Industry Leadership Position

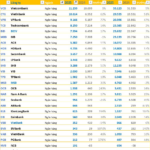

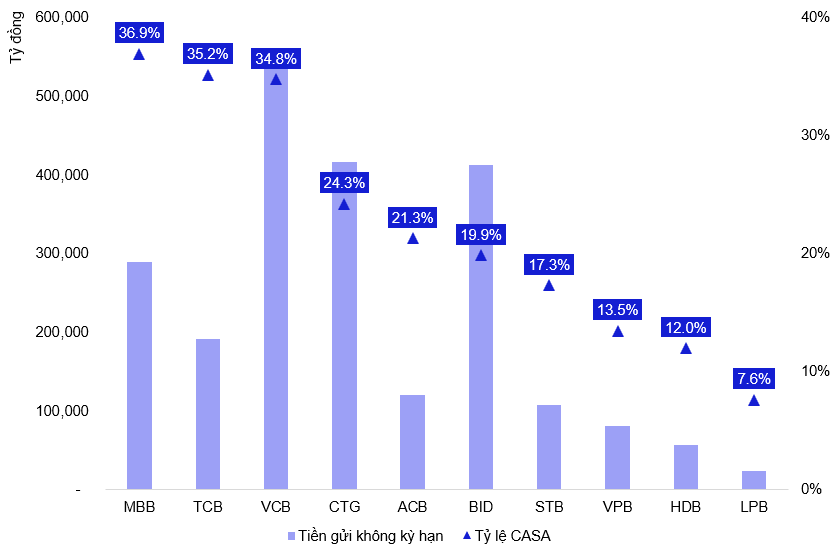

The CASA race favors efficiently digitized banks, with MBB emerging as the standout performer. As of Q2/2025, MBB maintains its lead with a CASA ratio of 36.9%. In a context of loosened monetary policy aimed at supporting economic growth, a high CASA ratio provides significant competitive advantages for banks.

Specifically, CASA reduces reliance on high-cost term deposits, lowering the cost of funds (COF), enhancing net interest margin (NIM), and enabling competitive lending rates.

Bank CASA Ratios as of 30/06/2025

Source: Ministry of Finance and VietstockFinance

In terms of operational metrics, MBB ranks among the most efficient banks in the system, consistently placing in the top 5 for NIM while maintaining a non-performing loan ratio below 2%. These results demonstrate the bank’s ability to balance growth, profitability, and operational safety effectively.

By the end of 2025, MBB is expected to sustain its leadership position in the banking sector.

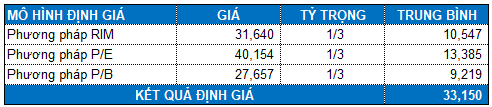

Stock Valuation

Using the Market Multiple Models (P/E, P/B) combined with the Residual Income Model (RIM) in equal weights, the fair value of MBB is estimated at approximately 33,150 VND/share. Thus, the current market price of MBB presents an attractive entry point for long-term investment.

Enterprise Analysis Division, Vietstock Advisory Department

– 08:30 04/11/2025

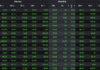

Top 20 Most Profitable Listed Companies in Q3 2025: 10 Firms Surpass 15 Trillion VND in Earnings, Including 7 Banks and 3 Real Estate Giants

The banking sector continues to dominate, with a strong presence in the top rankings. Notably, 7 banks secure positions in the top 10, while 11 banks claim spots within the top 20.

2025 Q3 Bank Performance Update: More Lenders Surpass VND 10 Trillion Pre-Tax Profit by October 29

In Q3/2025, a bank reported a staggering pre-tax profit, soaring 12 times higher than the same period last year.