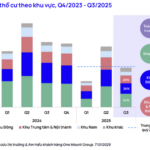

According to data from the Vietnam Real Estate Market Research Institute (VARS IRE), Hanoi recorded approximately 22,000 newly launched apartments in the first nine months of 2025. This figure represents 64% of the total supply in 2024 and marks the highest level since 2019. Condominiums continue to dominate, accounting for 76% of the new supply.

Contrary to expectations that increased supply would cool prices, Hanoi’s property market has seen a continued upward trend. The condominium price index in Q3/2025 rose by 5% compared to the previous quarter and surged by 96.2% since Q1/2019—1.7 times higher than the growth rate in the Southern key economic zone over the same period. The average primary market price for condominiums in Hanoi now stands at 95 million VND per square meter, with over 43% of new supply priced above 120 million VND per square meter.

Sky-high prices have narrowed profit margins, diminishing the appeal of investment capital. Simultaneously, property values have outpaced the financial capabilities of most individual investors, prompting a shift in capital from Hanoi to more affordably priced markets.

One standout destination is the Southern region. Mr. Nguyễn Thái Bình, CEO of Đông Tây Land and Deputy Secretary-General of VARS, noted that by the end of Q2/2025, Northern buyers accounted for only 20% of transactions in the South. However, by the end of Q3, this figure rose to 30%, approaching the peak levels seen during 2016–2020.

The Southern key economic zone has attracted capital due to its relatively stable price accumulation over the past three years and rapidly improving infrastructure. Some suburban areas near city centers offer prices 30–40% lower than Hanoi, while urbanization and real demand are surging. With a budget of 2–4 billion VND, investors in Hanoi can only access studio apartments, whereas in the South, they have a broader range of options, from condominiums to townhouses.

Beyond seeking affordable prices, many investors are adopting strategies to diversify their portfolios and optimize long-term returns. The Southern market offers clear segmentation, particularly in fully legalized, centrally located, high-end amenity apartments, catering to financially robust investors seeking sustainable returns. Rental demand from expatriates and high-skilled professionals in tech and finance hubs provides more stable yields compared to Hanoi.

Legal market recovery and the return of major developers have further fueled this migration trend. Many Northern individual investors are following familiar developers as they launch new projects in the South. Several coastal urban developments and suburban projects have garnered significant interest from Hanoi investors, with some recording a 5% price increase within a week of launch.

VARS IRE reports that the “Southern shift” is becoming increasingly pronounced. However, the institute advises investors to adopt long-term strategies, assess their financial capacity, and avoid excessive leverage amid rapid supply growth and market restructuring. Short-term profit expectations could leave investors vulnerable if interest rates rise or liquidity tightens.

Thủy Nguyên Real Estate, Hai Phong: A Rising Star Fueled by Infrastructure Development

As Haiphong transforms into a bustling metropolis of 4.7 million residents, Thuy Nguyen is emerging as the new administrative and political hub. With its rapidly modernizing infrastructure, the area is fueling a dynamic real estate market, poised for significant growth.