When Fintech Becomes the Foundation of a Digital Society

In recent years, Vietnam’s fintech industry has rapidly evolved from single-purpose payment solutions to a vibrant ecosystem encompassing essential sectors like healthcare, education, insurance, investment, and microfinance. This expansion highlights fintech’s significant role in digitizing daily life, reshaping spending habits, and transforming how people interact with essential services.

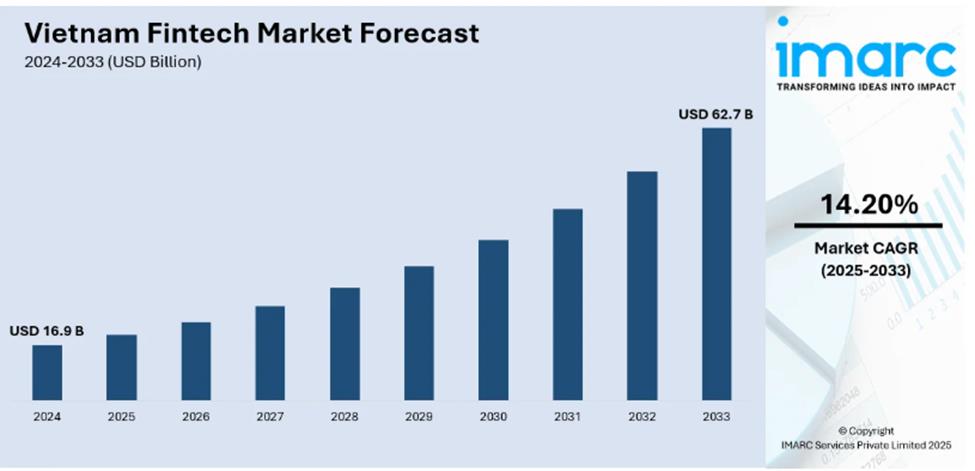

The total market value of Vietnam’s fintech sector is projected to surge from $16.9 billion in 2024 to $62.7 billion by 2033, cementing its position as a pioneering force in building a robust and inclusive digital economy in Vietnam.

According to the 2024 Vietnam Fintech Market Report by IMARC Group, the sector is expected to grow at a CAGR of 14.2% from 2025 to 2033. With over 32 million active e-wallets and 87% of adults owning payment accounts, fintech is poised to become a widely accessible foundation.

Viettel Money stands as a leading fintech application in digital finance, boasting 30 million users and processing over 1.5 billion transactions annually. Beyond payments, it offers a suite of financial and lifestyle services, including digital insurance, fund investments, gold purchases, savings, tuition payments, and utility bill settlements.

The platform simplifies registration, verification, and transactions while maintaining robust risk controls. Users can sign up with just a phone number and complete eKYC in minutes, replacing traditional paperwork. This digitization fosters digital behavior among millions of Vietnamese.

Viettel Money drives financial digitization, promoting digital adoption among millions of Vietnamese users.

Investing in Technology for Enhanced Convenience and Security

A wave of technological upgrades is sweeping Vietnam’s fintech sector, with companies investing in AI, big data, and automation to optimize operations, accelerate processing, and deliver safer, more convenient user experiences. This is crucial for competing with global platforms.

Viettel Money leads in developing “Make in Vietnam” solutions, adopting an “AI First” approach across user support, fraud detection, and transaction processing to reduce steps and enhance personalization.

Traditionally, many Vietnamese, especially in rural areas or self-employed, lack access to formal credit due to insufficient financial history or collateral. Viettel Money’s AI-driven credit scoring evaluates users comprehensively, enabling millions to access formal loans instantly.

Additionally, RPA automates repetitive tasks like transaction verification and fraud detection, while Customer 360 leverages over 1,000 data points to offer tailored services based on real needs.

Viettel Money offers a diverse digital financial ecosystem, catering to various essential needs.

Recognized for its efforts, Viettel Money was awarded “Outstanding Comprehensive Financial Ecosystem” at the 2025 Better Choice Awards, underscoring the impact of “Make in Vietnam” models on digital economic and social development.

Viettel Money honored as “Outstanding Comprehensive Financial Ecosystem” at the 2025 Better Choice Awards.

In the broader economic landscape, fintech is a key driver in expanding financial access, boosting consumption, supporting production, and creating ripple effects across sectors. With its current momentum, fintech is set to shape a more open, inclusive, and dynamic financial future for Vietnam.

Prime Minister Directs Ministry of Public Security to Launch Data Trading Platform in November

According to Prime Minister Phạm Minh Chính, the successful establishment of a data exchange platform in Vietnam will yield comprehensive strategic benefits.