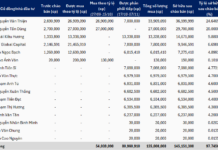

Following a volatile trading session, market sentiment turned cautious, causing the VN-Index to fluctuate within a narrow range. The VN-Index closed the November 5th session with a modest gain of 2.91 points (-0.18%), settling at 1,654 points. Trading volume significantly decreased, with transaction values on HOSE exceeding 20 trillion VND.

Foreign trading activity was a notable downside, with net selling reaching 875 billion VND across the market.

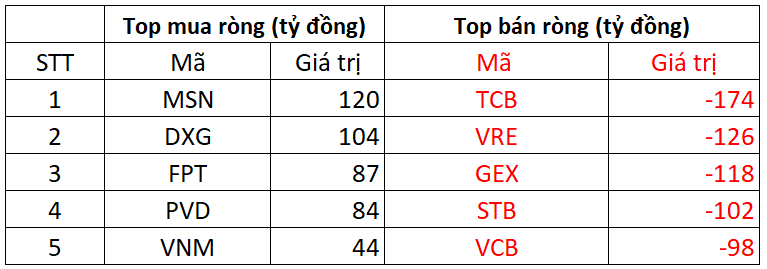

On HOSE, foreign investors net sold 807 billion VND

On the buying side, MSN led foreign purchases on HOSE with over 120 billion VND. DXG followed closely, attracting 104 billion VND. Additionally, FPT and PVD were bought for 87 billion VND and 84 billion VND, respectively.

Conversely, TCB saw the highest foreign selling at 174 billion VND. VRE and GEX also faced significant selling pressure, with 126 billion VND and 118 billion VND, respectively.

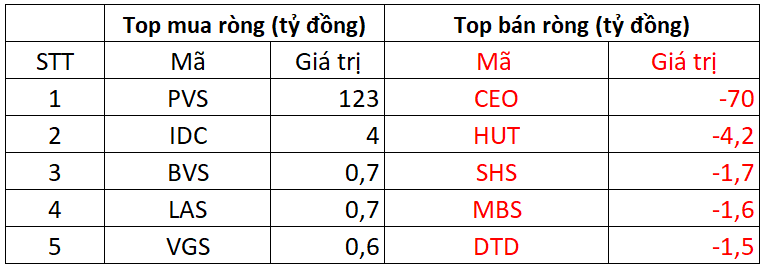

On HNX, foreign investors net bought 44 billion VND

PVS led the buying activity on HNX with a net purchase of 123 billion VND. IDC followed with 4 billion VND. Foreign investors also allocated a few billion VND to BVS, LAS, and VGS.

On the selling side, CEO faced the most significant foreign selling pressure at nearly 70 billion VND. HUT followed with 4 billion VND, while SHS, MBS, and DTD saw selling activity in the billions.

On UPCOM, foreign investors net sold 112 billion VND

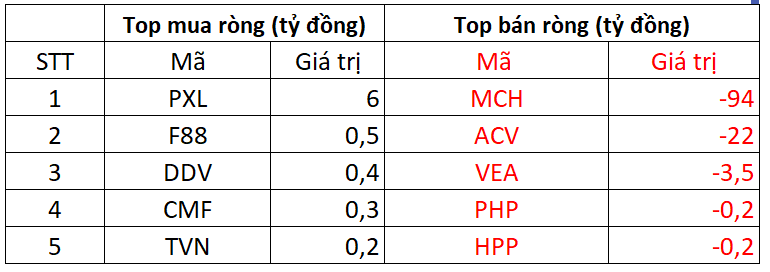

PXL led foreign purchases on UPCOM with 6 billion VND. F88 and DDV also saw net buying activity, each attracting a few billion VND.

Conversely, MCH faced the highest foreign selling at 94 billion VND. Foreign investors also net sold ACV, VEA, and others.

Mai Chi

Technical Analysis for the Afternoon Session of November 4th: Testing the August 2025 Lows Again

The VN-Index’s downward trajectory shows no signs of abating, plunging deeper into the August 2025 lows. Meanwhile, the HNX-Index continues its decline, clinging to the Lower Band of the Bollinger Bands.

Vietstock Daily 05/11/2025: A Powerful Comeback

The VN-Index staged a robust comeback, bolstered by trading volumes surpassing the 20-day average, reaffirming the August 2025 support level’s resilience. Sustained upward momentum paired with stable liquidity in upcoming sessions is crucial to cementing the recovery trend. However, heightened volatility remains a risk, as the MACD indicator lingers below zero and trails significantly behind the Signal line.

Bank Stocks Weigh on VN-Index in October

October closed in the red, marked by a sharp correction in the banking stock group, which negatively impacted the VN-Index.