The VN-Index kicked off the first trading session of November with a sharp decline of 22 points, retreating to 1,617 points. From its recent peak, the index has shed over 173 points, equivalent to nearly 10%. Despite this, analysts remain optimistic about November being a positive month for the stock market, typically marked by a recovery driven by seasonal factors.

VN-Index Enters the Second Best Performing Month of the Year

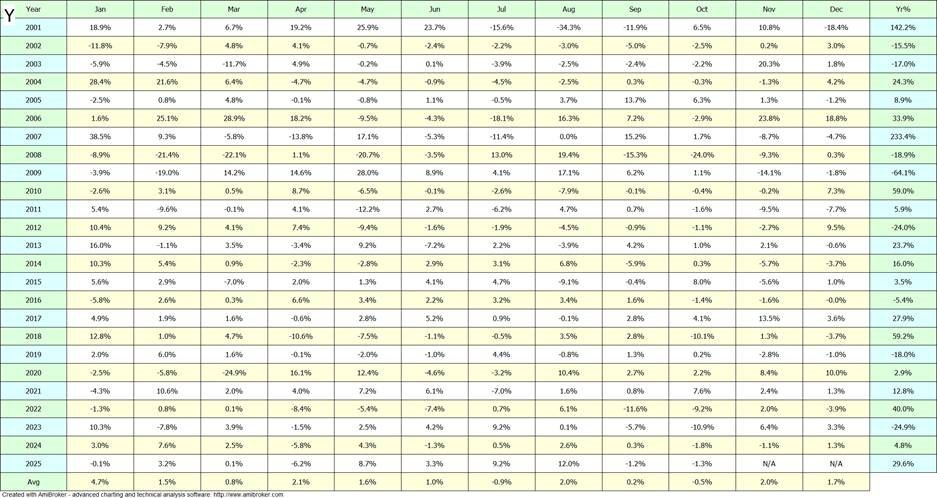

MBS Securities notes that as we move into November—historically the second-best performing month of the year (after January, averaging +2.3% from 2015–2024)—investors have reason to expect a short-term market rebound due to seasonal trends, even though strong supportive news remains absent.

According to MBS, November is usually a positive period for the market as investor sentiment stabilizes post-earnings season. However, liquidity is expected to remain low as major capital flows stay cautious. In the base scenario, the VN-Index is likely to continue trading in a narrow range, moving sideways on low liquidity.

On a more cautious note, MBS suggests that some blue-chip stocks may face further downward pressure, potentially pulling the index back to the 1,600-point support level or lower. Nevertheless, this is seen as an opportunity for investors to accumulate or restructure portfolios in preparation for a year-end recovery.

Echoing this sentiment, Nguyen The Minh, Director of Yuanta Vietnam Securities Analysis, points out that November is typically an uptrend month for both the S&P500 and VN-Index. Historical data from 1964–2024 shows the S&P500 averaging a 1.6% increase in November with a 69% probability of rising, peaking at 11% and dropping as much as -11%.

For the VN-Index, the average November increase is 2% with a 50% probability of rising, reaching highs of 23.8% and lows of -14.1%. Minh believes the declines in September and October were merely short-term adjustments after four consecutive months of gains, while the long-term market trend remains positive.

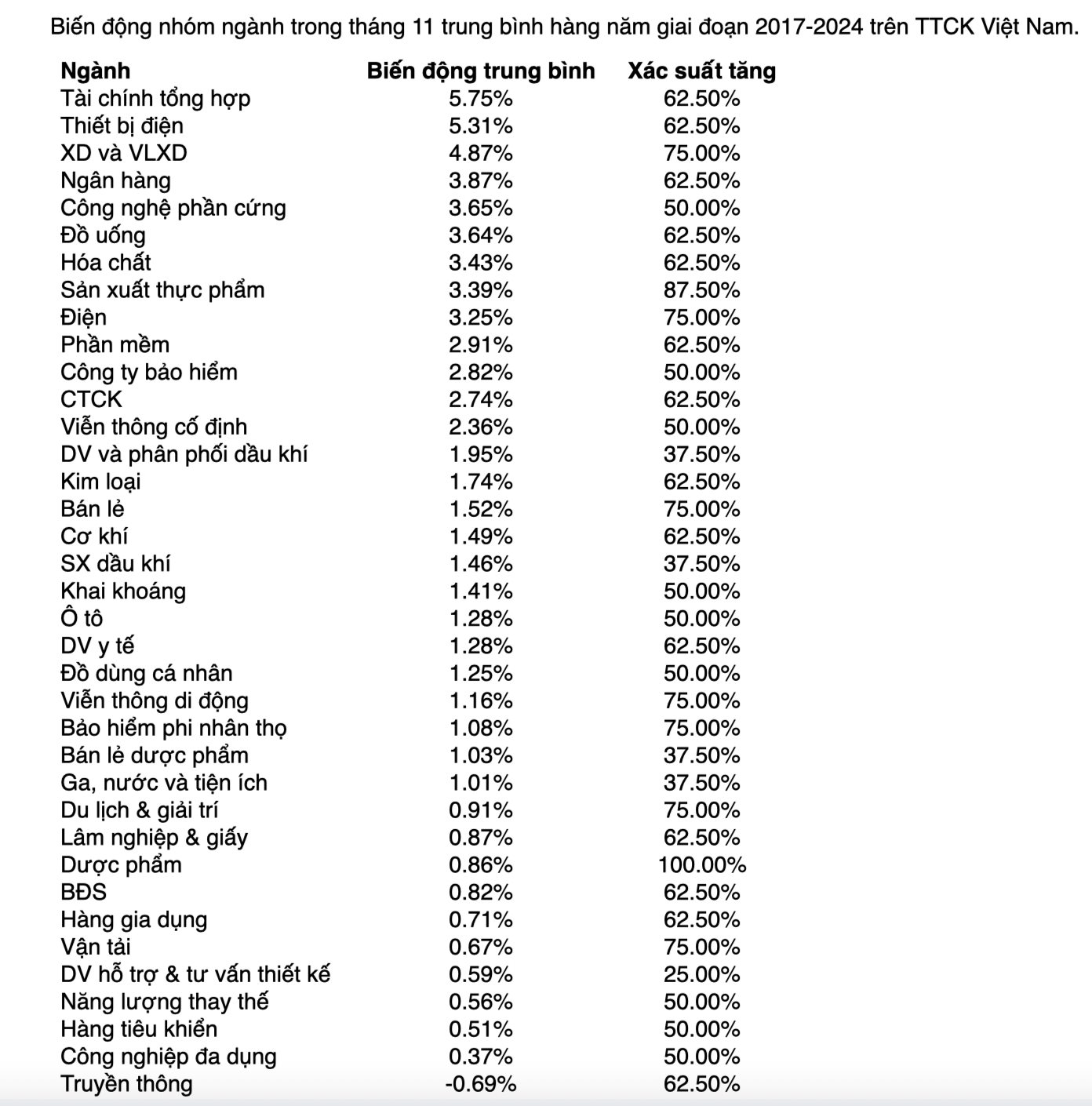

Which Sectors Typically Perform Best?

Analyzing Vietnamese sectors from 2017–2024, Yuanta experts highlight that November often sees clear differentiation. Financial conglomerates, electrical equipment, and construction materials lead with average increases of 4.87%–5.75%.

Pharmaceuticals show the highest stability with a 100% increase probability, albeit with modest 0.86% volatility, reflecting resilience and low risk. Food production follows with an 87.5% increase probability, showcasing defensive traits and benefiting from year-end consumption.

Construction materials, electricity, retail, mobile telecom, non-life insurance, tourism, and entertainment all share a 75% increase probability, signaling optimism during Q4’s peak business season.

Most other sectors like banking, securities, financial conglomerates, metals, real estate, and consumer goods remain stable, moving with broader market trends and influenced by macro factors and short-term capital flows.

Conversely, less active sectors such as design consulting, oil and gas, pharmaceutical retail, and utilities (gas, water) show only 25–37.5% increase probabilities. Notably, media is the only sector with negative volatility (-0.69%), indicating sluggishness and lack of upward momentum in late-year trading.

Foreign Investors’ Sudden U-Turn: Nearly VND 900 Billion Net Sold on November 5th – Which Stocks Were Hit Hardest?

Foreign investors’ trading activity has once again turned negative, with a net sell-off of VND 875 billion across the entire market.

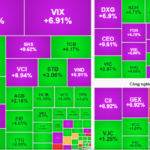

Market Pulse 04/11: Euphoria Returns, VN-Index Surges Nearly 35 Points

As the session closed on November 4th, the market rewarded investors with a robust gain of nearly 35 points, climbing to approximately 1,652 points. Meanwhile, the HNX-Index surged by almost 7 points, reaching 265.91 points.

Vietstock Daily 05/11/2025: A Powerful Comeback

The VN-Index staged a robust comeback, bolstered by trading volumes surpassing the 20-day average, reaffirming the August 2025 support level’s resilience. Sustained upward momentum paired with stable liquidity in upcoming sessions is crucial to cementing the recovery trend. However, heightened volatility remains a risk, as the MACD indicator lingers below zero and trails significantly behind the Signal line.