically, the VN-Index dropped by 1.38%, closing at 1,617 points, while the HNX-Index plunged by 2.51%, settling at 259.18 points.

– Trading volume on the HOSE floor increased by 24.1%, reaching over 965 million units. The HNX floor recorded more than 126 million matched units, a significant rise of 53.8% compared to the previous session.

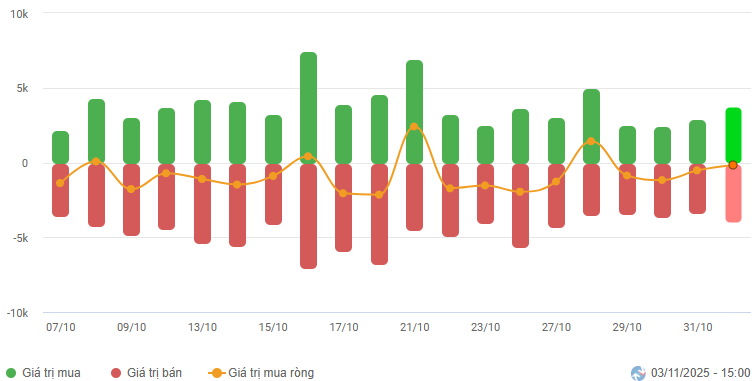

– Foreign investors continued to net sell, with a value of nearly VND 113 billion on the HOSE and almost VND 4 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

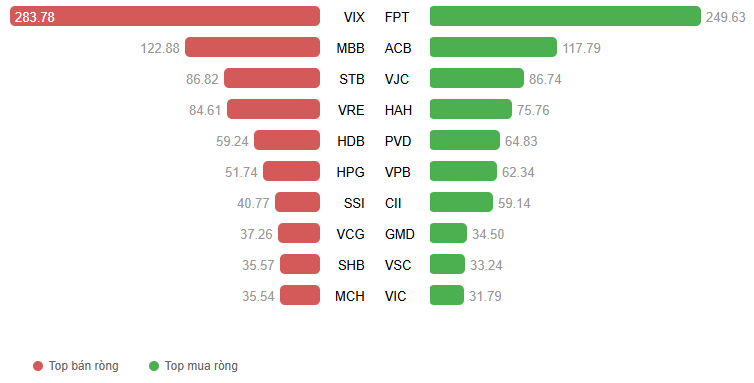

Net Trading Value by Stock Code. Unit: Billion VND

– Vietnam’s stock market kicked off November with a turbulent trading session. After a less-than-positive first half of the morning session, blue-chip stocks unexpectedly rebounded strongly, pulling the VN-Index from a decline of over 16 points to a gain of nearly 12 points before the midday break. However, hopes were quickly dashed in the afternoon session as heavy selling pressure returned, spreading across the entire market and even causing many stocks to enter a “no buyer” state. At the close, the VN-Index retreated to 1,617 points, down 22.65 points (-1.38%) from the previous session.

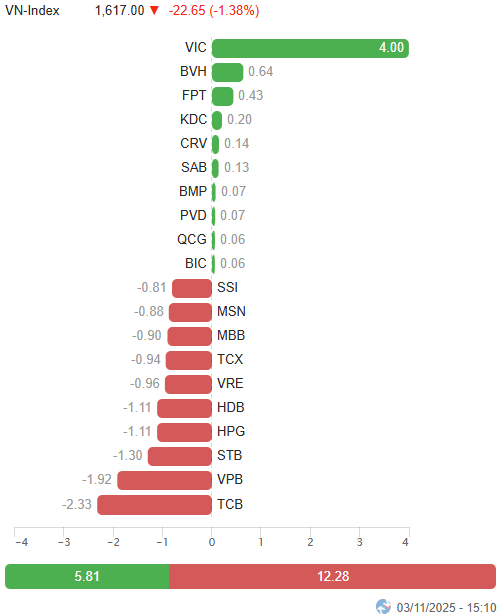

– In terms of impact, the financial sector weighed heavily on the market today, with 7 out of 10 stocks in this sector among the most negatively influential, causing the VN-Index to drop by a total of more than 9 points, led by TCB, VPB, and STB. On the flip side, VIC alone contributed 4 points to the index but was not enough to shift the overall sentiment.

Top Stocks Influencing the Index. Unit: Points

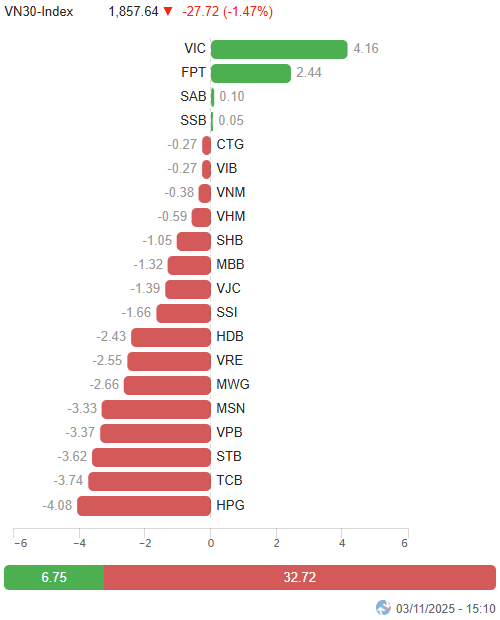

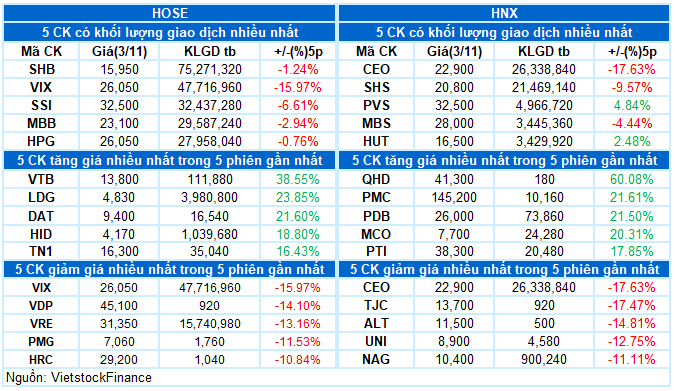

– The VN30-Index lost 27.72 points (-1.47%), falling to 1,857.64 points. Sellers dominated with 23 declining stocks, only 4 advancing stocks, and 3 unchanged stocks. VRE, STB, SSI, HDB, and TCB faced heavy pressure, dropping by 4-6%. Meanwhile, VIC, FPT, and SAB bucked the trend, rising by 2.3%, 1.1%, and 1%, respectively.

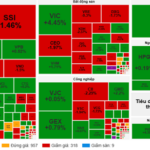

Red dominated most sectors. The communication services sector was the worst performer today, with major stocks in the industry adjusting sharply, such as VGI (-3.02%), FOX (-1.99%), CTR (-2.39%), YEG (-2.8%), and TTN (-5.26%).

Large-cap sectors like finance, industry, and real estate weighed heavily on the overall index, with numerous stocks plummeting by more than 3%, including SSI, SHB, TCB, VPB, HCM, SHS, VND, HDB, STB; VCG, VTP, HHV, CTD, DPG; VRE, PDR, KDH, DIG, and NVL. Many stocks even hit their lower limit, such as VIX, CTS; CII, VSC; CEO, DXG, HDC, TCH, NLG, and DXS.

On the upside, the essential consumer sector led with a 1.45% gain, primarily driven by MCH (+9.72%) and KDC (+5.62%). Most others still faced strong profit-taking pressure, notably MSN (-3.27%), HAG (-3.8%), DBC (-2.82%), VHC (-3.05%), ANV (-1.68%), and HSL hitting the lower limit. Similarly, the information technology sector maintained its green hue, mainly thanks to FPT (+1.06%).

Additionally, insurance stocks were a notable bright spot today. BVH stood out with an impressive ceiling session, while BMI (+6.62%), PVI (+9.61%), MIG (+4.44%), BIC (+4.94%), ABI (+1.48%), and PRE (+8.41%) all attracted strong buying interest.

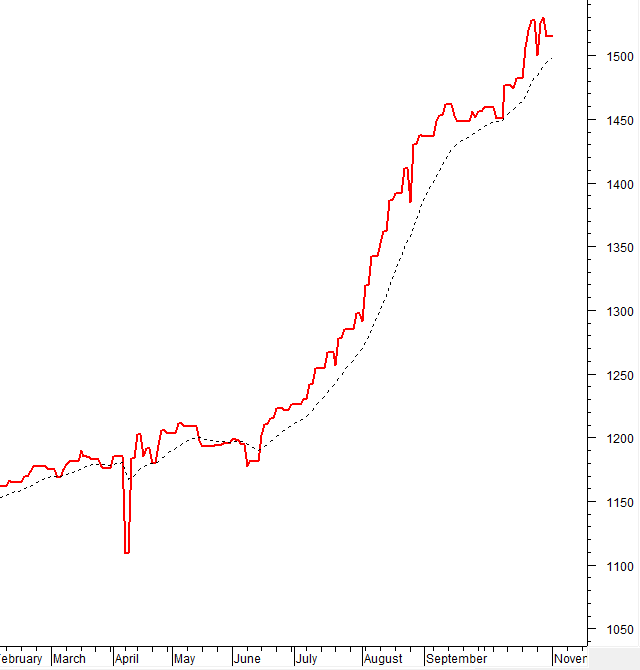

The VN-Index plunged for the third consecutive session, forming a Three Black Crows candlestick pattern. The situation will become even more pessimistic if the old August 2025 low (equivalent to the 1,605-1,630 point range) is breached in the coming sessions.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – Three Black Crows Candlestick Pattern Emerges

The VN-Index plummeted for the third straight session, forming a Three Black Crows candlestick pattern. The outlook will become even more bearish if the old August 2025 low (equivalent to the 1,605-1,630 point range) is broken in the upcoming sessions.

Furthermore, the Stochastic Oscillator and MACD indicators continue to weaken after giving sell signals, indicating a less-than-positive short-term outlook.

HNX-Index – Cuts Below the 100-Day SMA

The HNX-Index fell sharply with a Big Black Candle pattern, simultaneously cutting below the 100-day SMA. Trading volume surged above the 20-session average, reflecting widespread pessimistic sentiment.

The Stochastic Oscillator and MACD indicators continue to decline, suggesting that the risk of further correction is likely in the short term.

Capital Flow Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index is currently above the 20-day EMA. If this state continues in the next session, the risk of a sudden downward thrust will be mitigated.

Foreign Capital Flow: Foreign investors continued to net sell in the November 3, 2025, trading session. If foreign investors maintain this action in the coming sessions, the situation will become even more pessimistic.

III. MARKET STATISTICS ON NOVEMBER 3, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:07 November 3, 2025

Record Sell-Off by Foreign Investors Surpasses 100 Trillion VND: When Will the Pressure Ease?

In the first ten months of 2025, foreign investors recorded a net sell-off exceeding 100 trillion VND on the Ho Chi Minh City Stock Exchange (HOSE), surpassing the entire year’s record of 2024 and placing significant pressure on the VN-Index. However, experts anticipate that this pressure will ease in the coming period.

Market Pulse 03/11: Blue-Chip Stocks Rebound, VN-Index Regains Green Territory

A robust recovery signal emerged during the final moments of the morning session, propelling the VN-Index to swiftly rebound and reclaim positive territory. At the midday break, the VN-Index surged by over 12 points (+0.74%), reaching a strong 1,651.76 points. Meanwhile, the HNX-Index lagged, closing at 264.15 points, down 0.64%. Market breadth remained balanced, with 317 gainers, 327 decliners, and 957 unchanged stocks.