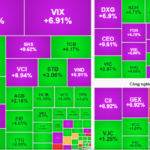

Following a period of downward pressure and increased liquidity, the stock market faced further adjustments during the November 4th session. However, the market rebounded strongly in the afternoon session. At closing, the VN-Index reversed its trend, climbing 34.98 points (+2.16%) to reach 1,651.98 points.

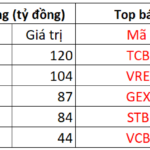

Foreign trading activity also turned positive, with net buying of 1.16 trillion VND across the market.

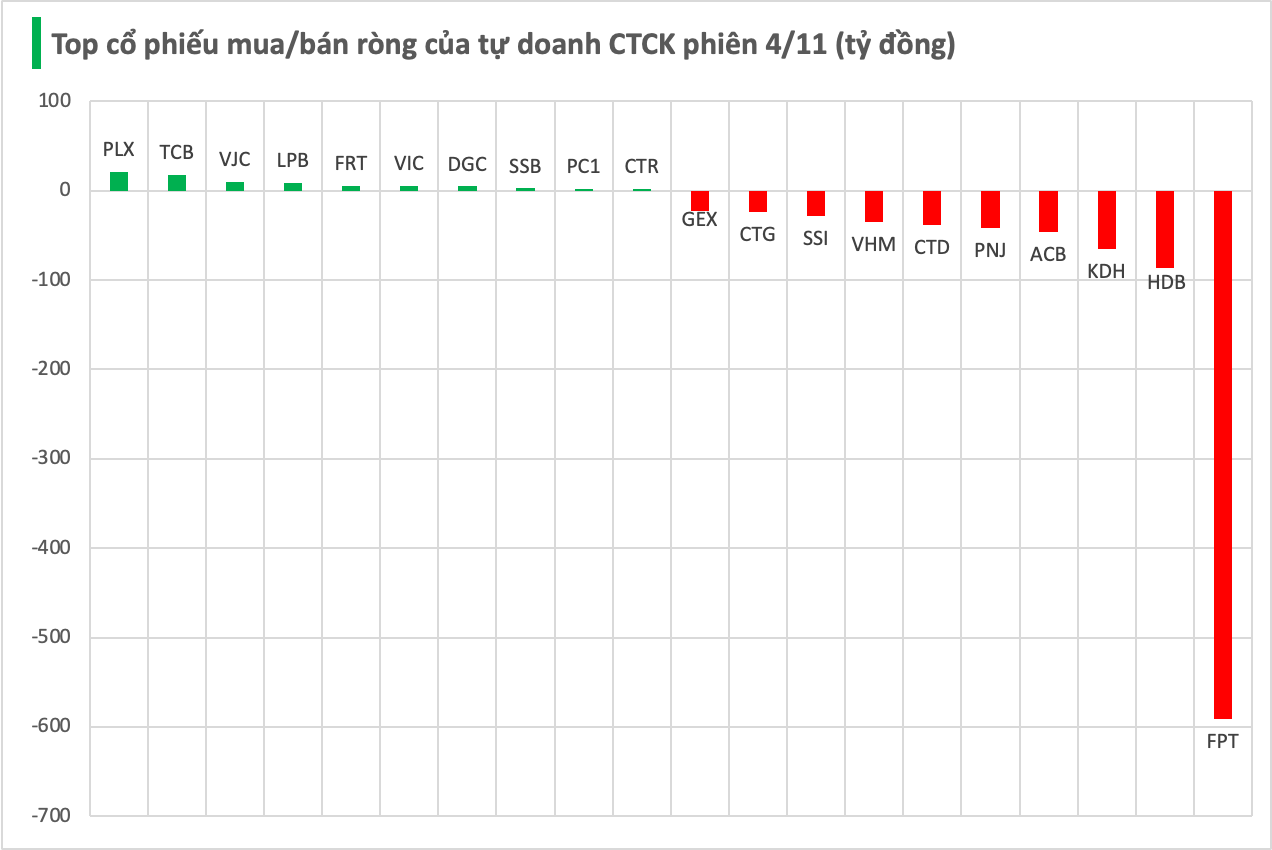

Securities companies’ proprietary trading desks recorded a net sell of 1.15 trillion VND on HOSE.

Specifically, securities firms led by net selling in FPT, totaling -591 billion VND, followed by HDB (-86 billion), KDH (-65 billion), ACB (-46 billion), and PNJ (-42 billion VND). Other notable net sell-offs included CTD (-38 billion), VHM (-35 billion), SSI (-28 billion), CTG (-24 billion), and GEX (-23 billion VND).

Conversely, PLX saw the strongest net buying at 21 billion VND. This was followed by TCB (17 billion), VJC (10 billion), LPB (8 billion), FRT (6 billion), VIC (5 billion), DGC (5 billion), SSB (3 billion), PC1 (2 billion), and CTR (2 billion VND).

Real Estate Stocks Ride the Wave, Propelling VN-Index to Surge

The trading session on November 4th concluded on a positive note, marking a significant rebound after over two weeks of consecutive declines. The VN-Index surged by more than 34 points, representing a 2.12% increase, closing in on the 1,652-point mark. This impressive rally signals a much-needed recovery following a prolonged period of steep losses.

Unlocking October’s High-Yield Potential: Which Sectors Historically Outperform in This Profitable Month?

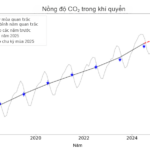

November historically marks a bullish trend for both the S&P 500 and VN-Index, as noted by Mr. Minh’s statistical analysis.

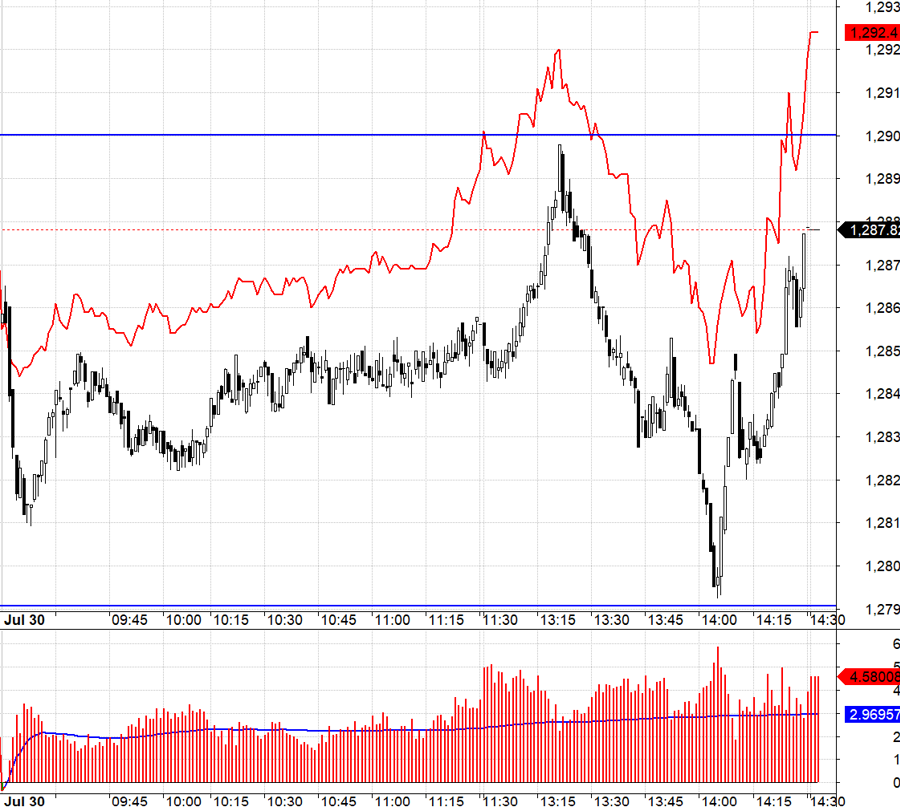

Technical Analysis for the Afternoon Session of November 4th: Testing the August 2025 Lows Again

The VN-Index’s downward trajectory shows no signs of abating, plunging deeper into the August 2025 lows. Meanwhile, the HNX-Index continues its decline, clinging to the Lower Band of the Bollinger Bands.