I. FUTURE CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

On November 5, 2025, VN30 futures contracts experienced a widespread decline. Specifically, 41I1FB000 (I1FB000) dropped by 0.63% to 1,886 points; VN30F2512 (F2512) fell by 0.59% to 1,884.1 points; 41I1G3000 (G3000) decreased by 0.09% to 1,882.1 points; and 41I1G6000 (I1G6000) declined by 0.16% to 1,880 points. The underlying index, VN30-Index, closed at 1,886.47 points.

In contrast, most VN100 futures contracts saw gains during the same session. Notably, 41I2FB000 (I2FB000) slipped by 0.7% to 1,804.1 points; 41I2FC000 (I2FC000) rose by 0.54% to 1,798 points; 41I2G3000 (I2G3000) surged by 1.47% to 1,798.9 points; and 41I2G6000 (I2G6000) climbed by 0.83% to 1,788.4 points. The VN100-Index closed at 1,802.59 points.

During the November 5, 2025 session, 41I1FB000 opened lower but quickly rebounded as buyers stepped in. However, short sellers maintained dominance, leading to a tug-of-war below the reference level throughout the morning. In the afternoon, selling pressure persisted, causing the contract to close in negative territory with a 12-point loss.

Intraday Chart of 41I1FB000

Source: https://stockchart.vietstock.vn/

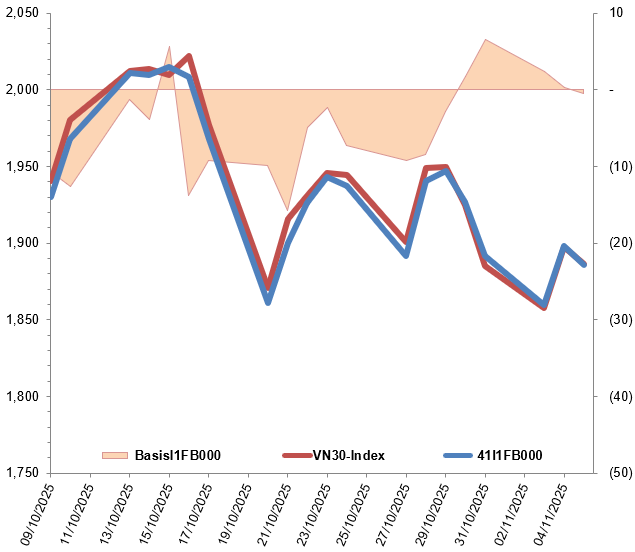

By the close, the basis of 41I1FB000 reversed from the previous session, reaching -0.47 points. This shift indicates a return to bearish sentiment among investors.

Fluctuations of 41I1FB000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

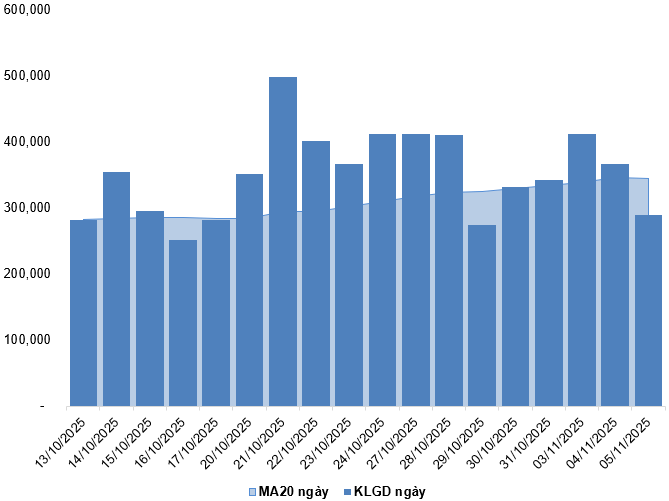

Trading volume and value in the derivatives market decreased by 21.21% and 20.65%, respectively, compared to November 4, 2025. Specifically, I1FB000 trading volume fell by 21.07% to 288,706 contracts, while I2FB000 volume dropped by 41.84% to 82 contracts.

Foreign investors continued to sell, with a net selling volume of 972 contracts on November 5, 2025.

Daily Trading Volume Trends in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

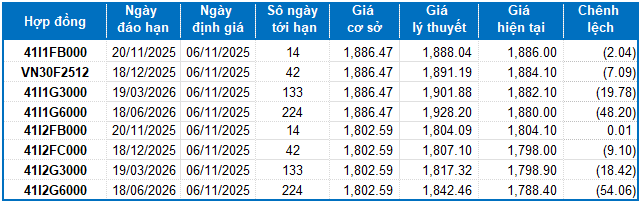

I.2. Futures Contract Valuation

Using a fair pricing method as of November 6, 2025, the reasonable price range for actively traded futures contracts is as follows:

Valuation Summary Table for VN30-Index and VN100-Index Derivatives

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each futures contract.

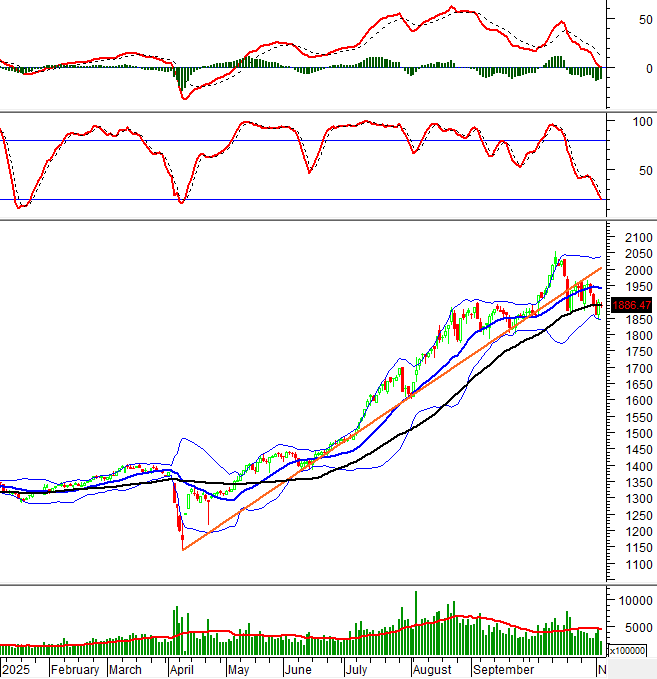

I.3. Technical Analysis of VN30-Index

On November 5, 2025, the VN30-Index declined, forming a small-bodied Doji candlestick pattern. This, coupled with reduced trading volume below the 20-session average, reflects investor caution.

Additionally, the index retested the 50-day SMA, while the MACD indicator continued to fall below the zero line after issuing a sell signal, suggesting a bearish short-term outlook.

If conditions do not improve and the index remains below the Bollinger Bands’ Middle line, the risk of continued downward momentum is high.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

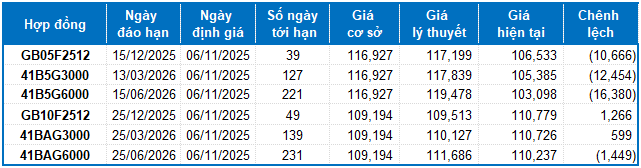

II. FUTURE CONTRACTS OF THE BOND MARKET

Using a fair pricing method as of November 6, 2025, the reasonable price range for actively traded bond futures contracts is as follows:

Valuation Summary Table for Government Bond Futures

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each futures contract.

According to the above valuation, contracts GB05F2512, 41B5G3000, 41B5G6000, and 41BAG6000 are currently attractively priced. Investors should consider focusing on and buying these futures contracts, as they present excellent value in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:28 05/11/2025

Technical Analysis for the Afternoon Session of November 4th: Testing the August 2025 Lows Again

The VN-Index’s downward trajectory shows no signs of abating, plunging deeper into the August 2025 lows. Meanwhile, the HNX-Index continues its decline, clinging to the Lower Band of the Bollinger Bands.

Derivatives Market Update 05/11/2025: Mixed Signals Emerge

On November 4, 2025, both the VN30 and VN100 futures contracts surged during the trading session. The VN30-Index reversed its trend, climbing higher and forming a prominent Big White Candle pattern on the chart. This bullish signal was further reinforced by a notable increase in trading volume compared to the previous session, indicating a shift in investor sentiment from pessimism to cautious optimism.

Derivatives Market Update 04/11/2025: Signals Favoring Short Positions

On November 3, 2025, both VN30 and VN100 futures contracts experienced a decline during the trading session. The VN30-Index continued its downward trend, forming a Three Black Crows candlestick pattern, accompanied by increased trading volume compared to the previous session, indicating persistent investor pessimism.

Technical Analysis Afternoon Session 03/11: Long Lower Shadow Emerges

The VN-Index staged a modest recovery, forming a Long Lower Shadow candlestick pattern after retesting its August 2025 lows. Conversely, the HNX-Index extended its decline as the Stochastic Oscillator triggered a sell signal.