I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON NOVEMBER 5, 2025

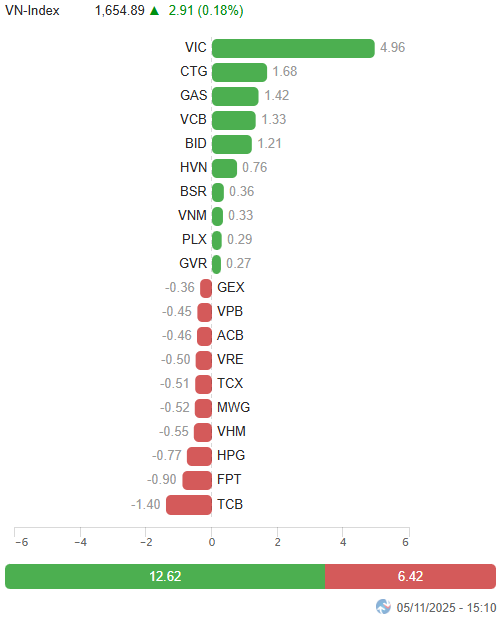

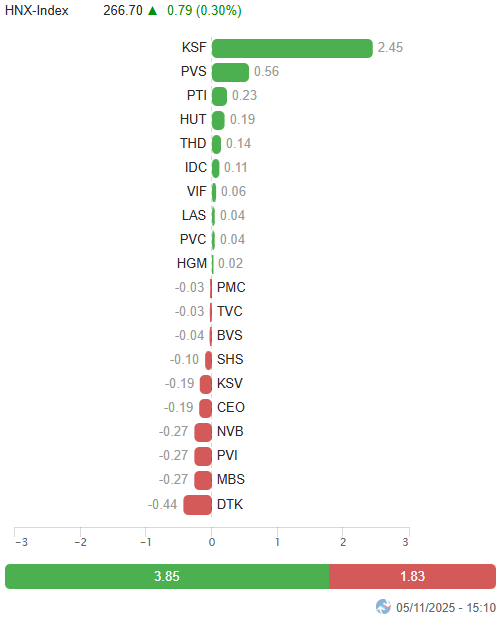

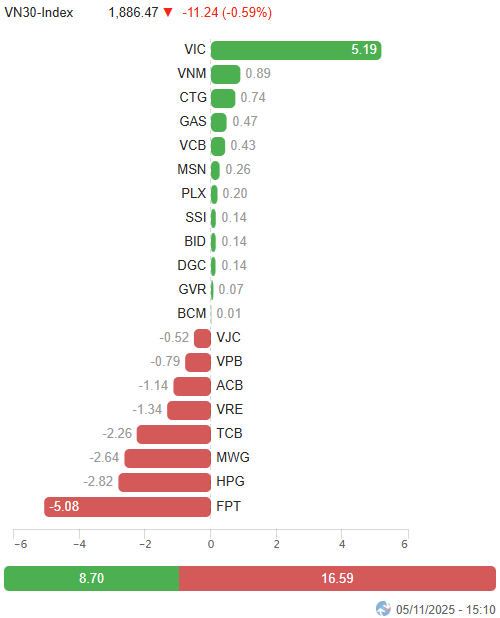

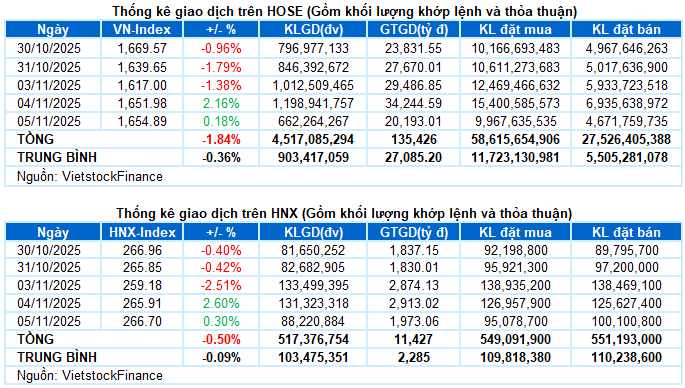

– Major indices maintained a faint green hue during the November 5 trading session. Specifically, the VN-Index rose by 0.18%, reaching 1,654.89 points, while the HNX-Index hovered near the reference level, closing at 266.7 points.

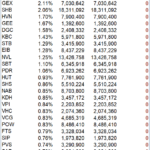

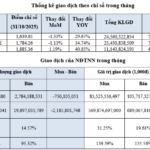

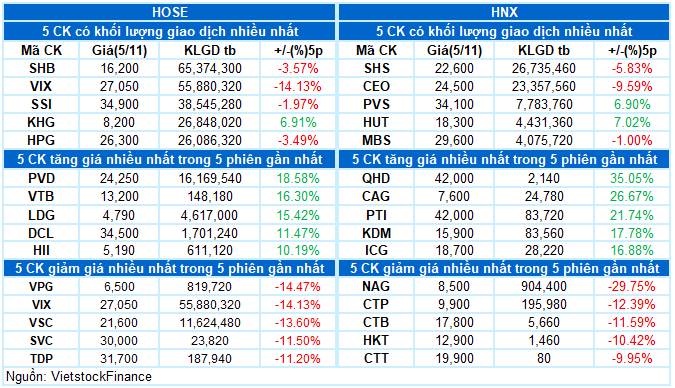

– Trading volume on the HOSE floor plummeted by 45.7%, totaling nearly 615 million units. Similarly, the HNX floor recorded just over 84 million matched units, a 25.2% decline compared to the previous session.

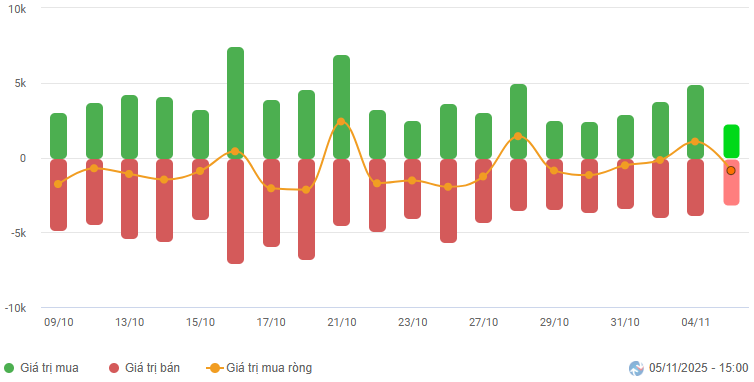

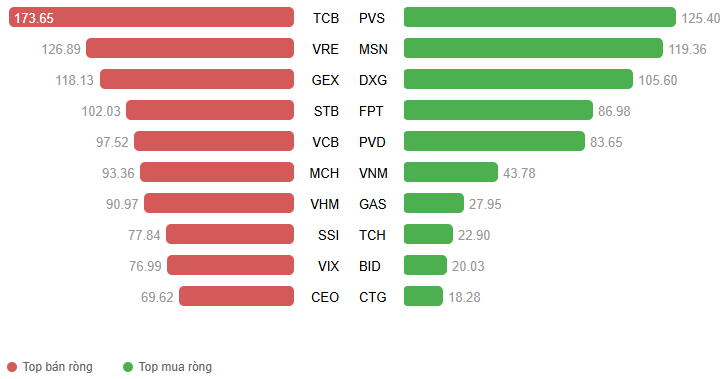

– Foreign investors net sold on the HOSE floor, with a value exceeding 807 billion VND, and net bought over 45 billion VND on the HNX floor.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– Following a robust bottom-fishing session the previous day, the market approached the November 5 trading session with heightened caution. Amid lackluster liquidity, the VN-Index primarily oscillated around the 1,650-point mark, exhibiting a clear state of polarization. Despite efforts to bolster key stocks, keeping the VN-Index in the green, the overall market breadth still leaned toward selling. By the close, the VN-Index edged up by 0.18% from the previous session, settling at 1,654.89 points.

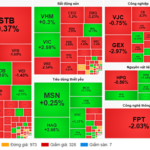

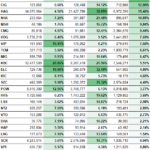

– Among the top 10 stocks influencing the VN-Index, VIC had the most positive impact, contributing nearly 5 points to the index. Other notable contributors included CTG, GAS, VCB, and BID, which collectively added 5.6 points. Conversely, TCB had the most negative impact, subtracting 1.4 points from the index.

Top Stocks Influencing the Index. Unit: Points

– The VN30-Index closed down by 11.24 points, ending at 1,886.47 points. The breadth favored sellers, with 18 decliners and 12 advancers. Notably, VRE led the decline with a 3% drop. Other significant losers included TCB, FPT, and TPB, each falling by over 2%. In contrast, GAS stood out as the top performer, surging by 4.1%.

By sector, the energy group led the market with an impressive 3.44% gain, driven by strong performances from stocks such as BSR (+3.07%), PLX (+2.92%), PVS (+5.9%), PVD (+5.9%), OIL (+4.76%), PVT (+4.05%), PVC (+7.48%), POS (+3.29%), and PVB (+3.62%). The communication services sector followed with a gain of over 2%, primarily led by VGI (+2.8%) and FOX (+1.43%).

Meanwhile, large-cap sectors such as real estate, industrials, and financials were weighed down by negative adjustments in stocks like VRE (-2.99%), KDH (-1.83%), KBC (-1.54%), PDR (-1.75%), VPI (-3.39%); GEX (-3.92%), VCG (-2.81%), CII (-3.97%), VSC (-5.88%), HHV (-2.08%), CDC (-3.67%); VIX (-2.87%), TCB (-2.57%), VCI (-2.99%), and ACB (-1.54%). However, buying interest persisted in select stocks such as VIC (+2.74%), NVL (+2.61%), TCH (+2.09%); CTD (+2.65%), ACV (+1.29%), HVN (+3.43%), TOS (+3.6%); CTG (+2.7%), VCB (+1.16%), and BID (+1.98%).

On the flip side, the information technology sector lagged with a 2.26% decline, dragged down by significant adjustments in FPT (-2.32%), CMG (-0.76%), ELC (-2.75%), VEC (-5.51%), and DLG (-1.09%).

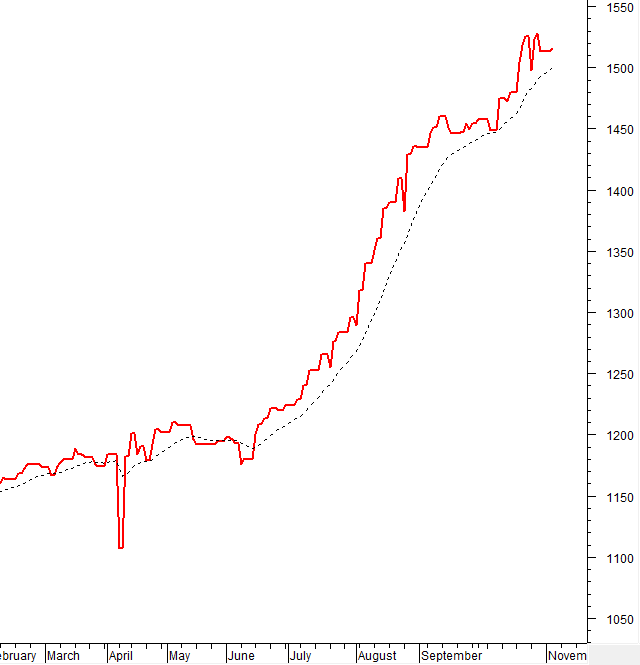

The VN-Index edged higher, but trading volume plummeted below the 20-day average, reflecting persistent market caution. Currently, the Stochastic Oscillator has dipped into oversold territory. If buying signals re-emerge within this zone, the index’s short-term outlook could improve.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Trading Volume Below 20-Day Average

The VN-Index inched higher, but trading volume sharply dropped below the 20-day average, indicating prevailing market caution.

Currently, the Stochastic Oscillator has entered oversold territory. If buying signals re-emerge within this zone, the index’s short-term outlook could improve.

HNX-Index – Stochastic Oscillator Signals Buying Opportunity

The HNX-Index continued its recovery with a Long Lower Shadow candlestick pattern during the November 5, 2025, trading session.

The Stochastic Oscillator has signaled a buying opportunity, while the MACD is narrowing its gap with the Signal line. If buying signals persist in upcoming sessions, the recovery momentum will strengthen.

However, the Middle Bollinger Band remains a strong resistance level, difficult to surpass without improved liquidity in the short term.

Capital Flow Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Flow: Foreign investors resumed net selling during the November 5, 2025, trading session. If foreign investors maintain this stance in upcoming sessions, market volatility will likely persist.

III. MARKET STATISTICS FOR NOVEMBER 5, 2025

Economic & Market Strategy Analysis Department, Vietstock Advisory Division

– 16:46 November 5, 2025

Market Pulse 05/11: Energy Sector Shines as Overall Market Liquidity Declines

At the close of trading, the VN-Index rose 2.91 points (+0.18%) to 1,654.89, while the HNX-Index gained 0.79 points (+0.3%) to 266.7. Market breadth tilted toward decliners, with 361 stocks falling and 323 advancing. Similarly, the VN30 basket saw red dominate, as 18 constituents declined and 12 advanced.

Vietnam’s VN-Index Plunges, Half-Billion-Dollar ETF Buys Only One Stock

During the period of October 24–31, as the VN-Index experienced significant declines, the VanEck Vectors Vietnam ETF (VNM ETF) remained largely unchanged. The only stock purchased net was HAG.