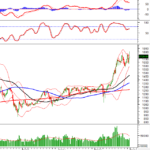

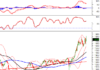

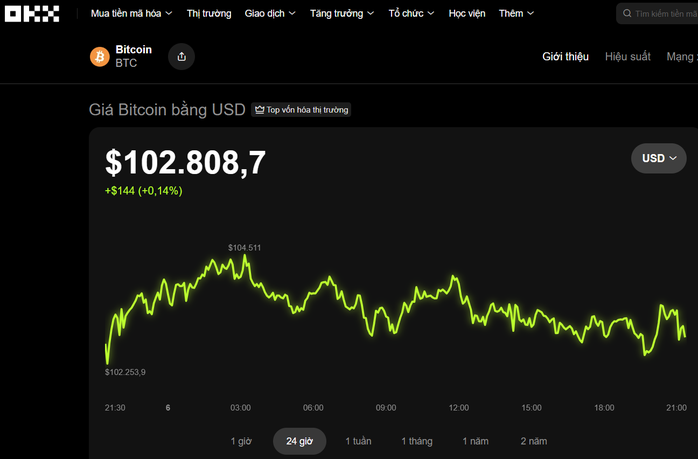

On the evening of November 6th, the cryptocurrency market experienced a slight uptick. Data from the OKX exchange reveals that over the past 24 hours, Bitcoin (BTC) rose by more than 0.1%, trading around $102,808.

Several other cryptocurrencies also saw gains, with Ethereum (ETH) climbing nearly 1% to $3,390, XRP increasing by almost 2% to $2.30, and Solana (SOL) rising over 0.7% to $160. Notably, BNB dipped by more than 1%, settling at $946.

Potential for Significant Market Volatility

According to Cointelegraph, Bitcoin previously hovered around $102,776, as heavy selling pressure near the $105,000 mark halted its recovery momentum.

Analysts suggest that large sell orders could be a tactic to push prices down to the $93,000–$98,000 range, although the long-term outlook remains positive if Bitcoin maintains its 50-week moving average.

Experts caution that the market may face heightened volatility in the coming period, as U.S. stocks cool off and the U.S. Supreme Court prepares to issue a ruling that could impact global trade tax policies.

Bitcoin is currently trading around $102,800. Source: OKX

Lingering Concerns

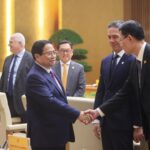

At the Vietnam Investment Forum 2026, jointly organized by VietnamBiz and Vietnammoi, Mr. Quản Trọng Thành, Director of Analysis at Maybank Securities Vietnam, highlighted Vietnam’s advantages as a young, dynamic economy embracing digital assets.

New legal frameworks, such as the Digital Technology Industry Law enacted in early June and Resolution 05/2025/NQ-CP on piloting the cryptocurrency market in Vietnam starting September 9th, are paving the way for testing new financial models at Vietnam’s International Financial Center.

“We now have legal frameworks enabling domestic and international financial institutions to experiment with new models.

However, one concern is that while the Digital Technology Industry Law allows for the issuance of stablecoins as intermediaries for digital asset transactions, Resolution 05 lacks provisions for issuing digital assets backed by fiat currency. This is essential,” he noted.

He emphasized that to establish a financial hub, Vietnam must align with emerging trends as real transactions shift to digital spaces.

He cited global shifts in digital asset perception, such as JP Morgan’s CEO—once a vocal Bitcoin critic—now accepting Bitcoin and Ethereum as collateral for loans.

Additionally, in 2022, digital artworks sold for tens of millions of dollars, and Bitcoin demand has surged recently.

Thus, he believes the key lies in crafting clear, feasible legal frameworks. While physical infrastructure can be developed, a robust legal system is more critical.

Vietnam Aims to Launch First Semiconductor Chip Plant by 2026, Prime Minister Announces

On the evening of November 6th, Prime Minister Pham Minh Chinh met with a delegation of leaders from the global semiconductor industry at the Government Office. The delegation, representing the SEMI (Semiconductor Equipment and Materials International) association and its member companies, was in Vietnam for the SEMI Expo Vietnam 2025, an international semiconductor exhibition. The meeting aimed to discuss opportunities and collaborations within Vietnam’s burgeoning semiconductor sector.

Prime Minister Pham Minh Chinh: Vietnam Aims to Launch First Semiconductor Chip Plant by 2026

The Prime Minister has called upon SEMI and industry leaders to support Vietnam in establishing cutting-edge Research and Development (R&D) centers, fostering high-quality workforce training, and enabling Vietnamese businesses to integrate into the global semiconductor value chain.

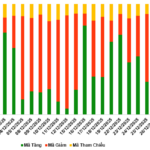

Unlocking Success: VinaCapital Expert Reveals 3 Core Factors for Vietnamese Startups to Triumph in IPOs

Vietnam’s stock market is entering a new phase of acceleration, fueled by FTSE Russell’s recent upgrade to “Secondary Emerging Market” status and liquidity levels that continue to lead the region. Amidst this wave of robust reform, the narrative of “going public – IPO” has emerged as a hot keyword among investors and Vietnam’s startup community.