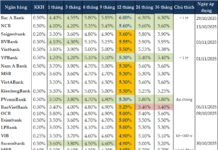

Divergent Trends in Non-Performing Loans Among Banks

Agribank continues to shine as its on-balance-sheet non-performing loan (NPL) ratio decreased by 0.39% compared to the beginning of the year, dropping to 1.19% as of September 30. The bank aims to reduce this ratio below 1% by the end of 2025—the lowest level since the first phase of restructuring in 2013. Agribank currently holds the title of the state-owned bank with the lowest NPL ratio.

Among commercial joint-stock banks, there is significant divergence. At VPBank, the NPL ratio stood at 3.5% as of September 30, down from over 4% at the start of the year. In the first nine months, debt recovery from risk provisions reached nearly VND 2.9 trillion, with a 29.7% increase in the third quarter compared to the previous quarter—indicating accelerated debt resolution efforts.

At ACB, the NPL ratio also saw a notable decline, dropping from 1.5% to 1.1%, among the lowest in the industry. Stage 2 debt remained stable at over 0.4%, while the NPL coverage ratio rose above 80%, reflecting robust financial capacity and provisioning.

Divergent trends in non-performing loans among banks.

ABBank also showed positive developments, with bad debt decreasing to VND 2.83 trillion and the NPL ratio falling from 3.7% to 2.6%. Over nine months, the bank recovered VND 282 billion in resolved debt, a 21% increase year-on-year, thanks to intensified recovery efforts in recent years.

Meanwhile, KienlongBank maintained an NPL ratio below 2% and an NPL coverage ratio above 80% for three consecutive quarters, among the highest in the system.

Conversely, several smaller banks reported rising NPLs. At PGBank, despite a 9.3% increase in total assets to VND 79.838 trillion, bad debt surged by 61% to VND 1.708 trillion. The NPL ratio rose from 2.5% to 3.8%, reflecting growing pressure across all debt categories.

VietABank also saw a 42.6% increase in NPLs compared to the end of 2024, reaching VND 1.556 trillion, pushing the NPL ratio from 1.37% to 1.79%. Notably, Stage 4 debt nearly doubled, from VND 558 billion to over VND 1.052 trillion.

Will Non-Performing Loans Decline by Year-End?

According to analysts, the industry’s NPLs showed a slight downward trend in the third quarter, driven by positive credit growth, a warming real estate market, and intensified debt recovery efforts.

A report by Vietcombank Securities (VCBS) suggests that provisioning reversals and debt recovery significantly improved many banks’ profitability in the second half of the year.

A survey by the Monetary Statistics and Forecasting Department of the State Bank of Vietnam also revealed that customer demand for banking services continued to improve in the third quarter. While risk levels are not expected to improve significantly compared to the end of 2024, credit institutions anticipate better conditions in 2026.

The State Bank is implementing the 2021-2025 Restructuring Plan, alongside measures to prevent new NPLs. Additionally, the amended Law on Credit Institutions 2025 (effective from October 15, 2025), which legalizes Resolution 42, is expected to provide a strong impetus for debt resolution and recovery, supporting the goal of reducing the system-wide NPL ratio below 3% by year-end 2025.

Alongside the cooling NPL trend, credit activities across the system continued their strong recovery.

As of September, credit growth reached 13.4% compared to the end of 2024, the highest in five years and significantly surpassing the 9.11% growth in the same period last year. This expansion is driven by flexible monetary policies, recovering capital demand, and the ripple effects of public and private investment.

Bank Stocks: Profit Quality and Inherent Risks Insufficient for Valuation Expansion

The Q3/2025 financial results of numerous banks reveal a promising outlook, driven by credit expansion and improved non-interest income, signaling that the toughest phase of the profit cycle may be behind us. However, the stock market has responded with caution, scrutinizing profit quality, net interest margin positioning, potential delays in bad debt formation, and lingering legal risks. As risk premiums rise amid macroeconomic uncertainties and capital flows, valuation multiples are compressing, tempering the short-term positive impact of profit growth.

Eximbank Reports VNĐ 2.049 Trillion Profit in First Nine Months of 2025

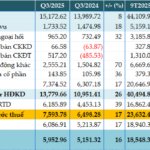

Eximbank reported a profit of VND 2.049 trillion in the first nine months of 2025, with its credit operations growing by over 8.51%. The bank’s return on equity (ROE) reached 6.23%.

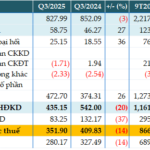

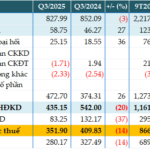

BIDV’s Total Assets Surpass 3 Quadrillion VND, Q3 Pre-Tax Profit Surges 17%

BIDV’s consolidated Q3/2025 financial report reveals a pre-tax profit of nearly VND 7,594 billion, marking a 17% year-on-year increase. As of the end of Q3, the bank’s total assets surpassed VND 3,000 trillion.