According to the Construction Newspaper, the Ministry of Finance has submitted a report to Deputy Prime Minister Nguyen Chi Dung regarding the evaluation of SK Group’s (South Korea) capabilities. SK Group is one of the conglomerates proposing to implement multiple projects in the energy and high-tech sectors in Vietnam.

Supporting Energy and High-Tech Projects

The Ministry of Finance is acting as the focal point for the task force supporting SK’s projects in Vietnam, closely coordinating with local authorities, particularly in Thanh Hoa and Nghe An provinces. Their role is to guide, research, and review investment proposals.

“Based on the directives from the Prime Minister and Deputy Prime Minister Nguyen Chi Dung, the Ministry of Finance continues to provide professional guidance and facilitate favorable conditions for SK to implement key projects. These efforts aim to promote sustainable development in Vietnam’s energy sector during this new phase,” the report stated.

SK Group – A Leading South Korean Industrial Conglomerate

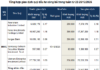

The Ministry of Finance’s assessment highlights SK Group as South Korea’s second-largest conglomerate, ranking among the top 100 largest corporations globally. With a market capitalization of $270 billion (as of 2024), SK Group operates 579 subsidiaries and branches worldwide, generating $150 billion in revenue last year.

SK Group’s core operations are structured around four strategic pillars: green energy, semiconductors and advanced materials, information technology, and biotechnology.

Green energy stands as the flagship sector, represented by SK Innovation – the largest private energy company in the Asia-Pacific region, with total assets of $75 billion. Following its merger with SK E&S in November 2024, SK Innovation expanded into petrochemicals, LNG, power generation, batteries, and renewable energy.

Currently, SK Group is South Korea’s largest private power producer, operating plants with a combined capacity of nearly 5 GW. The company has maintained a stable annual profit of approximately $715 million for three consecutive years.

Notably, the group has established a closed-loop LNG value chain, importing over 5 million tons of LNG annually. This ensures a competitive advantage in both cost and supply stability.

Investment Activities in Vietnam

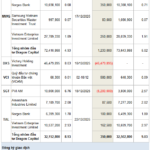

Since establishing its presence in Vietnam, SK Group has invested over $3.5 billion, primarily through capital contributions and share acquisitions in major companies such as Vingroup, Masan, Petrolimex, PV OIL, and Imexpharm. However, after years of strategic adjustments, the group has divested from several ventures, reducing its total investment value to approximately $650 million.

In 2018, SK invested approximately $1.1 billion to acquire a 9.5% stake in Masan Group, becoming a strategic shareholder. The agreement granted SK the option to sell this stake back to Masan in 2024. By September 2024, both parties agreed to extend the option period by up to 5 years, while SK Investment Vina I’s representative withdrew from Masan’s Board of Directors.

By October 2025, SK Invest VINA II Pte. Ltd – an SK Group subsidiary – sold 42.6 million MSN shares, valued at around $127 million, completing the transaction on October 20, 2025. Following this deal, SK Group nearly fully divested from Masan, retaining only 1,000 shares. This marked the end of a seven-year partnership between the South Korean and Vietnamese conglomerates.

Similarly, in 2019, SK and Vingroup signed a strategic cooperation agreement, with SK investing $1 billion to purchase Vingroup shares. However, by August 5, 2025, SK had sold all its shares in Vingroup.

Additionally, SK withdrew from Imexpharm, transferring its entire stake to a Chinese enterprise, concluding its indirect investment phase in Vietnam.

BIDV and WMI Partner to Develop International Standard Private Banker Team

Recently, the Bank for Investment and Development of Vietnam (BIDV) and the Wealth Management Institute (WMI) of Singapore—a leading regional and international training organization in wealth management and private banking for high-net-worth individuals—officially signed a strategic partnership agreement.

Why Vietnam’s GDP Growth Miracle Surpasses Global Precedents: Insights from Prof. Tran Dinh Thien

For the first time in history, Vietnam has set a target of double-digit growth over the next five years—an ambition that, according to Associate Professor Dr. Trần Đình Thiên, is “unfeasible not only for Vietnam but for the entire world.” However, he believes that by daring to innovate in institutional frameworks and regional development thinking, the “Resolution Quartet” will pave the way to turn the seemingly impossible into reality.