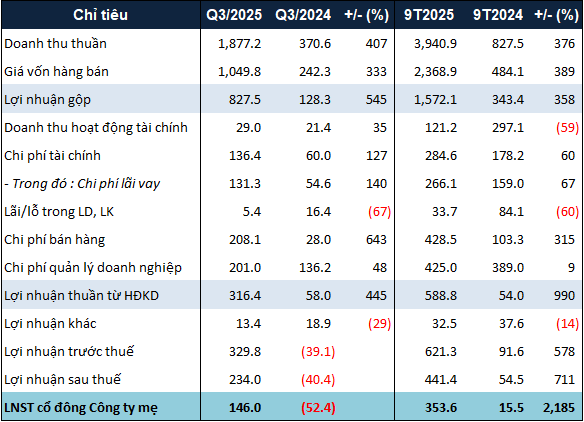

Reviewing the achievements of the first nine months, NLG‘s revenue and net profit (NPAT-MI) reached nearly VND 3,941 billion and VND 354 billion, respectively, approximately five times and 23 times higher than the same period last year. The revenue primarily came from the handover of Akari (VND 967 billion), Nam Long II Central Lake (VND 1,529 billion), and Southgate (VND 983 billion) projects.

Notably, the company maintained a high gross profit margin of 40% due to the handover of low-rise products.

|

Q3 and 9-month 2025 business results of NLG. Unit: Billion VND

Source: VietstockFinance

|

Although showing strong growth compared to the same period, to achieve the targeted net profit of nearly VND 701 billion for 2025, NLG needs to generate over VND 347 billion in profit in the final quarter. While this figure is substantial, NLG has a solid foundation to reach it.

Firstly, in its core business, NLG reported sales of over VND 5 trillion in the first nine months, equivalent to the entire year of 2024, mainly from the Southgate (VND 3.1 trillion) and Can Tho (VND 1 trillion) projects. In the final months, NLG plans to launch additional sales at Paragon, Izumi Canaria, and Mizuki Park – Trellia Cove projects.

Additionally, the company has a significant “reserve” of over VND 2.4 trillion as of the end of September 2025. This is advance payment from customers interested in purchasing apartments, townhouses, villas, and land in projects developed by the company. Once handed over, this substantial amount will be recognized as revenue, significantly contributing to NLG‘s Q4 results.

The second driver for NLG‘s Q4 performance is the transfer of a 15% stake in the Izumi City project. Specifically, NLG announced that the company signed the transfer agreement in July, and the profit from this transaction could be recognized in the final quarter. If recognized, this will be an extraordinary profit, helping the company not only meet but also exceed its annual business plan.

Izumi City project of NLG in Dong Nai

|

The Izumi City project is developed by Waterfront Dong Nai LLC, a subsidiary of NLG, covering nearly 170 hectares, adjacent to the Dong Nai River and two major roads – Huong Lo 2 and Nam Cao. The project is developed based on the international “Modern township” model, built on four pillars: synchronized infrastructure, standard urban planning, regular destination-creating programs, and technology application in urban management to meet five essential life needs: living, studying, working, entertainment, and shopping.

With its professional development model, Izumi City promises to provide residents with a high-quality living environment and diverse daily experiences. Currently, phase 3 of the project has obtained a sales permit. The value of work in progress for the project exceeded VND 8.7 trillion by the end of September 2025, an increase of nearly VND 27 billion compared to the beginning of the year.

Furthermore, the legal status of the Izumi City project has seen positive developments. In mid-June 2025, the People’s Committee of Bien Hoa City approved the adjusted detailed construction planning at a scale of 1/500 for the Izumi City project of Waterfront Dong Nai LLC.

The speed at which Izumi City has obtained important planning approvals is considered ahead of schedule, as earlier this year, NLG‘s CEO Lucas Loh predicted that the project would only achieve the 1/500 planning by the end of the year.

– 07:00 06/11/2025

What Drove Masan’s Record-Breaking Quarterly Profit of Over 1.8 Trillion VND?

After five years of steadfastly building an integrated consumer-retail platform, Masan Group (HOSE: MSN) has officially marked a pivotal milestone in profitability.